Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Company inaugurated a compensatory stock option plan for its top management on 1/1/20x5. Each of sixteen managers are granted 1000 options for company nopar

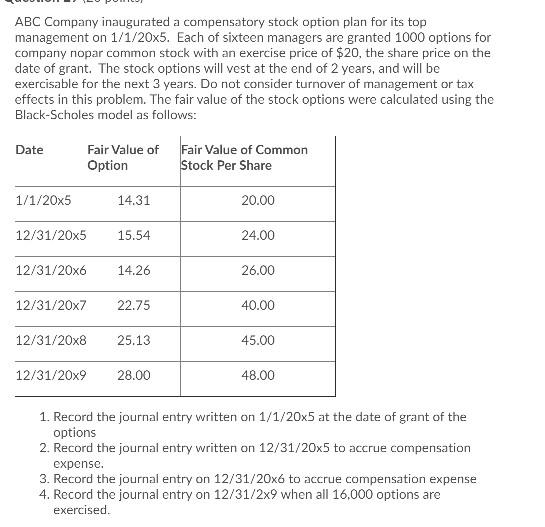

ABC Company inaugurated a compensatory stock option plan for its top management on 1/1/20x5. Each of sixteen managers are granted 1000 options for company nopar common stock with an exercise price of $20, the share price on the date of grant. The stock options will vest at the end of 2 years, and will be exercisable for the next 3 years. Do not consider turnover of management or tax effects in this problem. The fair value of the stock options were calculated using the Black-Scholes model as follows: Date Fair Value of Fair Value of Common Option Stock Per Share 1/1/20x5 14.31 20.00 12/31/20x5 15.54 24.00 12/31/20x6 14.26 26.00 12/31/20x7 22.75 40.00 12/31/20x8 25.13 45.00 12/31/20x9 28.00 48.00 1. Record the journal entry written on 1/1/20x5 at the date of grant of the options 2. Record the journal entry written on 12/31/20x5 to accrue compensation expense. 3. Record the journal entry on 12/31/20x6 to accrue compensation expense 4. Record the journal entry on 12/31/2x9 when all 16.000 options are exercised. ABC Company inaugurated a compensatory stock option plan for its top management on 1/1/20x5. Each of sixteen managers are granted 1000 options for company nopar common stock with an exercise price of $20, the share price on the date of grant. The stock options will vest at the end of 2 years, and will be exercisable for the next 3 years. Do not consider turnover of management or tax effects in this problem. The fair value of the stock options were calculated using the Black-Scholes model as follows: Date Fair Value of Fair Value of Common Option Stock Per Share 1/1/20x5 14.31 20.00 12/31/20x5 15.54 24.00 12/31/20x6 14.26 26.00 12/31/20x7 22.75 40.00 12/31/20x8 25.13 45.00 12/31/20x9 28.00 48.00 1. Record the journal entry written on 1/1/20x5 at the date of grant of the options 2. Record the journal entry written on 12/31/20x5 to accrue compensation expense. 3. Record the journal entry on 12/31/20x6 to accrue compensation expense 4. Record the journal entry on 12/31/2x9 when all 16.000 options are exercised

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started