Question

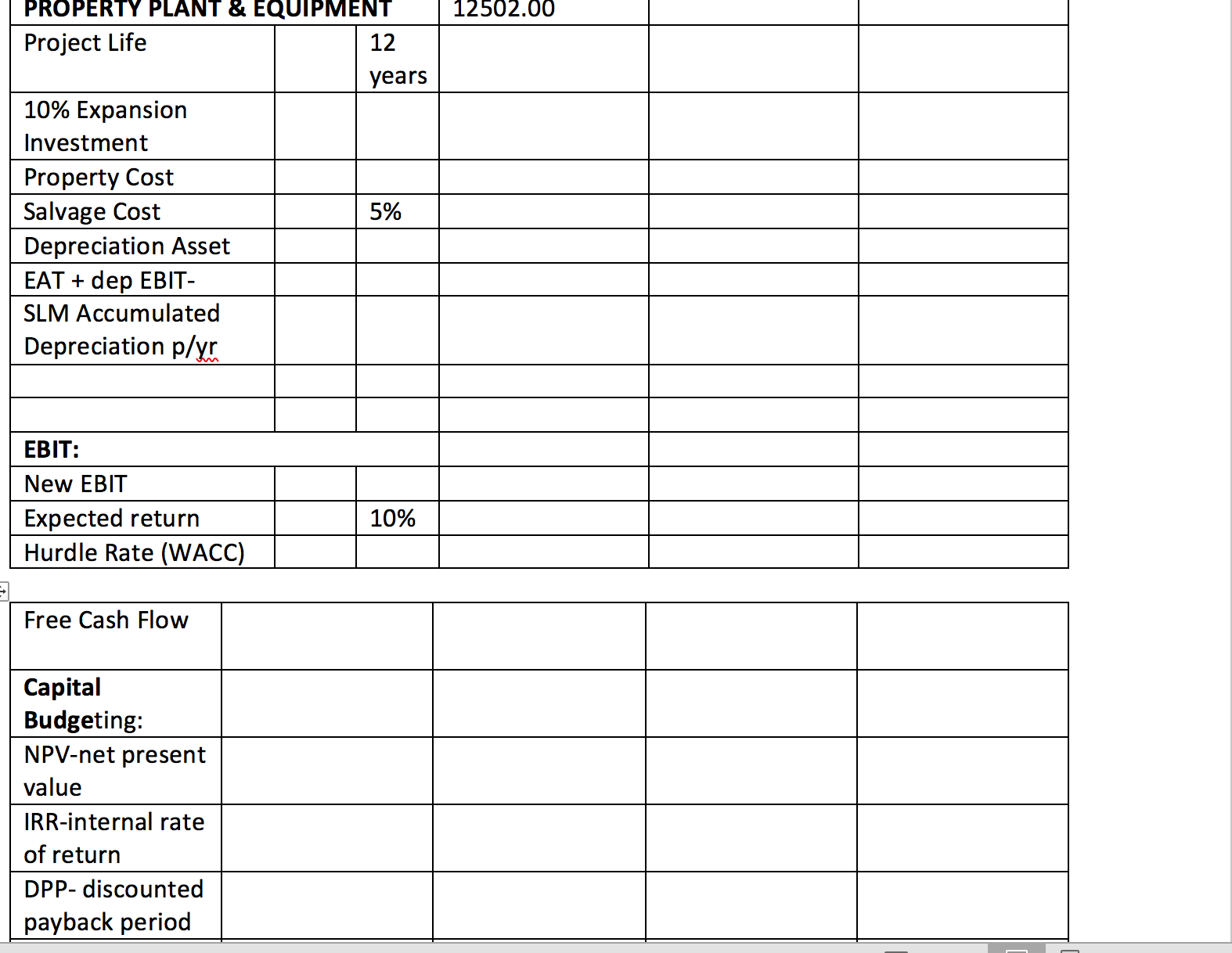

ABC COMPANY has property plant equipment of $12, 502. They are looking to expand their operations by 10% What is the new PPE based on

ABC COMPANY has property plant equipment of $12, 502. They are looking to expand their operations by 10%

What is the new PPE based on based on 10% expansion amount?

The life of the new equipment is 12 years, what is the salvage value based on 5% of the equipment cost/

What is the annual EBIT of the project based on 18% project cost?

Using the straight and 35% tax rate, what is annual depreciated equipment amount?

What is EBIT to free cash flow for the 12 years?

WACC is 9.5%

What are the capital budgeting results of:

** net present value (npv)=?

3. internal rate of return (IRR)=?

4. discounted payback period (DPP)=?

PLEASE SHOW ALL CALCULATIONS

PROPERTY PLANT & EQUIPMENT 12502.00 Project Life 12 years 10% Expansion Investment Property Cost Salvage Cost Depreciation Asset EAT + dep EBIT- SLM Accumulated Depreciation p/yr EBIT: New EBIT Expected return Hurdle Rate (WACC) Free Cash Flow Capital Budgeting: NPV-net present value IRR-internal rate of return DPP- discounted payback period 5% 10%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started