Answered step by step

Verified Expert Solution

Question

1 Approved Answer

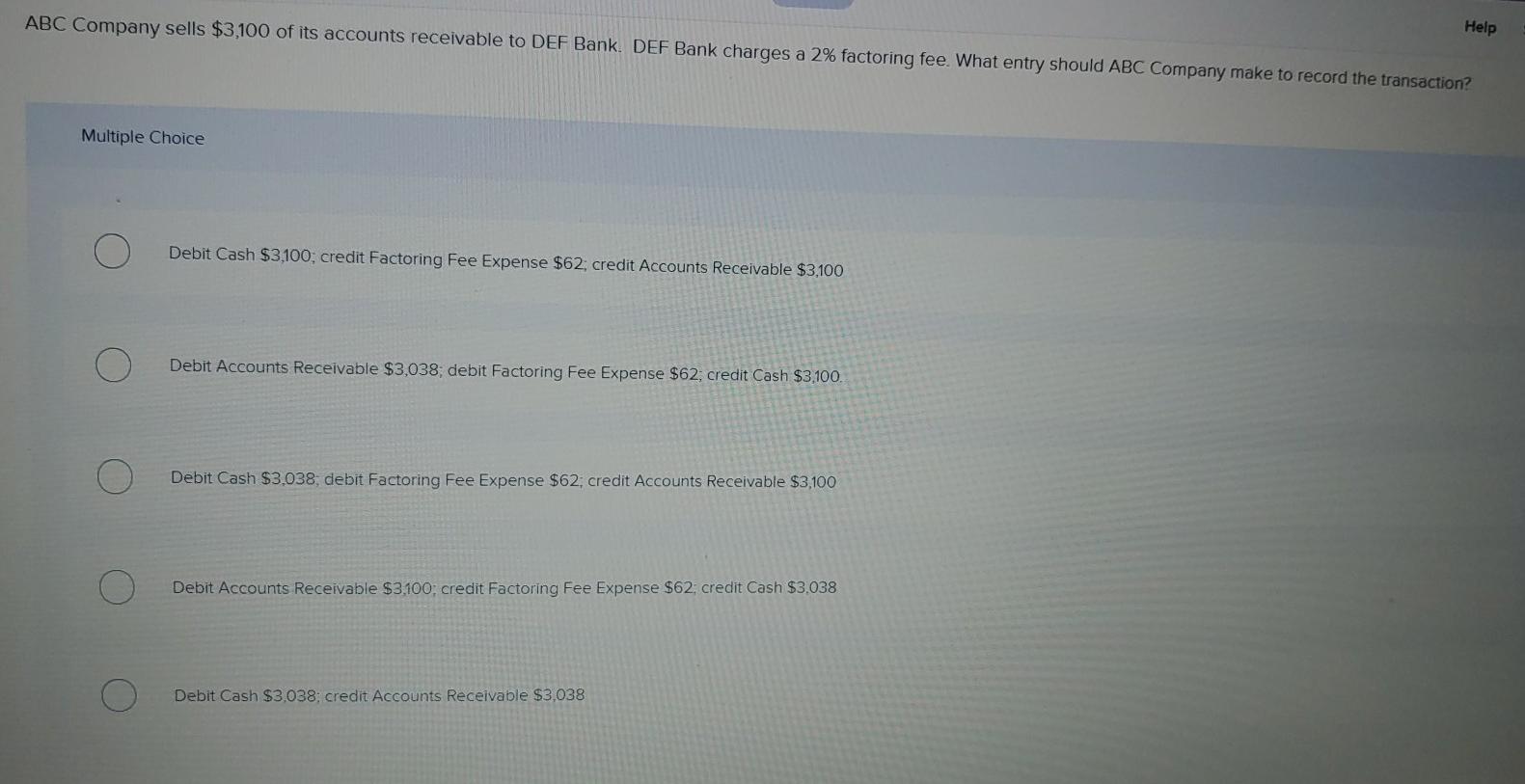

ABC Company sells $3,100 of its accounts receivable to DEF Bank. DEF Bank charges a 2% factoring fee. What entry should ABC Company make to

