Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Company is considering a new project. The required new equipment will cost $74,240 and has a 3-year MACRS life, with the allowed depreciation

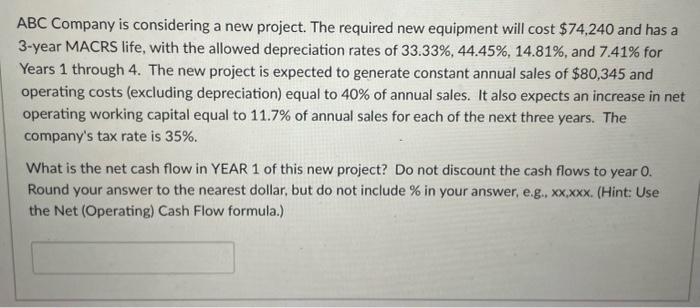

ABC Company is considering a new project. The required new equipment will cost $74,240 and has a 3-year MACRS life, with the allowed depreciation rates of 33.33%, 44.45%, 14.81%, and 7.41% for Years 1 through 4. The new project is expected to generate constant annual sales of $80,345 and operating costs (excluding depreciation) equal to 40% of annual sales. It also expects an increase in net operating working capital equal to 11.7% of annual sales for each of the next three years. The company's tax rate is 35%. What is the net cash flow in YEAR 1 of this new project? Do not discount the cash flows to year 0. Round your answer to the nearest dollar, but do not include % in your answer, e.g., xx,xxx. (Hint: Use the Net (Operating) Cash Flow formula.)

Step by Step Solution

★★★★★

3.56 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net cash flow in Year 1 of the new project we need to determine the net operating c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started