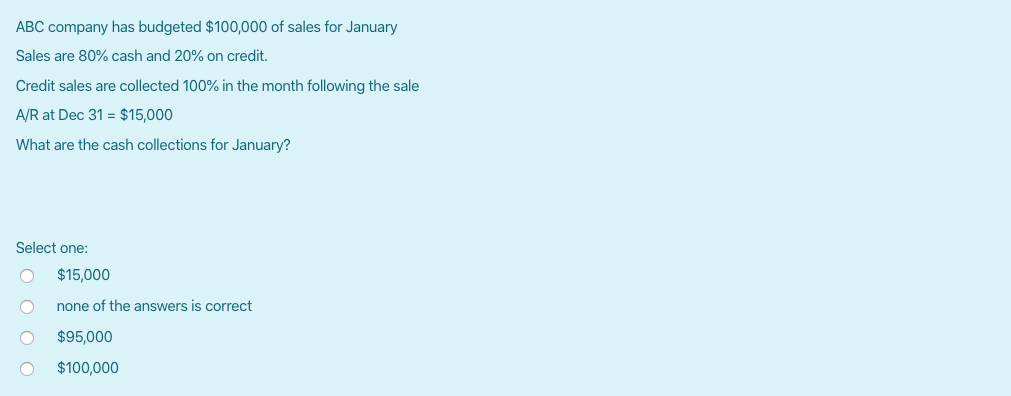

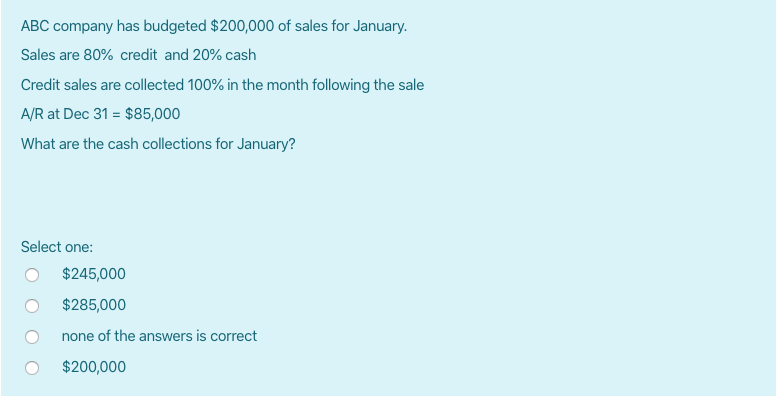

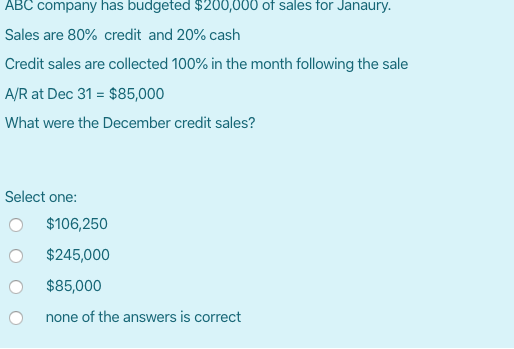

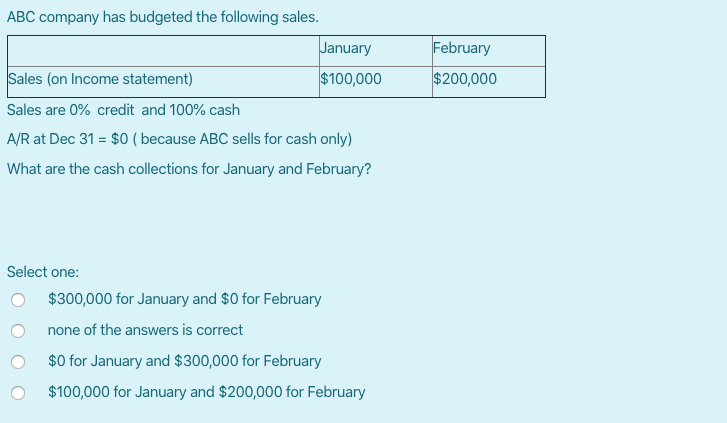

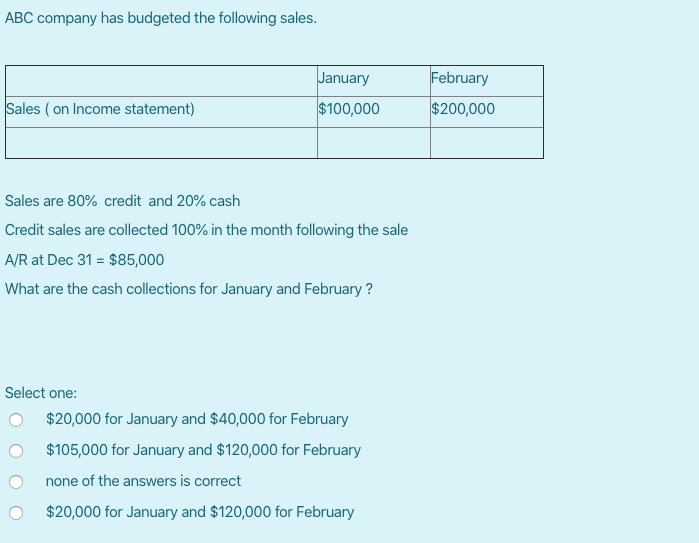

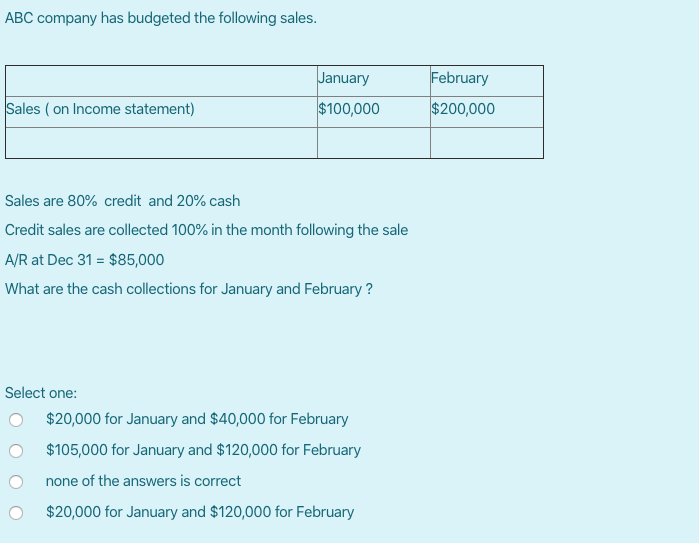

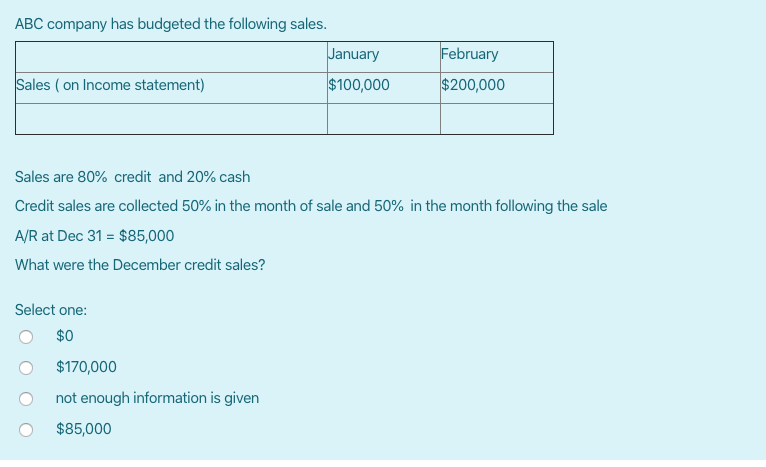

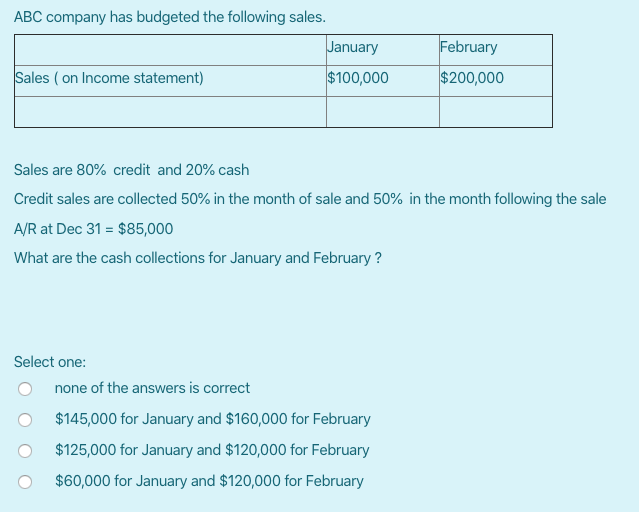

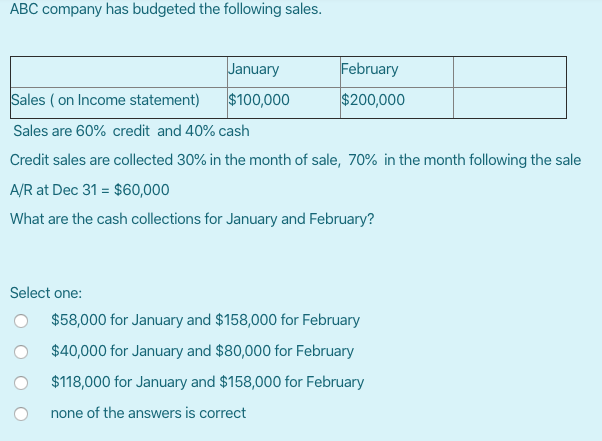

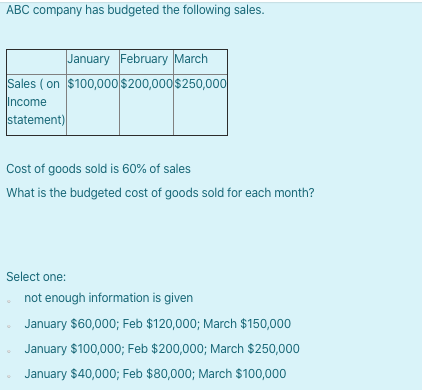

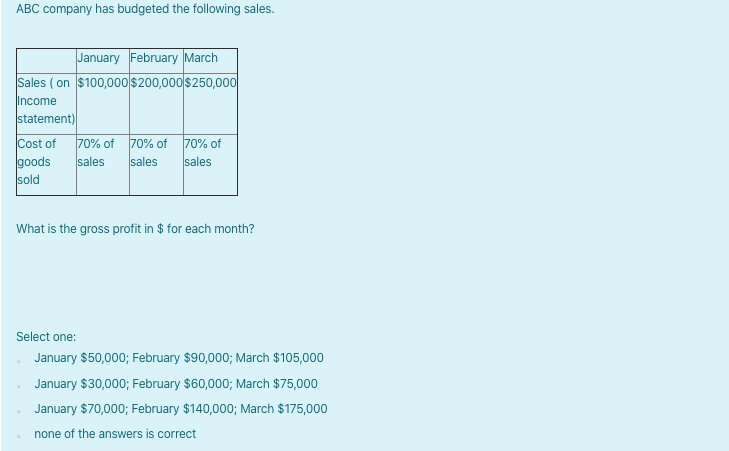

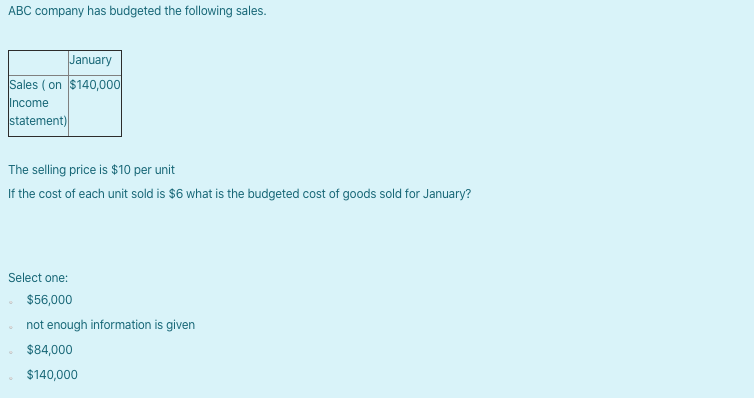

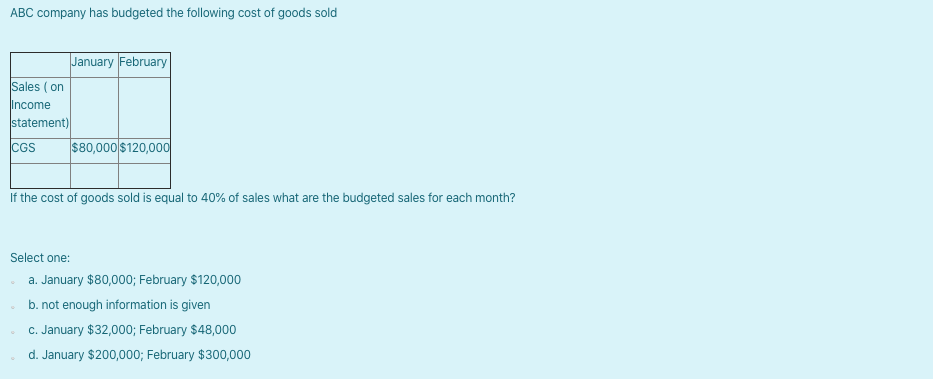

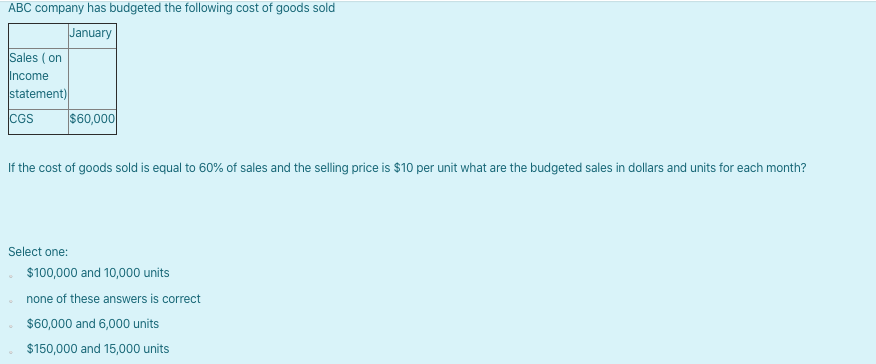

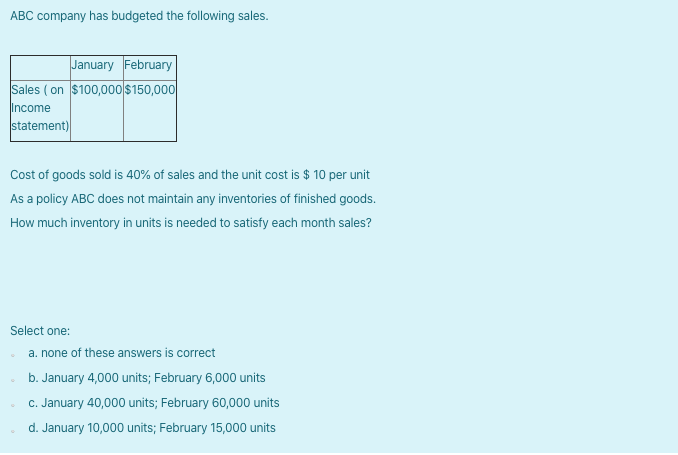

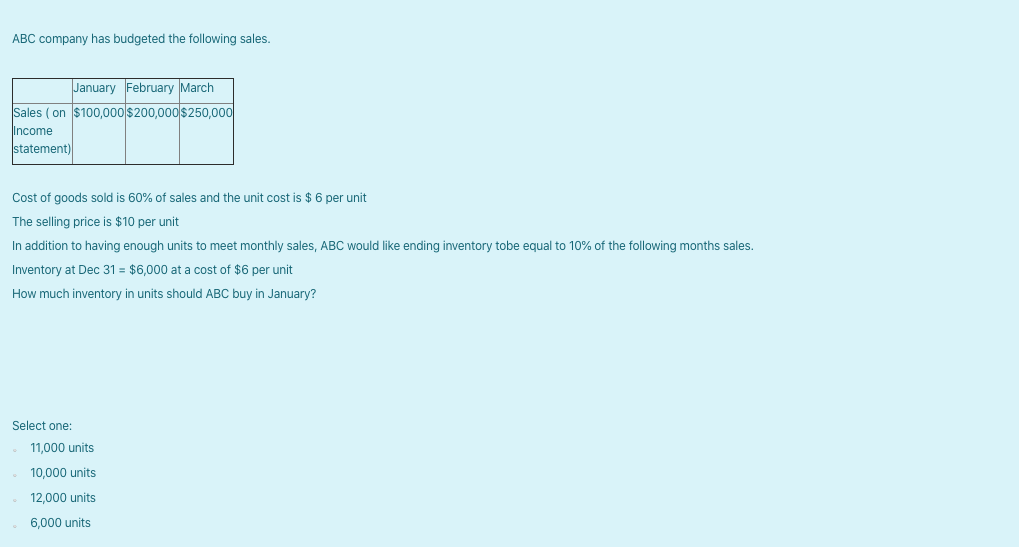

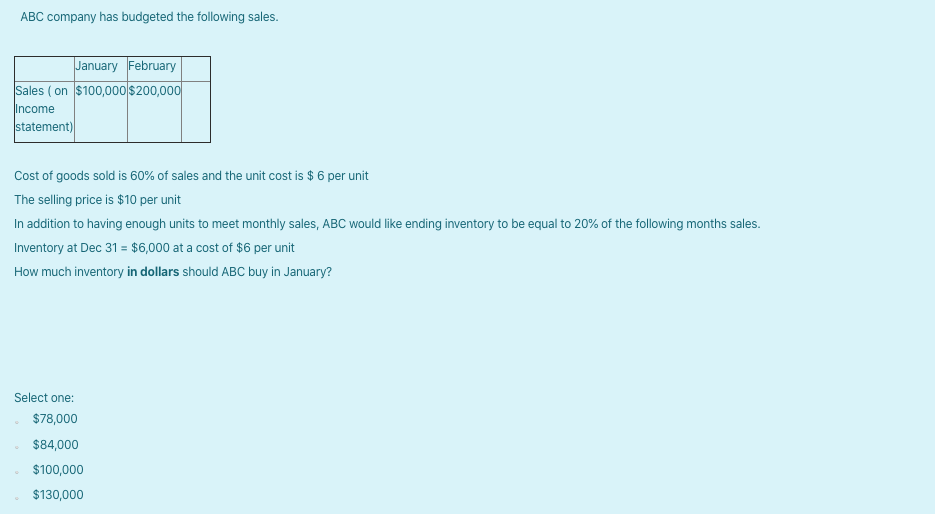

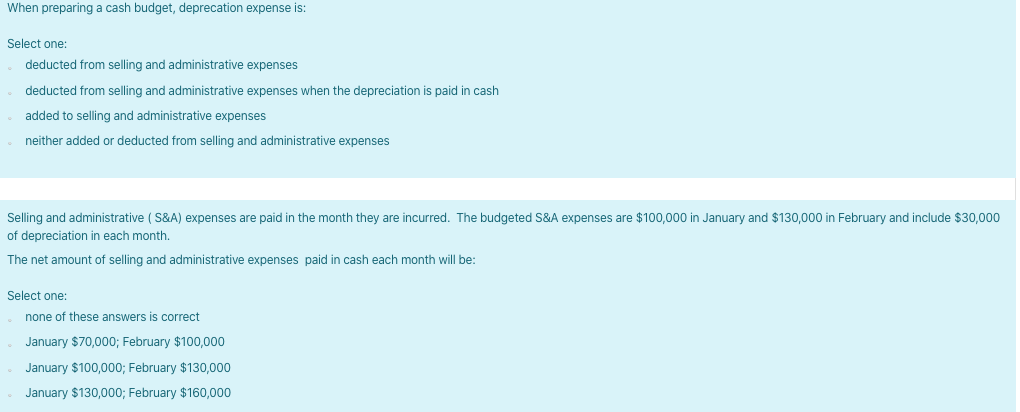

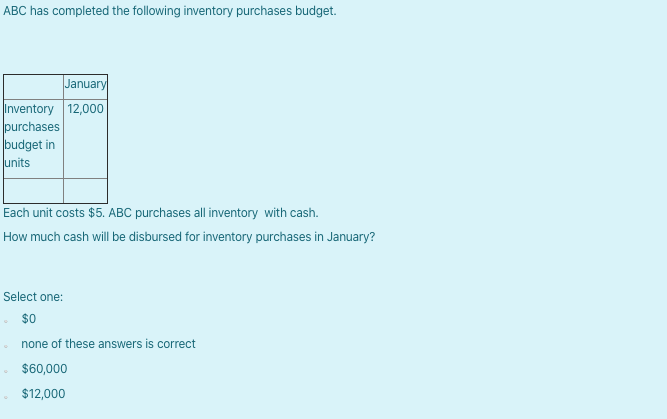

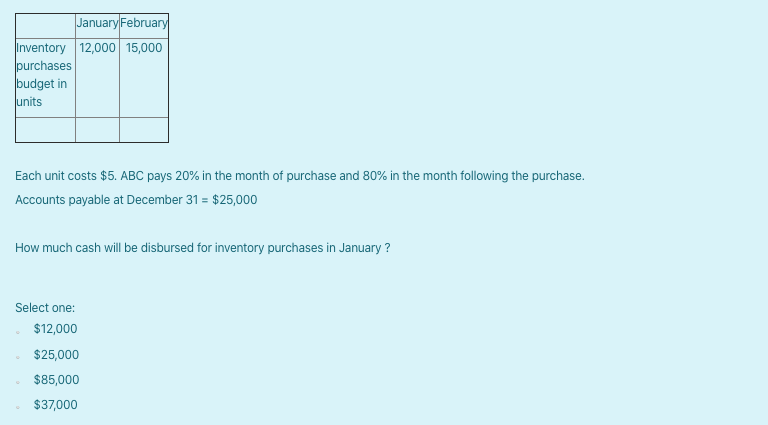

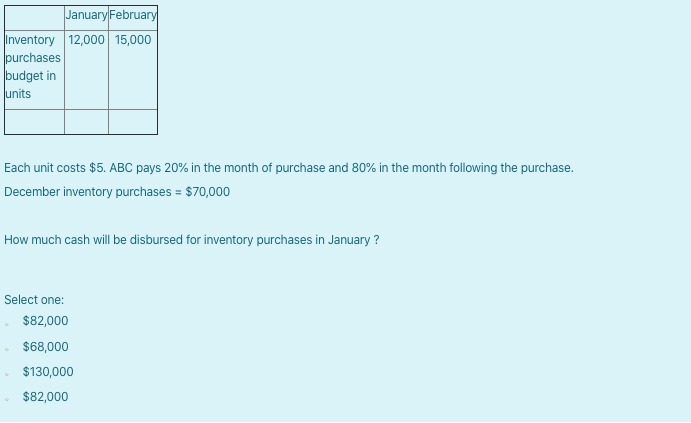

