Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Corp has subsidiaries in Belgium and Australia and sells its final goods in Australia for AUD56.942. It wants to transfer intermediate goods from the

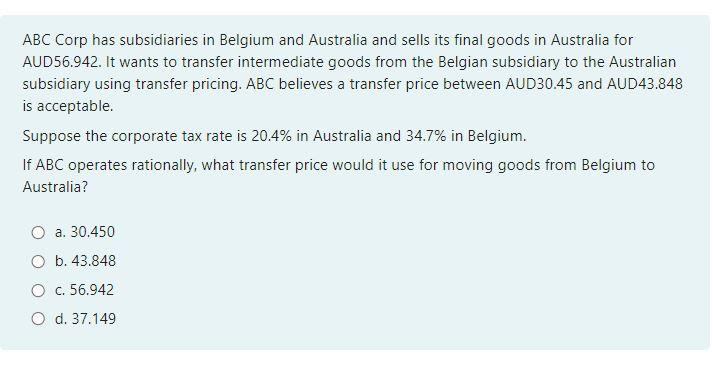

ABC Corp has subsidiaries in Belgium and Australia and sells its final goods in Australia for AUD56.942. It wants to transfer intermediate goods from the Belgian subsidiary to the Australian subsidiary using transfer pricing. ABC believes a transfer price between AUD30.45 and AUD43.848 is acceptable.

Suppose the corporate tax rate is 20.4% in Australia and 34.7% in Belgium.

If ABC operates rationally, what transfer price would it use for moving goods from Belgium to Australia?

a.

30.450

b.

43.848

c.

56.942

d.

37.149

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started