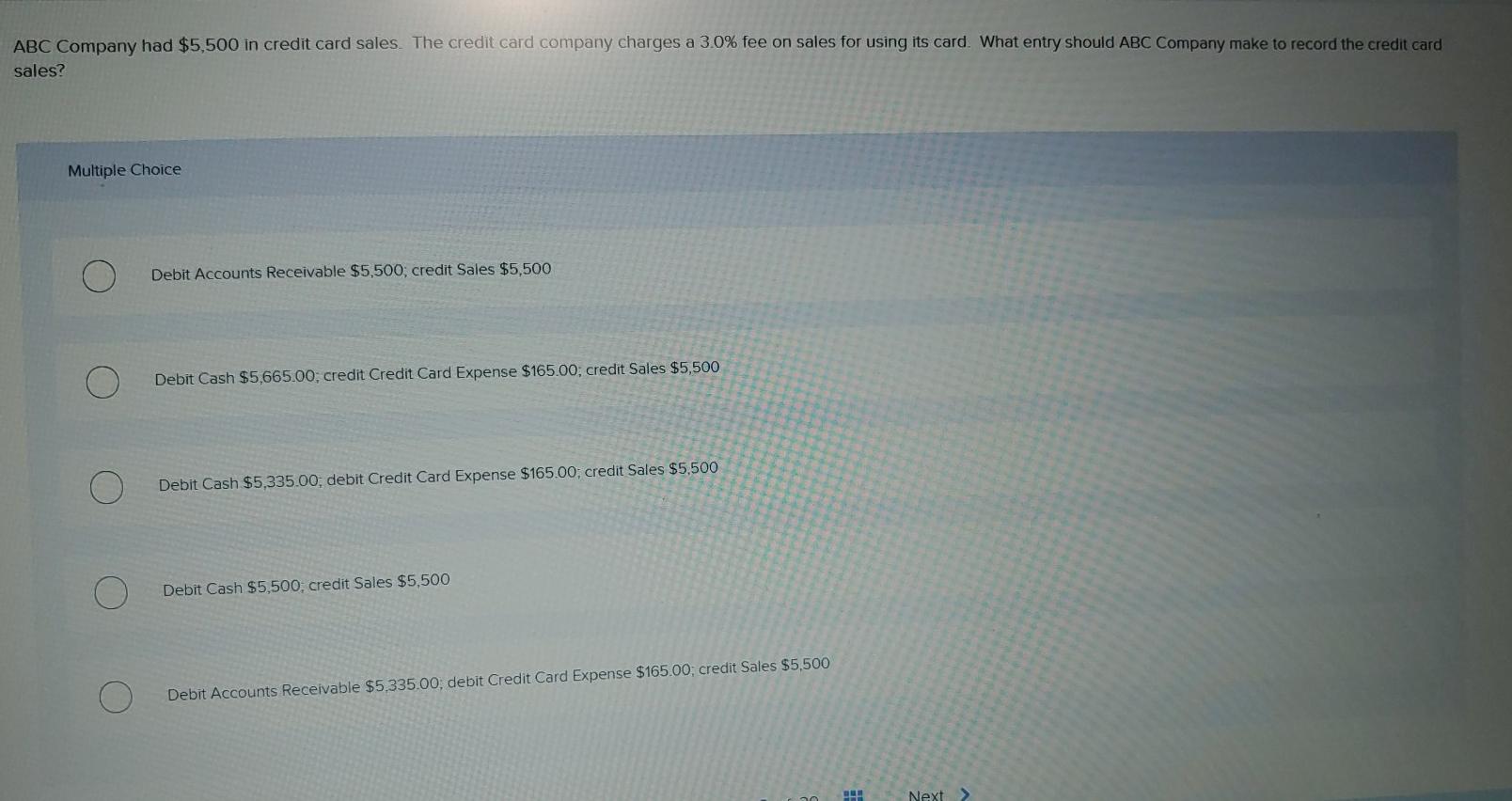

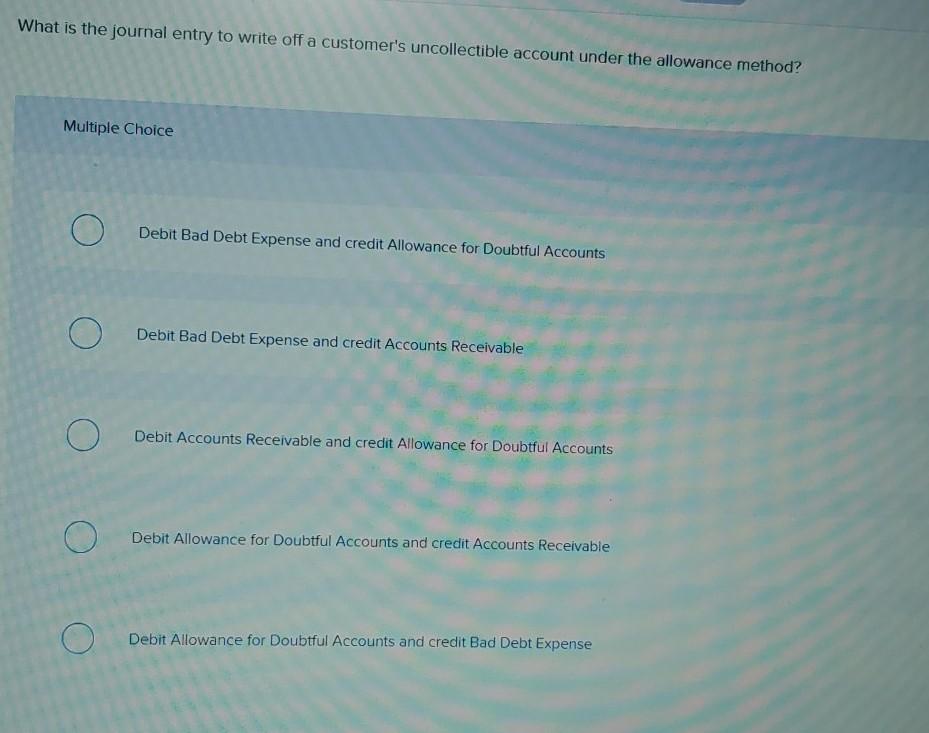

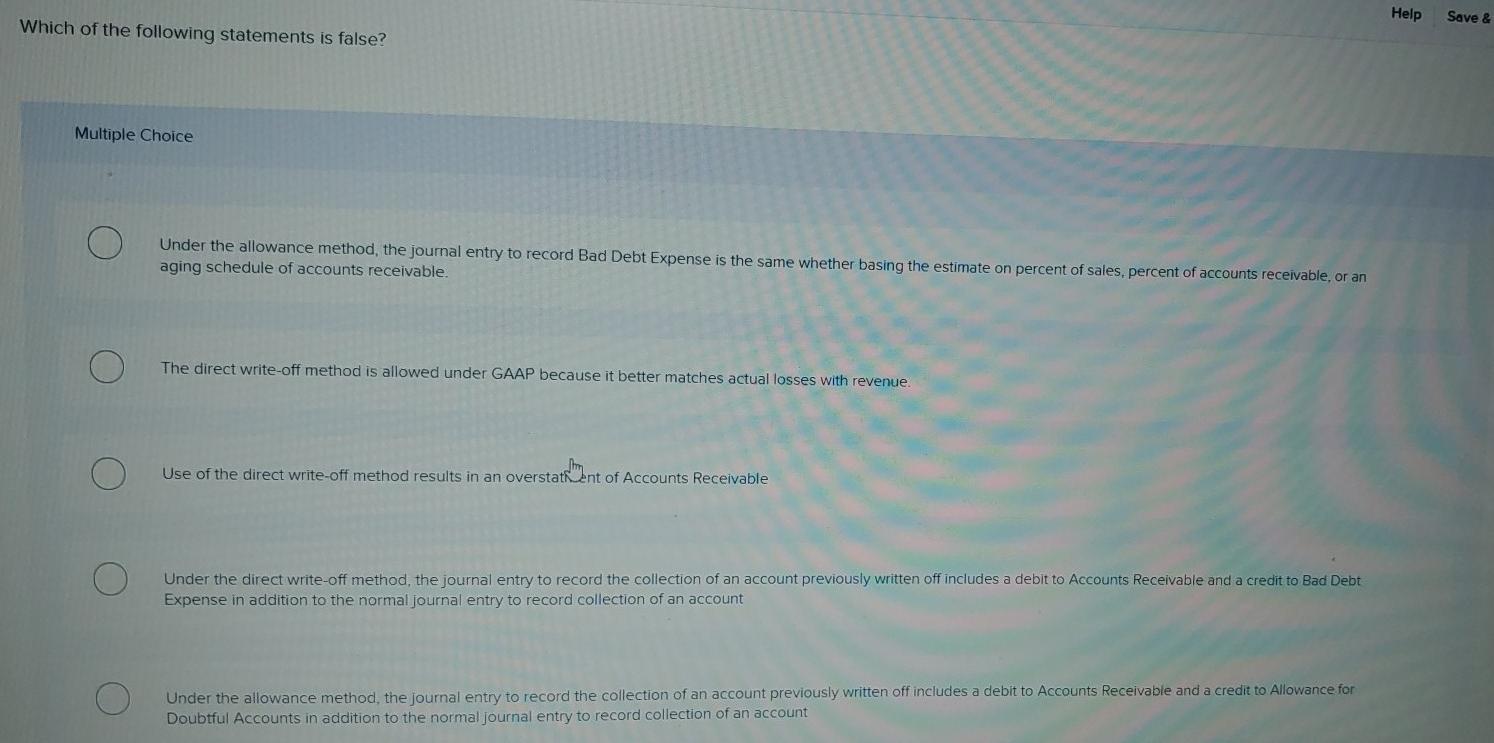

ABC Company sells $3,100 of its accounts receivable to DEF Bank. DEF Bank charges a 2% factoring fee. What entry should ABC Company make to record the transaction? Help Multiple Choice Debit Cash $3,100; credit Factoring Fee Expense $62, credit Accounts Receivable $3,100 Debit Accounts Receivable $3,038; debit Factoring Fee Expense $62, credit Cash $3,100. Debit Cash $3,038, debit Factoring Fee Expense $62, credit Accounts Receivable $3,100 Debit Accounts Receivable $3,100: credit Factoring Fee Expense $62, credit Cash $3.038 Debit Cash $3.038 credit Accounts Receivable $3,038 ABC Company had $5,500 in credit card sales. The credit card company charges a 3.0% fee on sales for using its card. What entry should ABC Company make to record the credit card sales? Multiple Choice Debit Accounts