Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shiva Inc. has two divisions A and B. The company manufactures mountain bikes. Division A manufactures the frame (intermediate product) and division B assembles

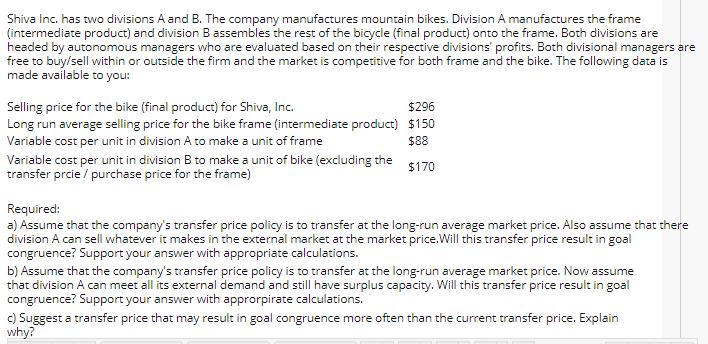

Shiva Inc. has two divisions A and B. The company manufactures mountain bikes. Division A manufactures the frame (intermediate product) and division B assembles the rest of the bicycle (final product) onto the frame. Both divisions are headed by autonomous managers who are evaluated based on their respective divisions' profits. Both divisional managers are free to buy/sell within or outside the firm and the market is competitive for both frame and the bike. The following data is made available to you: Selling price for the bike (final product) for Shiva, Inc. $296 Long run average selling price for the bike frame (intermediate product) $150 Variable cost per unit in division A to make a unit of frame $88 Variable cost per unit in division B to make a unit of bike (excluding the transfer prcie / purchase price for the frame) $170 Required: a) Assume that the company's transfer price policy is to transfer at the long-run average market price. Also assume that there division A can sell whatever it makes in the external market at the market price. Will this transfer price result in goal congruence? Support your answer with appropriate calculations. b) Assume that the company's transfer price policy is to transfer at the long-run average market price. Now assume that division A can meet all its external demand and still have surplus capacity. Will this transfer price result in goal congruence? Support your answer with approrpirate calculations. c) Suggest a transfer price that may result in goal congruence more often than the current transfer price. Explain why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Shiva Inc Transfer Pricing Analysis Scenario Assumptions Selling price of assembled bike final product296 Longrun average selling price of frame inter...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started