Question

Barrett Company is facing financial difficulties and has decided to encourage some of their highly paid employees to take early retirement. Michelle, their CFO, is

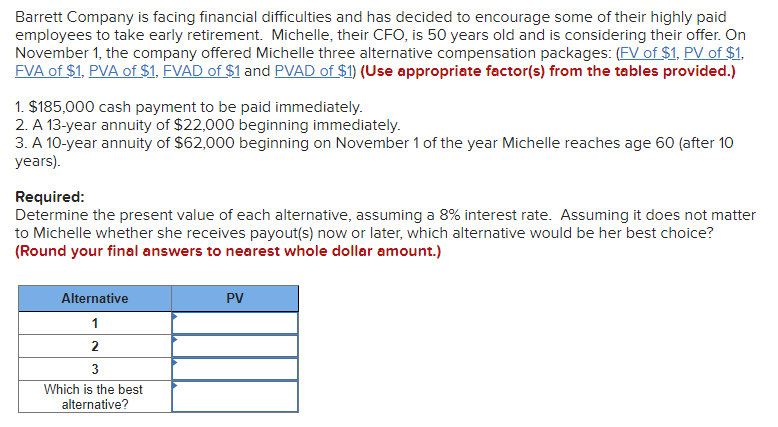

Barrett Company is facing financial difficulties and has decided to encourage some of their highly paid employees to take early retirement. Michelle, their CFO, is 50 years old and is considering their offer. On November 1, the company offered Michelle three alternative compensation packages: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) 1. $185,000 cash payment to be paid immediately. 2. A 13-year annuity of $22,000 beginning immediately. 3. A 10-year annuity of $62,000 beginning on November 1 of the year Michelle reaches age 60 (after 10 years). Required: Determine the present value of each alternative, assuming a 8% interest rate. Assuming it does not matter to Michelle whether she receives payout(s) now or later, which alternative would be her best choice? (Round your final answers to nearest whole dollar amount.)

Barrett Company is facing financial difficulties and has decided to encourage some of their highly paid employees to take early retirement. Michelle, their CFO, is 50 years old and is considering their offer. On November 1, the company offered Michelle three alternative compensation packages: ( FV of $1,PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1 ) (Use appropriate factor(s) from the tables provided.) 1. $185,000 cash payment to be paid immediately. 2. A 13 -year annuity of $22,000 beginning immediately. 3. A 10 -year annuity of $62,000 beginning on November 1 of the year Michelle reaches age 60 (after 10 years). Required: Determine the present value of each alternative, assuming a 8% interest rate. Assuming it does not matter to Michelle whether she receives payout(s) now or later, which alternative would be her best choice? (Round your final answers to nearest whole dollar amount.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started