Receivable $5,500, credit Sales $5,500 Debit Cash $5,665.00; credit Credit Card Expense $165.00: credit Sales $5,500 Debit Cash $5,335.00, debit Credit Card Expense $165.00; credit Sales $5,500 Debit Cash $5,500, credit Sales $5,500 Debit Accounts Receivable $5.335.00, debit Credit Card Expense $165.00, credit Sales $5,500 Next > What is the journal entry to write off a customer's uncollectible account under the allowance method? Multiple Choice Debit Bad Debt Expense and credit Allowance for Doubtful Accounts O Debit Bad Debt Expense and credit Accounts Receivable O O Debit Accounts Receivable and credit Allowance for Doubtful Accounts Debit Allowance for Doubtful Accounts and credit Accounts Receivable O O Debit Allowance for Doubtful Accounts and credit Bad Debt Expense Help Save & Which of the following statements is false? Multiple Choice Under the allowance method, the journal entry to record Bad Debt Expense is the same whether basing the estimate on percent of sales, percent of accounts receivable, or an aging schedule of accounts receivable. The direct write-off method is allowed under GAAP because it better matches actual losses with revenue. Use of the direct write-off method results in an overstatent of Accounts Receivable Under the direct write-off method, the journal entry to record the collection of an account previously written off includes a debit to Accounts Receivable and a credit to Bad Debt Expense in addition to the normal Journal entry to record collection of an account Under the allowance method, the journal entry to record the collection of an account previously written off includes a debit to Accounts Receivable and a credit to Allowance for Doubtful Accounts in addition to the normal journal entry to record collection of an account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started