Answered step by step

Verified Expert Solution

Question

1 Approved Answer

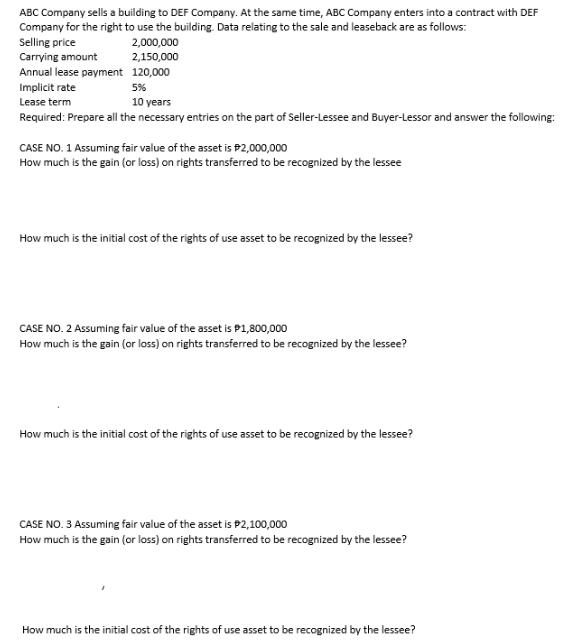

ABC Company sells a building to DEF Company. At the same time, ABC Company enters into a contract with DEF Company for the right

ABC Company sells a building to DEF Company. At the same time, ABC Company enters into a contract with DEF Company for the right to use the building. Data relating to the sale and leaseback are as follows: Selling price Carrying amount Annual lease payment 2,000,000 2,150,000 120,000 Implicit rate Lease term 5% 10 years Required: Prepare all the necessary entries on the part of Seller-Lessee and Buyer-Lessor and answer the following: CASE NO. 1 Assuming fair value of the asset is #2,000,000 How much is the gain (or loss) on rights transferred to be recognized by the lessee How much is the initial cost of the rights of use asset to be recognized by the lessee? CASE NO. 2 Assuming fair value of the asset is $1,800,000 How much is the gain (or loss) on rights transferred to be recognized by the lessee? How much is the initial cost of the rights of use asset to be recognized by the lessee? CASE NO. 3 Assuming fair value of the asset is $2,100,000 How much is the gain (or loss) on rights transferred to be recognized by the lessee? How much is the initial cost of the rights of use asset to be recognized by the lessee?

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

SellerLessee Entries 1 To record the sale of the building Debit Cash 2000000 Credit Building 2150000 Credit Gain on Sale 150000 2 To record the leaseb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started