Question

ABC company plans to introduce a new line of fashion. The project has a two year life. An initial investment of $100 is required to

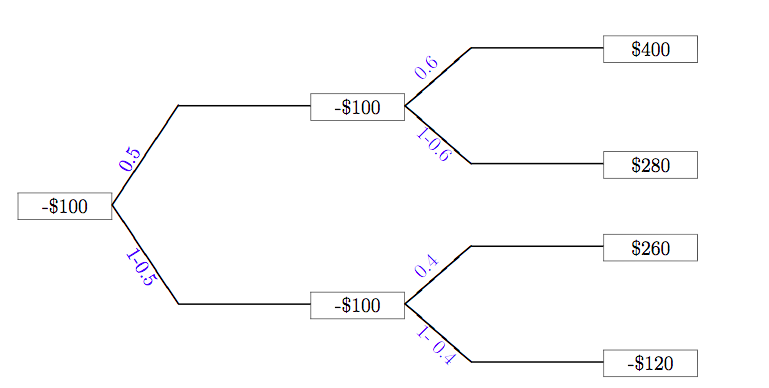

ABC company plans to introduce a new line of fashion. The project has a two year life. An initial investment of $100 is required to fund a year-long design phase. At the end of the first year, a further $100 is required for production, and after-tax cash inflows from sales (net of selling expenses) will occur at the end of the second year. The actual probability occurrences and the associated cash flows are given in the following diagram:

Suppose a risk-adjusted discount rate is 15% per annum for such a project, and the risk-free rate is 5%.

a) Find the expected cash ows each year and the naive NPV. Will you accept the project based on the naive NPV rule?

(b) Calculate the risk neutral probabilities for each decision node.

(c) Assume the rm can abandon the project in year 2 (European type option) if the situation is unfavorable. What is the optimal decision and what is the project value at optimality?

(d) In addition, assume the rm can also abandon the project in year 1 (American type option). What is the optimal decision and what is the present value of the project at optimality?

$400 0.6 -$100 -$100 $280 $260 -$100 -$120 1-0.6 0.5 0.4 1-0.5 I-0.4 $400 0.6 -$100 -$100 $280 $260 -$100 -$120 1-0.6 0.5 0.4 1-0.5 I-0.4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started