Question

ABC Company is considering a new investment . Initially , this project requires a new fixed asset , which c osts 5 million . The

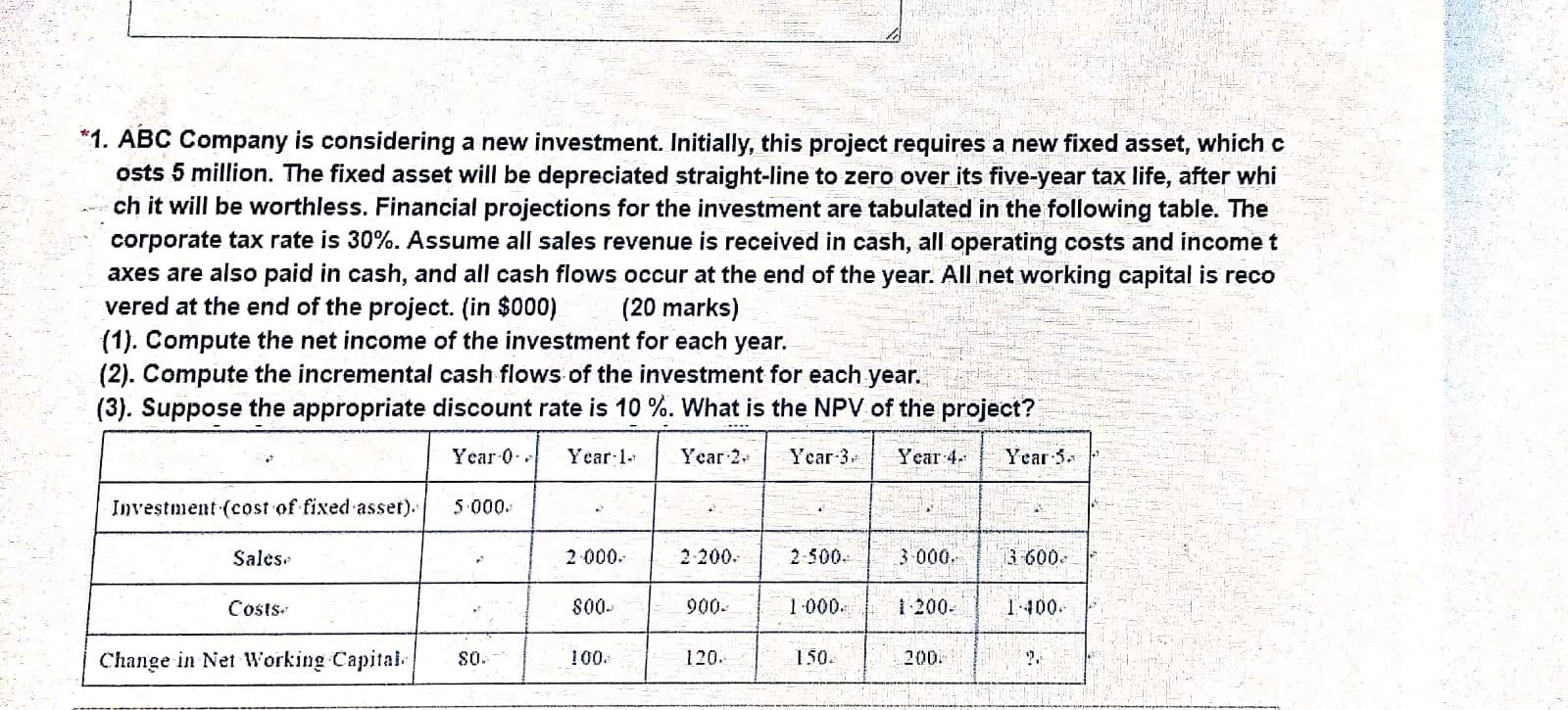

ABC Company is considering a new investment . Initially , this project requires a new fixed asset , which c osts 5 million . The fixed asset will be depreciated straight - line to zero over its five - year tax life , after whi ch it will be worthless . Financial projections for the investment are tabulated in the following table . The corporate tax rate is 30 % . Assume all sales revenue is received in cash , all operating costs and income t axes are also paid in cash , and all cash flows occur at the end of the year . All net working capital is reco vered at the end of the project ( in $ 000 )

( 1 ) . Compute the net income of the investment for each year .

( 2 ) . Compute the incremental cash flows of the investment for each year .

( 3 ) . Suppose the appropriate discount rate is 10 % . What is the NPV of the project ?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started