Answered step by step

Verified Expert Solution

Question

1 Approved Answer

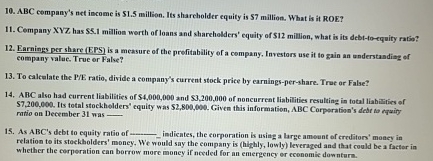

ABC company's net income is 5 1 . 5 million. Its sharcholder equity is 5 7 million. What is it ROE? Cempany XYZ has $

ABC company's net income is million. Its sharcholder equity is million. What is it ROE?

Cempany XYZ has $ milliom werth of loans and shareholders' equity of $ million, what is its debttoequity ratio?

Earnings per share EPS is a measure of the profitability of a company, Investors use it to gain an understandiag of company value. True or False?

To calculate the PE ratio, divide a company's current stock price by earningspershare. True or False?

ABC also had current liabilities of $ and $ of noncurrent liabilities resulting in total liahizities of $ Its total stockholders' equity was $ Given this information, ABC Corporation's debe wo equily ratio on December was

As ABC's debt to equity ratio of indicates, the corporation is using a brge amount of creditors' moacy in relation to its stockholders' moncy. We would sny the company is highly lowly leveraged and that could be a facter in whether the corperation can borrow more moncy if needed for an emergency or economic downturn.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started