Answered step by step

Verified Expert Solution

Question

1 Approved Answer

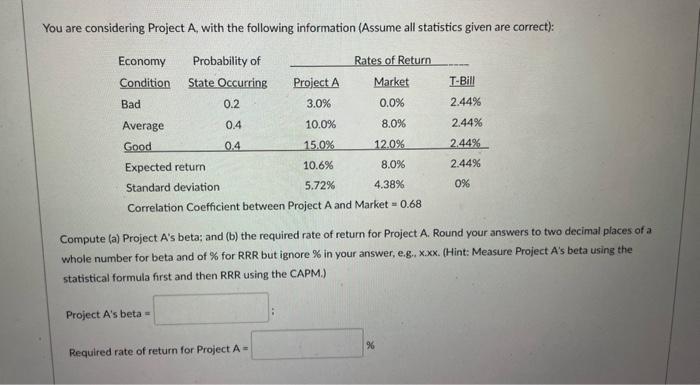

You are considering Project A, with the following information (Assume all statistics given are correct): Probability of State Occurring 0.2 0.4 0.4 Rates of

You are considering Project A, with the following information (Assume all statistics given are correct): Probability of State Occurring 0.2 0.4 0.4 Rates of Return Market 0.0% 8.0% 12.0% 8.0% 4.38% Correlation Coefficient between Project A and Market = 0.68 Economy Condition Bad Average Good Expected return Standard deviation Project A's beta = Project A 3.0% 10.0% 15.0% 10.6% 5.72% Compute (a) Project A's beta; and (b) the required rate of return for Project A. Round your answers to two decimal places of a whole number for beta and of % for RRR but ignore % in your answer, e.g., x.xx. (Hint: Measure Project A's beta using the statistical formula first and then RRR using the CAPM.) Required rate of return for Project A= T-Bill 2.44% 2.44% 2.44% 2.44% 0% %

Step by Step Solution

★★★★★

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Project As beta we can use the formula Beta Covariance Project A Returns Market Returns ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started