Answered step by step

Verified Expert Solution

Question

1 Approved Answer

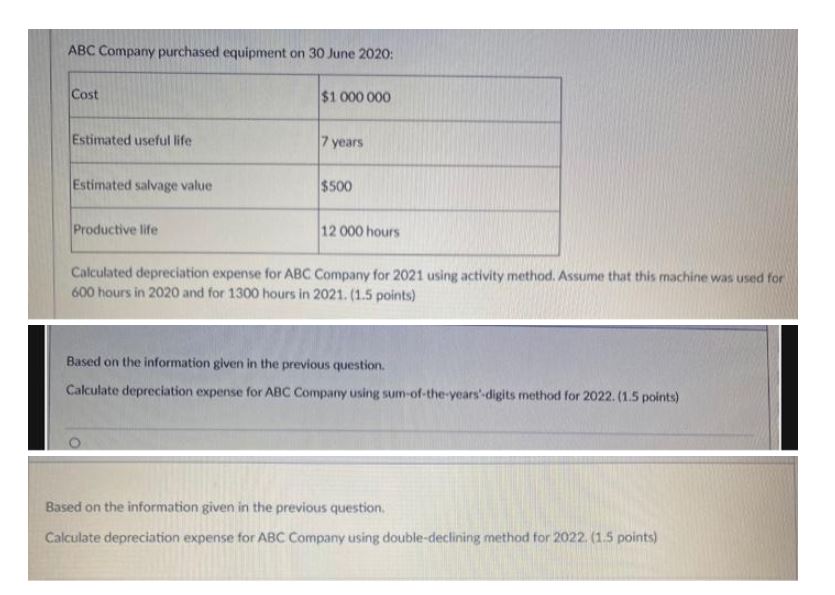

ABC Company purchased equipment on 30 June 2020: Cost $1 000 000 Estimated useful life 7 years Estimated salvage value $500 Productive life 12

ABC Company purchased equipment on 30 June 2020: Cost $1 000 000 Estimated useful life 7 years Estimated salvage value $500 Productive life 12 000 hours Calculated depreciation expense for ABC Company for 2021 using activity method. Assume that this machine was used for 600 hours in 2020 and for 1300 hours in 2021. (1.5 points) Based on the information given in the previous question. Calculate depreciation expense for ABC Company using sum-of-the-years'-digits method for 2022. (1.5 points) Based on the information given in the previous question. Calculate depreciation expense for ABC Company using double-declining method for 2022. (1.5 points)

Step by Step Solution

★★★★★

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the depreciation expense for ABC Company for 2021 using the activity method we need to determine the depreciation per hour and multiply i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started