Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Company Ltd. is working in food and beverages industry and is producer of Fruit Juices. The management of company is thinking to expand

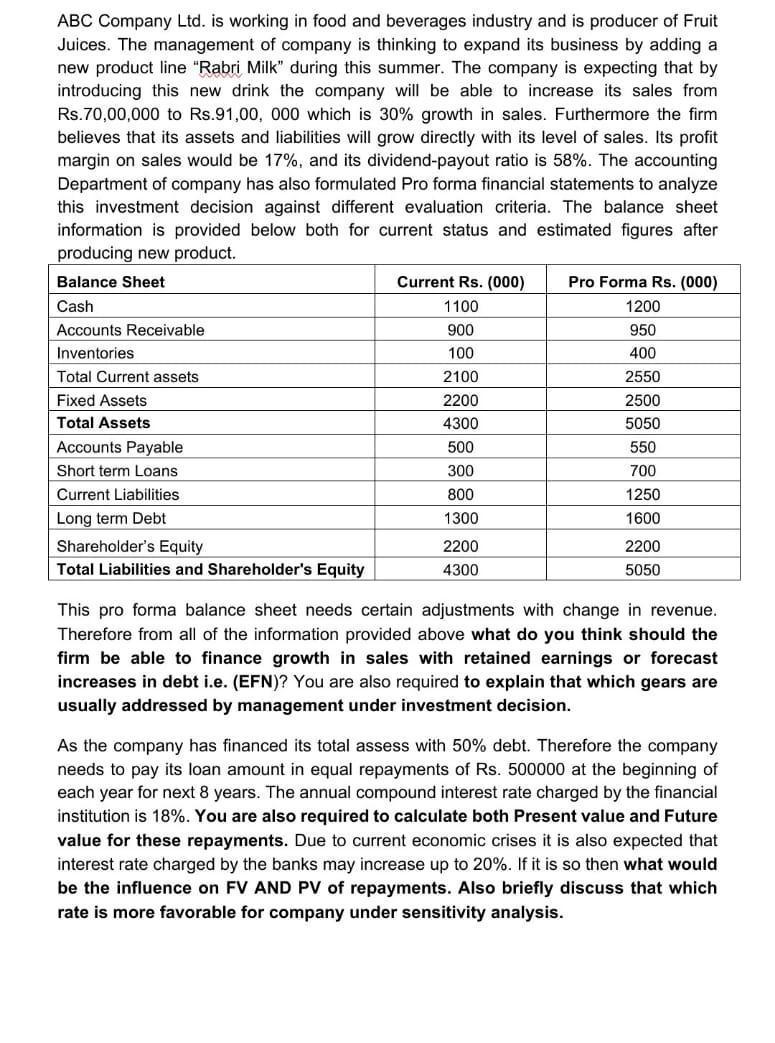

ABC Company Ltd. is working in food and beverages industry and is producer of Fruit Juices. The management of company is thinking to expand its business by adding a new product line "Rabri Milk" during this summer. The company is expecting that by introducing this new drink the company will be able to increase its sales from Rs.70,00,000 to Rs.91,00, 000 which is 30% growth in sales. Furthermore the firm believes that its assets and liabilities will grow directly with its level of sales. Its profit margin on sales would be 17%, and its dividend-payout ratio is 58%. The accounting Department of company has also formulated Pro forma financial statements to analyze this investment decision against different evaluation criteria. The balance sheet information is provided below both for current status and estimated figures after producing new product. Balance Sheet Cash Accounts Receivable Inventories Total Current assets Fixed Assets Total Assets Accounts Payable Short term Loans Current Liabilities Long term Debt Shareholder's Equity Total Liabilities and Shareholder's Equity Current Rs. (000) 1100 900 100 2100 2200 4300 500 300 800 1300 2200 4300 Pro Forma Rs. (000) 1200 950 400 2550 2500 5050 550 700 1250 1600 2200 5050 This pro forma balance sheet needs certain adjustments with change in revenue. Therefore from all of the information provided above what do you think should the firm be able to finance growth in sales with retained earnings or forecast increases in debt i.e. (EFN)? You are also required to explain that which gears are usually addressed by management under investment decision. As the company has financed its total assess with 50% debt. Therefore the company needs to pay its loan amount in equal repayments of Rs. 500000 at the beginning of each year for next 8 years. The annual compound interest rate charged by the financial institution is 18%. You are also required to calculate both Present value and Future value for these repayments. Due to current economic crises it is also expected that interest rate charged by the banks may increase up to 20%. If it is so then what would be the influence on FV AND PV of repayments. Also briefly discuss that which rate is more favorable for company under sensitivity analysis.

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER A sensitivity analysis also referred to as a whatif analysis is a mathematical tool used in s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started