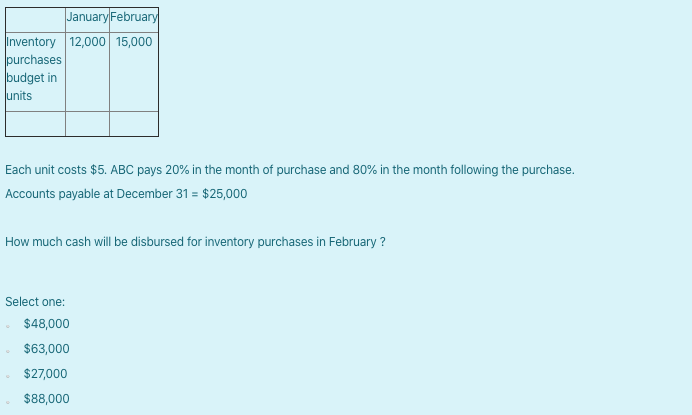

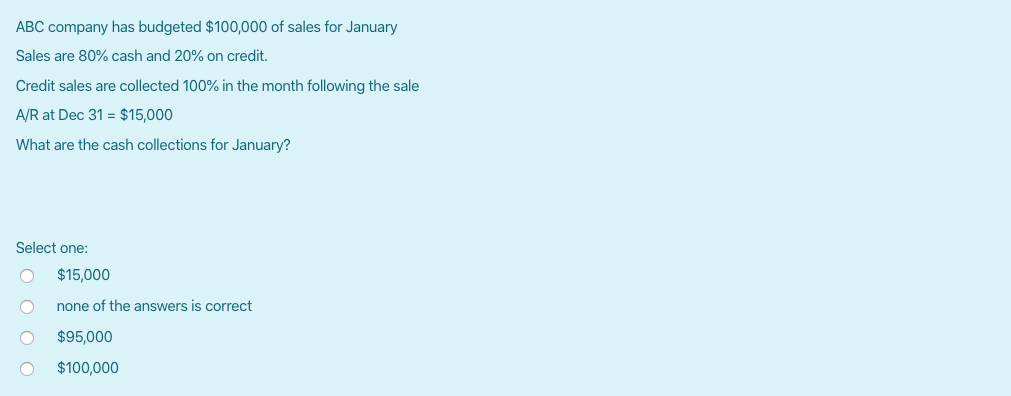

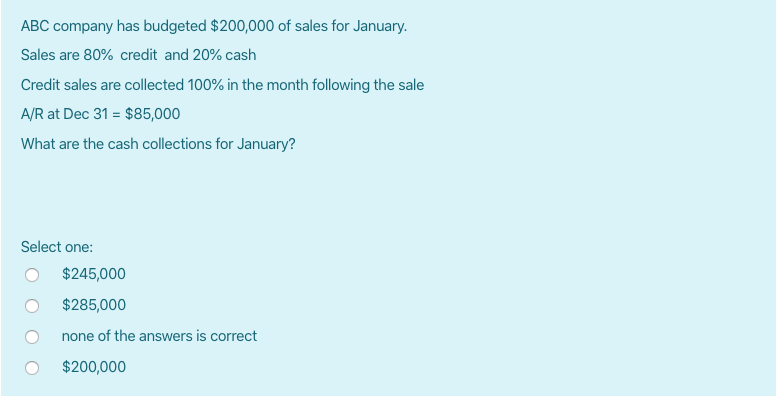

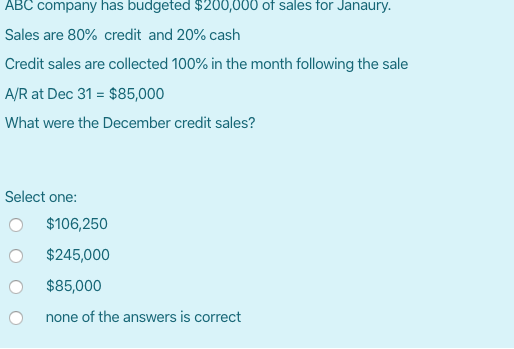

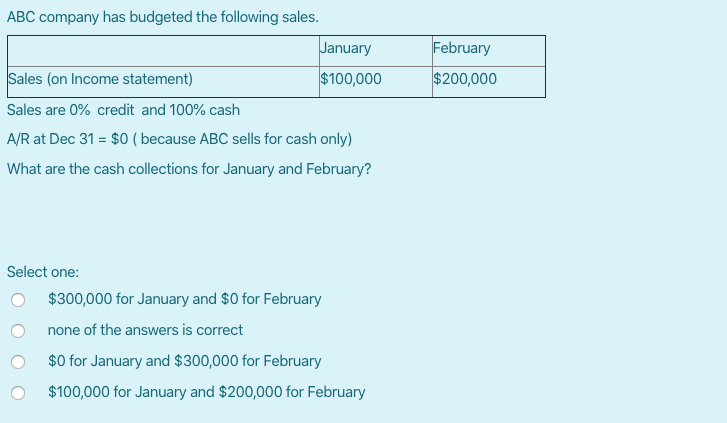

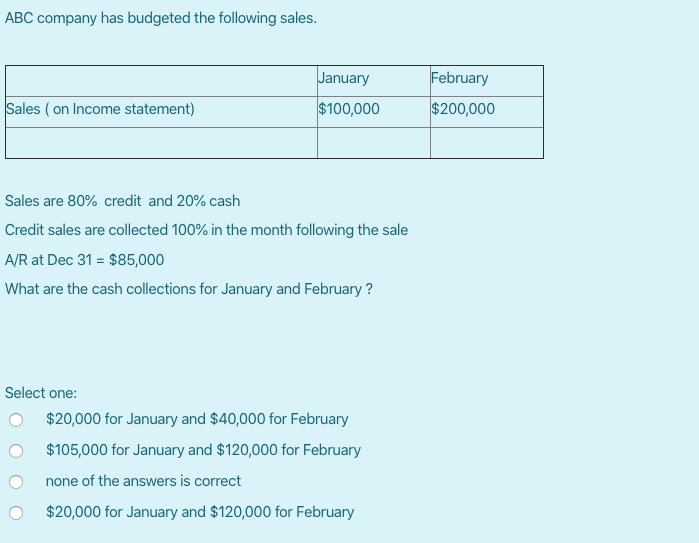

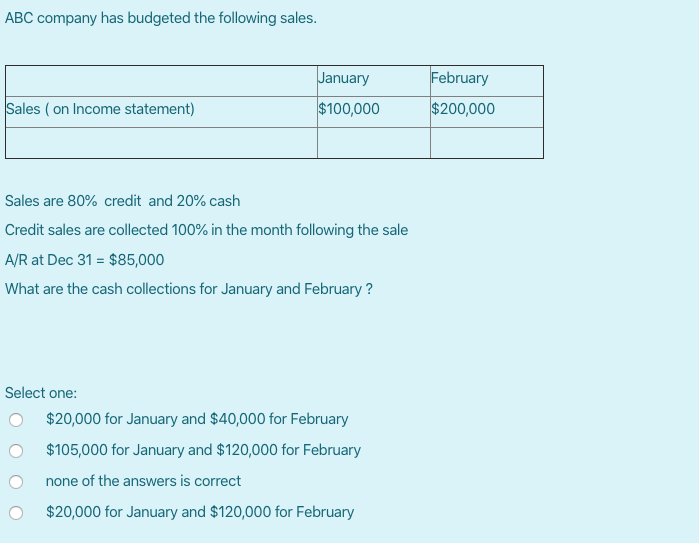

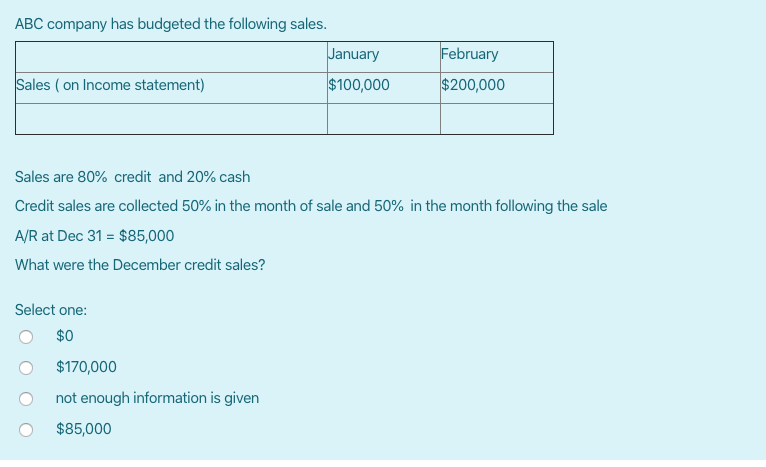

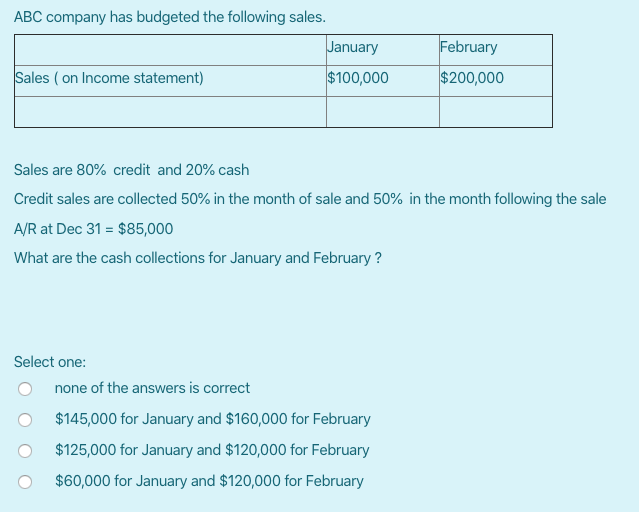

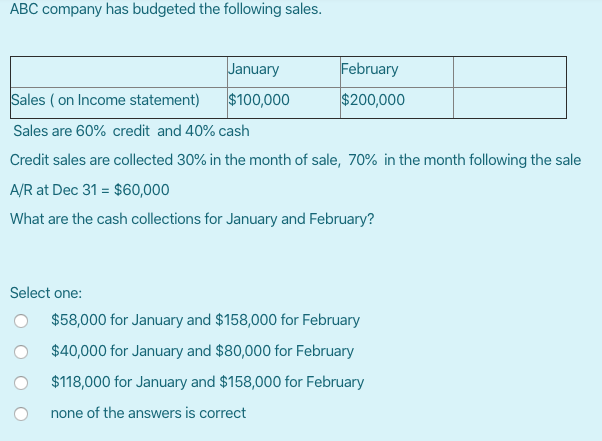

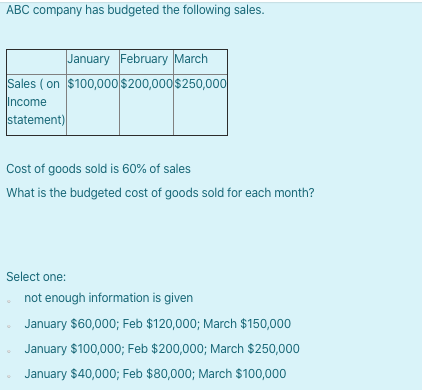

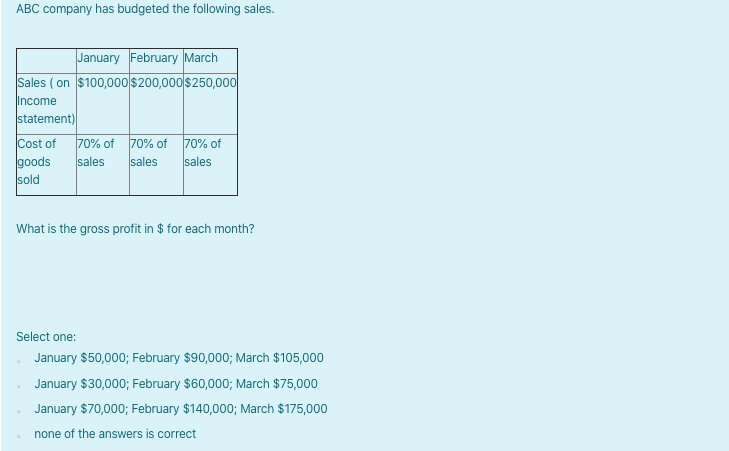

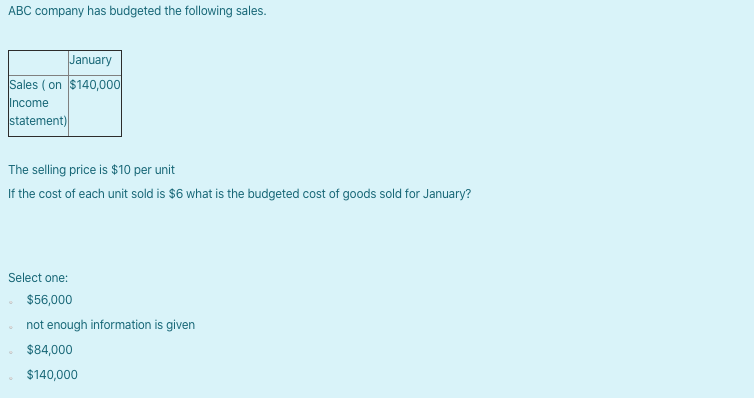

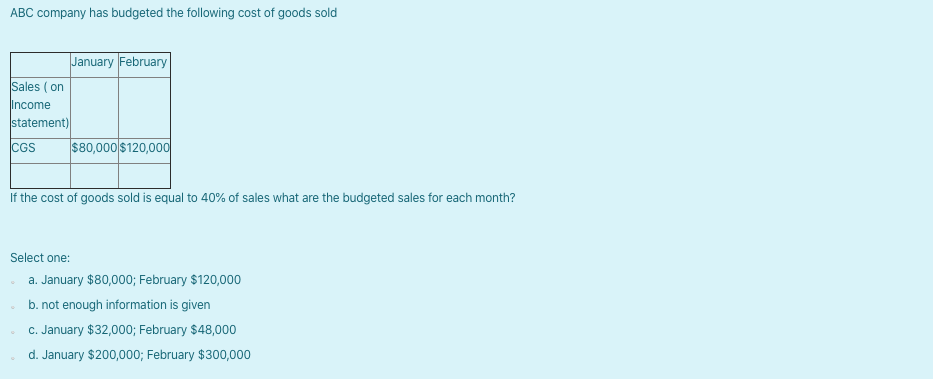

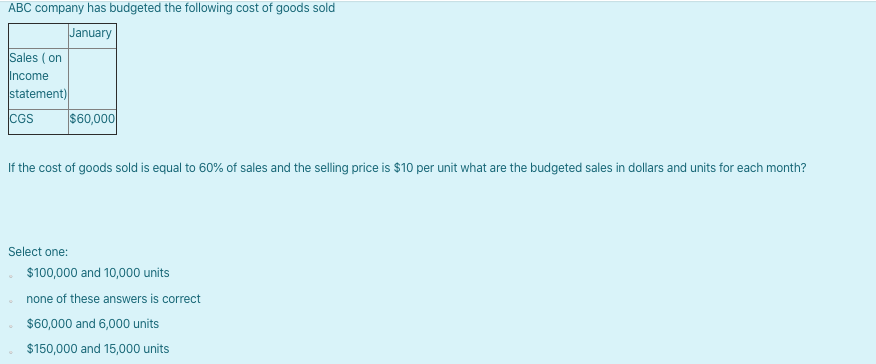

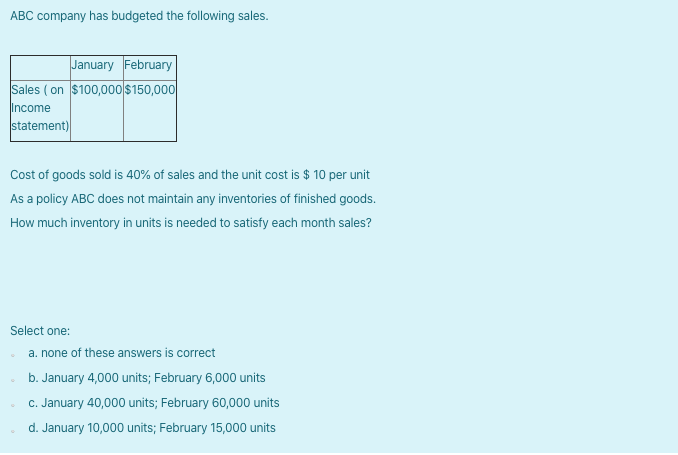

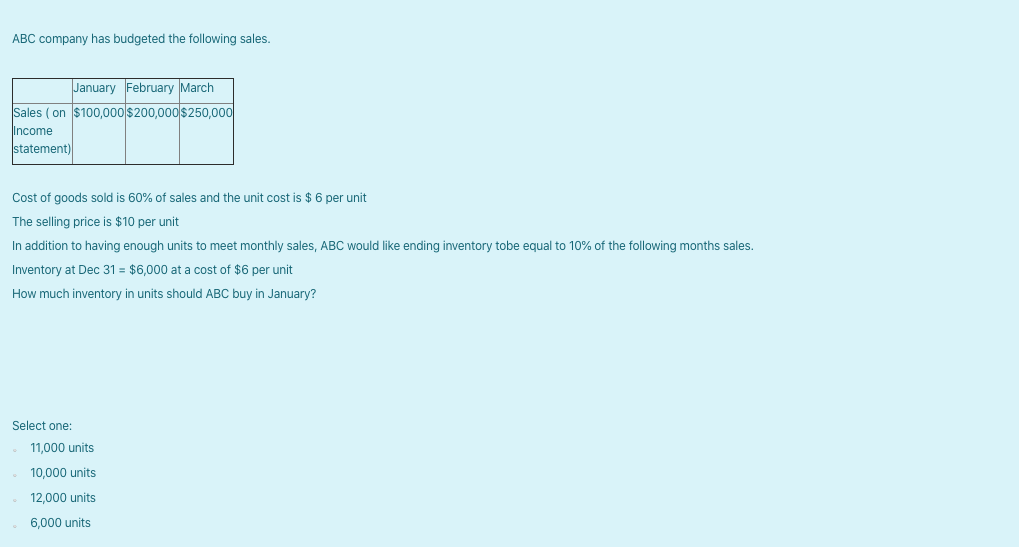

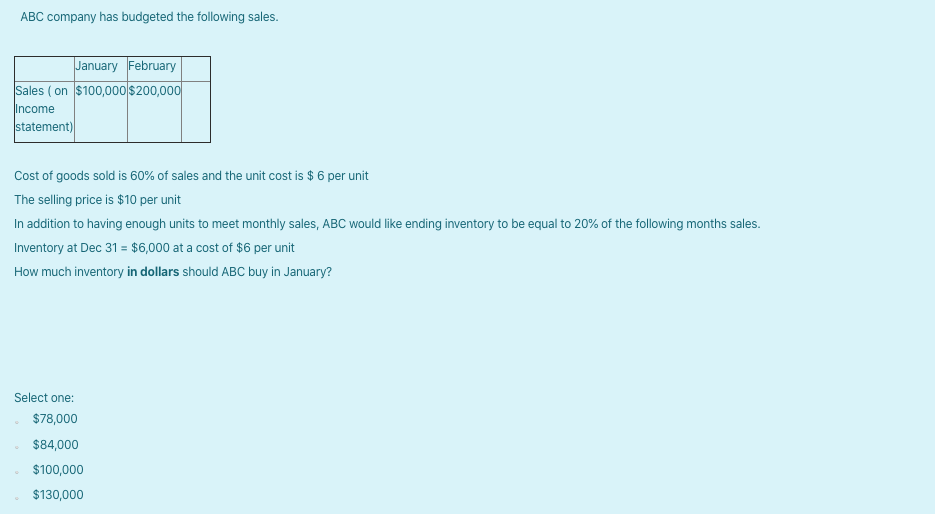

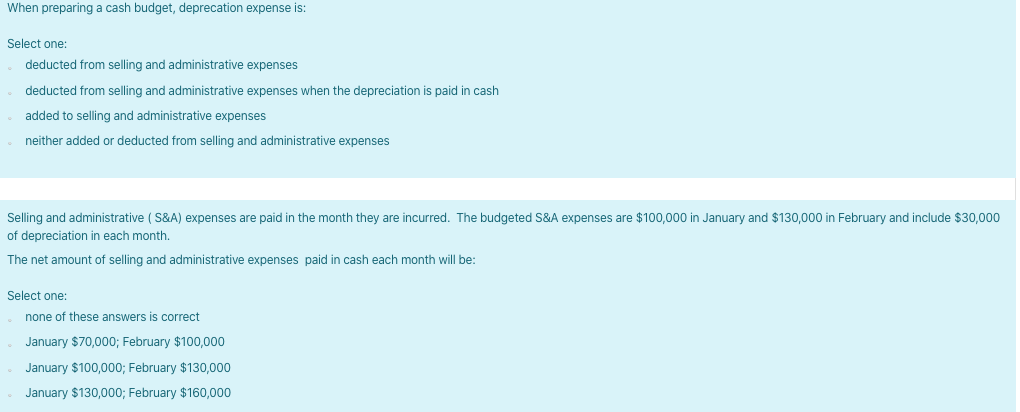

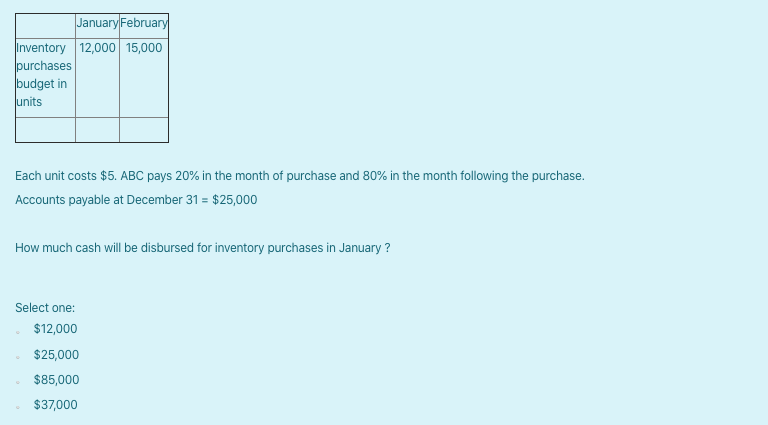

