Question

ABC company is considering purchasing a new rubber extrusion line that produces rolling bands, flanks, and other products used in the process of tire manufacturing.

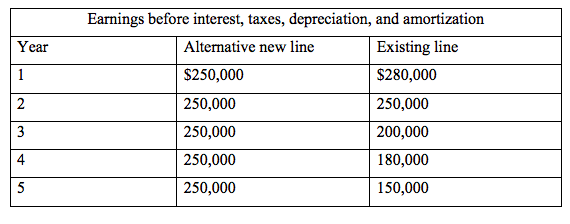

ABC company is considering purchasing a new rubber extrusion line that produces rolling bands, flanks, and other products used in the process of tire manufacturing. This line will replace the existing one, which was purchased 3 years ago for $200,000, at an installation cost of $50,000; it was depreciated under straight-line amortization, and with 5 years of usable life remaining. The new line is more expensive (it costs $800,000 and does not have any additional installation costs), but at the same time requires an increase in accounts receivable by $800,000, inventories by $200,000 and accounts payable by $500,000. ABC company can sell the existing line for $150,000 without incurring any additional costs. In addition, suppose the new rubber extrusion line is amortized for 5 years, with the following methods: 20% in year 1, 30% in year 2, 15% in year 3, 10% in year 4 and 5% in year 5. At the end of 5 years, the existing line would have a market value of zero; the new line would be sold to net $100,000 after removal and clean-up costs and before tax. The firm is subject to 24% tax rate. The following table shows the estimated earnings before interest, tax, depreciation, and amortization over the 5 years for both the new and the existing line.

i. Calculate the initial investment associated with the alternative line.

ii. Determine the incremental operating cash flows associated with the alternative line replacement.

iii. Determine the terminal cash flow expected at the end of year 5 from the alternative line replacement.

iv. Depict on a timeline the incremental cash flows associated with the alternative line replacement decision.

Year 1 2 Earnings before interest, taxes, depreciation, and amortization Alternative new line Existing line $250,000 $280,000 250,000 250,000 250,000 200,000 250,000 180,000 250,000 150,000 3 4 5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started