Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare journal entries to record the purchase of intangible assets and amortization expenses on December 31, 2019 (where necessary) for each of the following

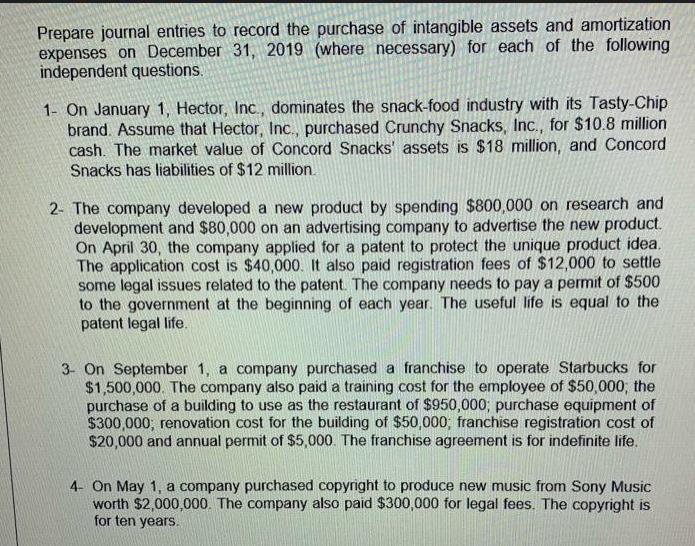

Prepare journal entries to record the purchase of intangible assets and amortization expenses on December 31, 2019 (where necessary) for each of the following independent questions. 1- On January 1, Hector, Inc., dominates the snack-food industry with its Tasty-Chip brand. Assume that Hector, Inc., purchased Crunchy Snacks, Inc., for $10.8 million cash. The market value of Concord Snacks' assets is $18 million, and Concord Snacks has liabilities of $12 million. 2- The company developed a new product by spending $800,000 on research and development and $80,000 on an advertising company to advertise the new product. On April 30, the company applied for a patent to protect the unique product idea. The application cost is $40,000. It also paid registration fees of $12,000 to settle some legal issues related to the patent. The company needs to pay a permit of $500 to the government at the beginning of each year. The useful life is equal to the patent legal life. 3- On September 1, a company purchased a franchise to operate Starbucks for $1,500,000. The company also paid a training cost for the employee of $50,000, the purchase of a building to use as the restaurant of $950,000; purchase equipment of $300,000, renovation cost for the building of $50,000; franchise registration cost of $20,000 and annual permit of $5,000. The franchise agreement is for indefinite life. 4- On May 1, a company purchased copyright to produce new music from Sony Music worth $2,000,000. The company also paid $300,000 for legal fees. The copyright is for ten years.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Journal entries for the purchase of Crunchy Snacks Inc by Hector Inc a To record the acquisition of Crunchy Snacks Inc Date December 31 2019 Account ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started