ABC company has budgeted $100,000 of sales for January Sales are 80% cash and 20% on credit Credit sales are collected 100% in the month following the sale A/R at Dec 31 = $15,000 What are the cash collections for January? Select one: O $15,000 none of the answers is correct $95,000 O $100,000 ABC company has budgeted $200,000 of sales for January. Sales are 80% credit and 20% cash Credit sales are collected 100% in the month following the sale A/R at Dec 31 = $85,000 What are the cash collections for January? Select one: O $245,000 O $285,000 O none of the answers is correct $200,000 ABC company has budgeted $200,000 of sales for Janaury. Sales are 80% credit and 20% cash Credit sales are collected 100% in the month following the sale A/R at Dec 31 = $85,000 What were the December credit sales? Select one: o $106,250 O $245,000 $85,000 none of the answers is correct February $200,000 ABC company has budgeted the following sales. January Sales (on Income statement) $100,000 Sales are 0% credit and 100% cash A/R at Dec 31 = $0 ( because ABC sells for cash only) What are the cash collections for January and February? Select one: o $300,000 for January and $0 for February O O O none of the answers is correct $0 for January and $300,000 for February $100,000 for January and $200,000 for February ABC company has budgeted the following sales. January February $200,000 Sales (on Income statement) $100,000 Sales are 80% credit and 20% cash Credit sales are collected 100% in the month following the sale A/R at Dec 31 = $85,000 What are the cash collections for January and February ? Select one: $20,000 for January and $40,000 for February $105,000 for January and $120,000 for February none of the answers is correct O $20,000 for January and $120,000 for February ABC company has budgeted the following sales. January