Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC company is considering a project with an initial investment of $1500 followed by a cash inflow of $500, $750, and $880 in the

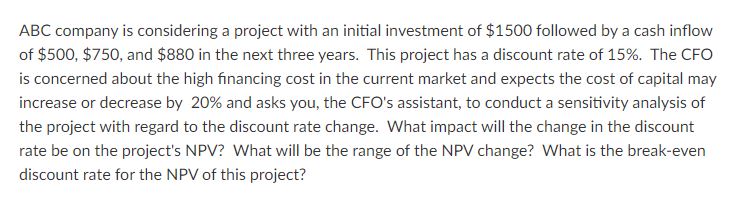

ABC company is considering a project with an initial investment of $1500 followed by a cash inflow of $500, $750, and $880 in the next three years. This project has a discount rate of 15%. The CFO is concerned about the high financing cost in the current market and expects the cost of capital may increase or decrease by 20% and asks you, the CFO's assistant, to conduct a sensitivity analysis of the project with regard to the discount rate change. What impact will the change in the discount rate be on the project's NPV? What will be the range of the NPV change? What is the break-even discount rate for the NPV of this project?

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the sensitivity of the projects net present value NPV to changes in the discount rate well calculate the NPV for different discount rate sc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started