Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Company entered into the following transactions during May, its first month of operations: May 1: ABC Company sold common stock to owners in the

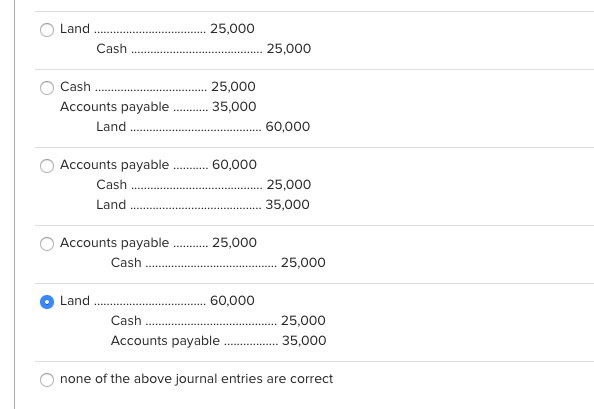

ABC Company entered into the following transactions during May, its first month of operations: May 1: ABC Company sold common stock to owners in the amount of $200,000. May 1: ABC Company paid $36,000 cash for office rent for May, June, and July. May 3: ABC Company purchased a parcel of land costing $60,000 by paying $25,000 in cash and agreeing to pay the remainder within sixty days. May 9: ABC Company provided $32,000 of services to a customer. The customer didn't pay any cash on May 9, but agreed to pay the balance due by the end of the month. May 15: ABC Company received and paid utility bills in the amount of $14,000. May 18: ABC Company sold the land purchased on May 3 for $79,000 cash. May 21: A customer paid $20,000 cash to ABC Company for services to be provided in June and July. May 27: The customer from May 9 paid the amount owed to ABC Company. May 31: ABC Company received a $9,000 bill for advertising done during May. No payment was made at this time. 1. The journal entry made by ABC Company to record the May 3 transaction would be:

2.

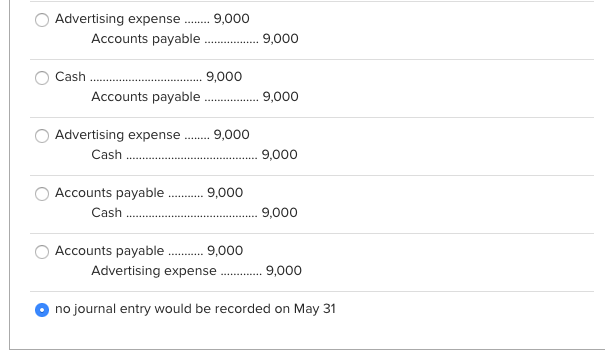

The journal entry made by ABC Company to record the May 31 transaction would be:

3.

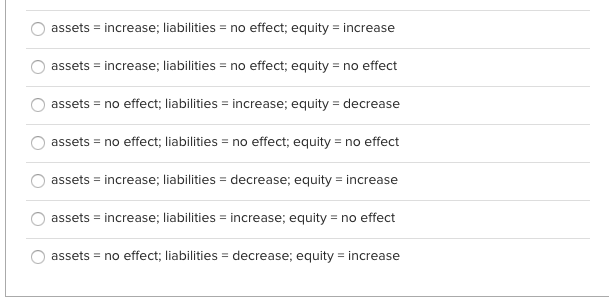

The immediate effects on the balance sheet of the May 21 transaction would be:

4.

The immediate effects on the balance sheet of the May 2725,000 Land Cash 25,000 Cash Accounts payable Land 25,000 35,000 60,000 60,000 Accounts payable Cash Land 25,000 35,000 25,000 Accounts payable Cash 25,000 Land 60,000 Cash Accounts payable 25,000 35,000 none of the above journal entries are correct 9,000 Advertising expense Accounts payable 9,000 9,000 Cash Accounts payable 9,000 9,000 Advertising expense Cash 9,000 9,000 Accounts payable Cash 9,000 Accounts payable 9,000 Advertising expense 9,000 no journal entry would be recorded on May 31 assets = increase; liabilities = no effect; equity = increase assets = increase; liabilities = no effect; equity = no effect assets = no effect; liabilities = increase; equity = decrease assets = no effect; liabilities = no effect; equity = no effect assets = increase; liabilities = decrease; equity = increase assets = increase; liabilities = increase; equity = no effect assets = no effect; liabilities = decrease; equity = increase assets = increase; liabilities = no effect; equity = increase assets = increase; liabilities = no effect; equity = no effect assets = increase; liabilities = decrease; equity = no effect assets = no effect; liabilities = no effect; equity = no effect assets = increase; liabilities = decrease; equity = increase assets = increase; liabilities = increase; equity = no effect assets = no effect; liabilities = decrease; equity = increasetransaction would be:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started