Sales (on Income statement) $100,000 February $200,000 Sales are 80% credit and 20% cash Credit sales are collected 50% in the month of sale and 50% in the month following the sale A/R at Dec 31 = $85,000 What were the December credit sales? Select one: O $0 $170,000 o not enough information is given $85,000 ABC company has budgeted the following sales. January Sales (on Income statement) $100,000 February $200,000 Sales are 80% credit and 20% cash Credit sales are collected 50% in the month of sale and 50% in the month following the sale A/R at Dec 31 = $85,000 What are the cash collections for January and February ? Select one: O none of the answers is correct $145,000 for January and $160,000 for February $125,000 for January and $120,000 for February $60,000 for January and $120,000 for February ABC company has budgeted the following sales. January $100,000 February $200,000 Sales (on Income statement) Sales are 60% credit and 40% cash Credit sales are collected 30% in the month of sale, 70% in the month following the sale A/R at Dec 31 = $60,000 What are the cash collections for January and February? Select one: o $58,000 for January and $158,000 for February o $40,000 for January and $80,000 for February $118,000 for January and $158,000 for February O none of the answers is correct ABC company has budgeted the following sales. January February March Sales (on $100,000 $200,000 $250,000 Income statement) Cost of goods sold is 60% of sales What is the budgeted cost of goods sold for each month? Select one: not enough information is given January $60,000; Feb $120,000; March $150,000 January $100,000; Feb $200,000; March $250,000 January $40,000; Feb $80,000; March $100,000 ABC company has budgeted the following cost of goods sold January