Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Company has a policy for financing investments as follows: procured from 50% borrowing. Provided from additional retained earnings (additions to retained earnings) 50%.

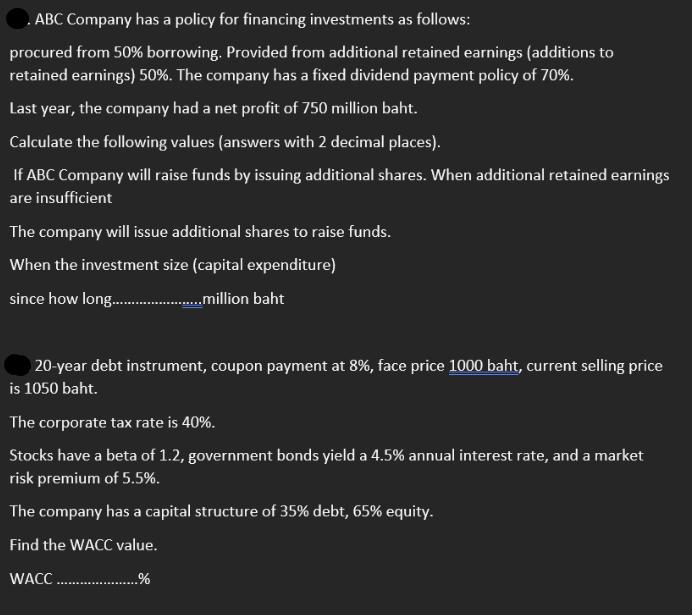

ABC Company has a policy for financing investments as follows: procured from 50% borrowing. Provided from additional retained earnings (additions to retained earnings) 50%. The company has a fixed dividend payment policy of 70%. Last year, the company had a net profit of 750 million baht. Calculate the following values (answers with 2 decimal places). If ABC Company will raise funds by issuing additional shares. When additional retained earnings are insufficient The company will issue additional shares to raise funds. When the investment size (capital expenditure) since how long...................million baht 20-year debt instrument, coupon payment at 8%, face price 1000 baht, current selling price is 1050 baht. The corporate tax rate is 40%. Stocks have a beta of 1.2, government bonds yield a 4.5% annual interest rate, and a market risk premium of 5.5%. The company has a capital structure of 35% debt, 65% equity. Find the WACC value. WACC. .%

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the weighted average cost of capital WACC we need to consider the cost of debt and the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started