Answered step by step

Verified Expert Solution

Question

1 Approved Answer

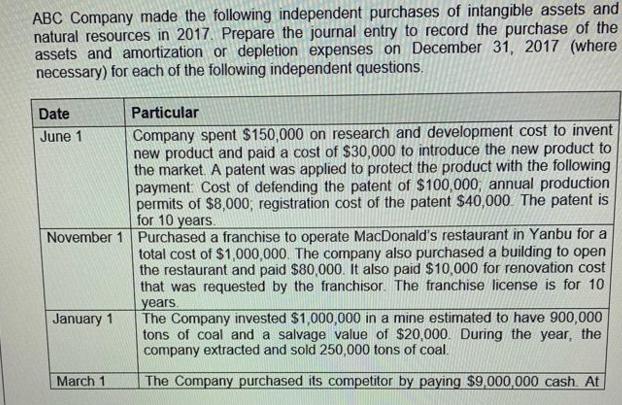

ABC Company made the following independent purchases of intangible assets and natural resources in 2017. Prepare the journal entry to record the purchase of

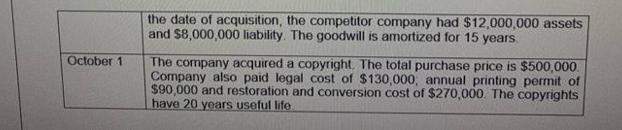

ABC Company made the following independent purchases of intangible assets and natural resources in 2017. Prepare the journal entry to record the purchase of the assets and amortization or depletion expenses on December 31, 2017 (where necessary) for each of the following independent questions. Date June 1 November 1 Purchased a franchise to operate MacDonald's restaurant in Yanbu for a total cost of $1,000,000. The company also purchased a building to open the restaurant and paid $80,000. It also paid $10,000 for renovation cost that was requested by the franchisor. The franchise license is for 10 years. January 1 Particular Company spent $150,000 on research and development cost to invent new product and paid a cost of $30,000 to introduce the new product to the market. A patent was applied to protect the product with the following payment: Cost of defending the patent of $100,000; annual production permits of $8,000; registration cost of the patent $40,000. The patent is for 10 years. March 1 The Company invested $1,000,000 in a mine estimated to have 900,000 tons of coal and a salvage value of $20,000. During the year, the company extracted and sold 250,000 tons of coal. The Company purchased its competitor by paying $9,000,000 cash. At October 1 the date of acquisition, the competitor company had $12,000,000 assets and $8,000,000 liability. The goodwill is amortized for 15 years. The company acquired a copyright. The total purchase price is $500,000. Company also paid legal cost of $130,000, annual printing permit of $90,000 and restoration and conversion cost of $270,000. The copyrights have 20 years useful life.

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Transaction 1 Research and Development and Patent Date Particulars Debit Credit June 1 Research and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started