February Sales (on Income statement) CGS $80,000 $120,000 If the cost of goods sold is equal to 40% of sales what are the budgeted sales for each month? Select one: a. January $80,000; February $120,000 b. not enough information is given C. January $32,000; February $48,000 d. January $200,000; February $300,000 ABC company has budgeted the following cost of goods sold January Sales (on Income statement) CGS $60,000 If the cost of goods sold is equal to 60% of sales and the selling price is $10 per unit what are the budgeted sales in dollars and units for each month? Select one: $100,000 and 10,000 units none of these answers is correct $60,000 and 6,000 units $150,000 and 15,000 units When preparing a cash budget, deprecation expense is: Select one: deducted from selling and administrative expenses deducted from selling and administrative expenses when the depreciation is paid in cash added to selling and administrative expenses neither added or deducted from selling and administrative expenses Selling and administrative (S&A) expenses are paid in the month they are incurred. The budgeted S&A expenses are $100,000 in January and $130,000 in February and include $30,000 of depreciation in each month. The net amount of selling and administrative expenses paid in cash each month will be: Select one: none of these answers is correct January $70,000; February $100,000 January $100,000; February $130,000 January $130,000; February $160,000 January February Inventory 12,000 15,000 purchases budget in units Each unit costs $5. ABC pays 20% in the month of purchase and 80% in the month following the purchase. Accounts payable at December 31 = $ 25,000 How much cash will be disbursed for inventory purchases in January? Select one: $12,000 $25,000 $85,000 $37,000