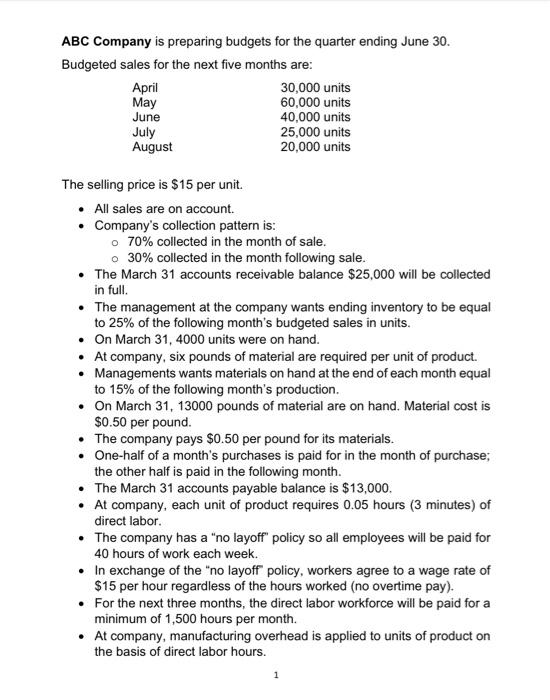

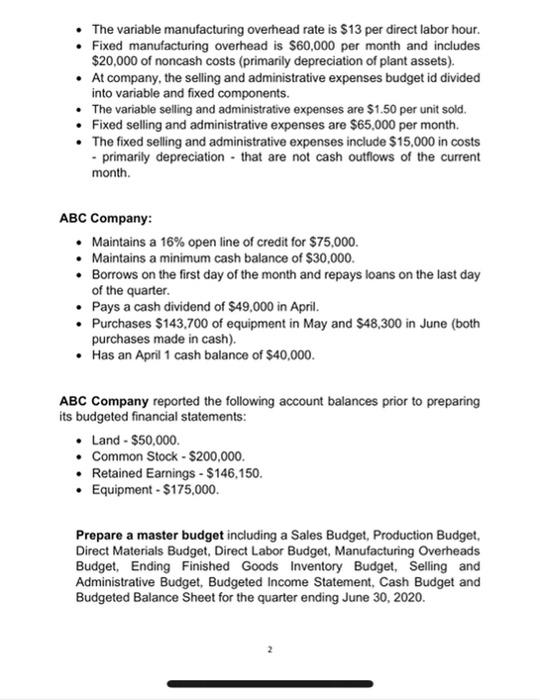

ABC Company is preparing budgets for the quarter ending June 30 . Budgeted sales for the next five months are: The selling price is $15 per unit. - All sales are on account. - Company's collection pattern is: - 70% collected in the month of sale. - 30% collected in the month following sale. - The March 31 accounts receivable balance $25,000 will be collected in full. - The management at the company wants ending inventory to be equal to 25% of the following month's budgeted sales in units. - On March 31, 4000 units were on hand. - At company, six pounds of material are required per unit of product. - Managements wants materials on hand at the end of each month equal to 15% of the following month's production. - On March 31, 13000 pounds of material are on hand. Material cost is $0.50 per pound. - The company pays $0.50 per pound for its materials. - One-half of a month's purchases is paid for in the month of purchase; the other half is paid in the following month. - The March 31 accounts payable balance is $13,000. - At company, each unit of product requires 0.05 hours (3 minutes) of direct labor. - The company has a "no layoff" policy so all employees will be paid for 40 hours of work each week. - In exchange of the "no layoff policy, workers agree to a wage rate of $15 per hour regardless of the hours worked (no overtime pay). - For the next three months, the direct labor workforce will be paid for a minimum of 1,500 hours per month. - At company, manufacturing overhead is applied to units of product on the basis of direct labor hours. 1 - The variable manufacturing overhead rate is $13 per direct labor hour. - Fixed manufacturing overhead is $60,000 per month and includes $20,000 of noncash costs (primarily depreciation of plant assets). - At company, the selling and administrative expenses budget id divided into variable and fixed components. - The variable selling and administrative expenses are $1.50 per unit sold. - Fixed selling and administrative expenses are $65,000 per month. - The fixed selling and administrative expenses include $15,000 in costs - primarily depreciation - that are not cash outflows of the current month. ABC Company: - Maintains a 16% open line of credit for $75,000. - Maintains a minimum cash balance of $30,000. - Borrows on the first day of the month and repays loans on the last day of the quarter. - Pays a cash dividend of $49,000 in April. - Purchases $143,700 of equipment in May and $48,300 in June (both purchases made in cash). - Has an April 1 cash balance of $40,000. ABC Company reported the following account balances prior to preparing its budgeted financial statements: - Land $50,000. - Common Stock - $200,000. - Retained Earnings - $146,150. - Equipment - $175,000. Prepare a master budget including a Sales Budget, Production Budget, Direct Materials Budget, Direct Labor Budget, Manufacturing Overheads Budget, Ending Finished Goods Inventory Budget, Selling and Administrative Budget, Budgeted Income Statement, Cash Budget and Budgeted Balance Sheet for the quarter ending June 30, 2020