Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC company would like to invest in a project that requires $50000 capital investment. This capital will be raised partially by selling company bonds and

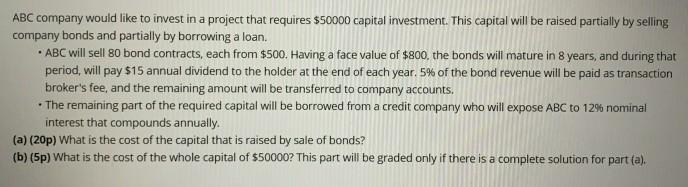

ABC company would like to invest in a project that requires $50000 capital investment. This capital will be raised partially by selling company bonds and partially by borrowing a loan. ABC will sell 80 bond contracts, each from $500. Having a face value of $800, the bonds will mature in 8 years, and during that period, will pay $15 annual dividend to the holder at the end of each year, 5% of the bond revenue will be paid as transaction broker's fee, and the remaining amount will be transferred to company accounts. The remaining part of the required capital will be borrowed from a credit company who will expose ABC to 12% nominal interest that compounds annually. (a) (20p) What is the cost of the capital that is raised by sale of bonds? (b) (5p) What is the cost of the whole capital of $50000? This part will be graded only if there is a complete solution for part (a)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started