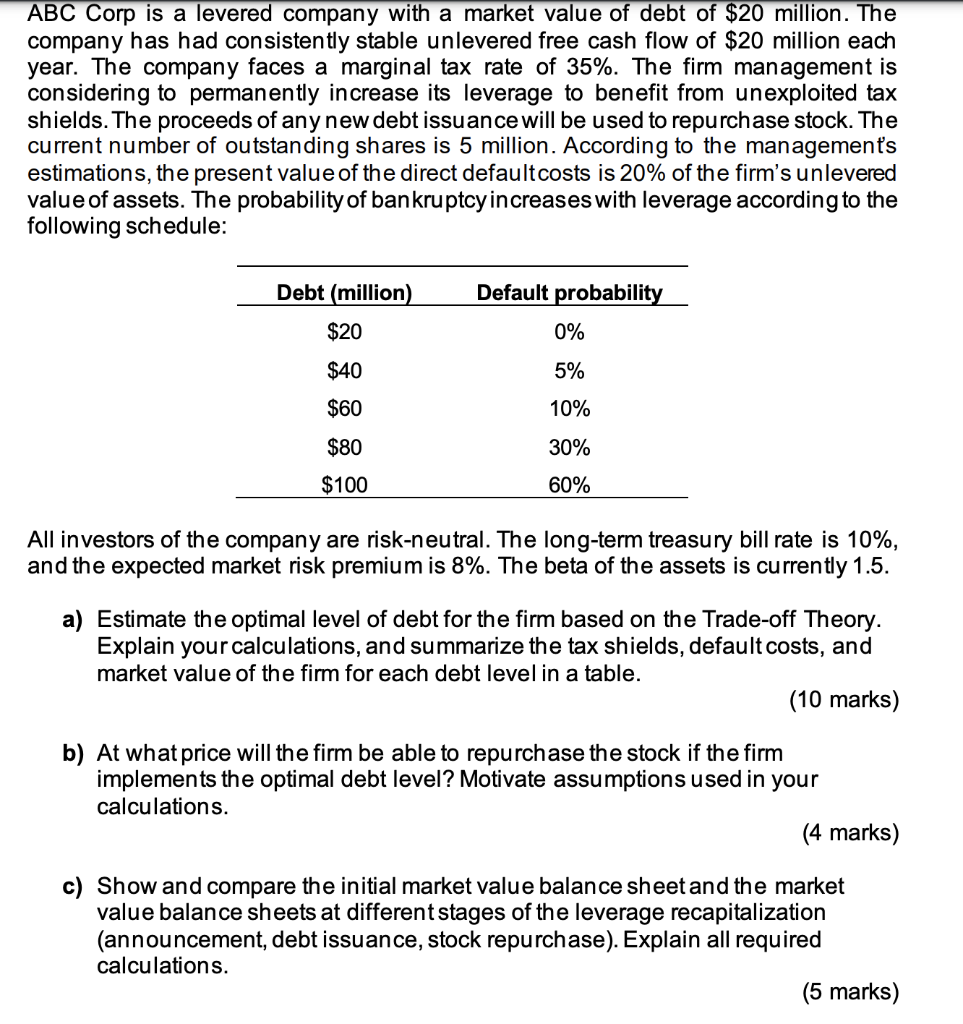

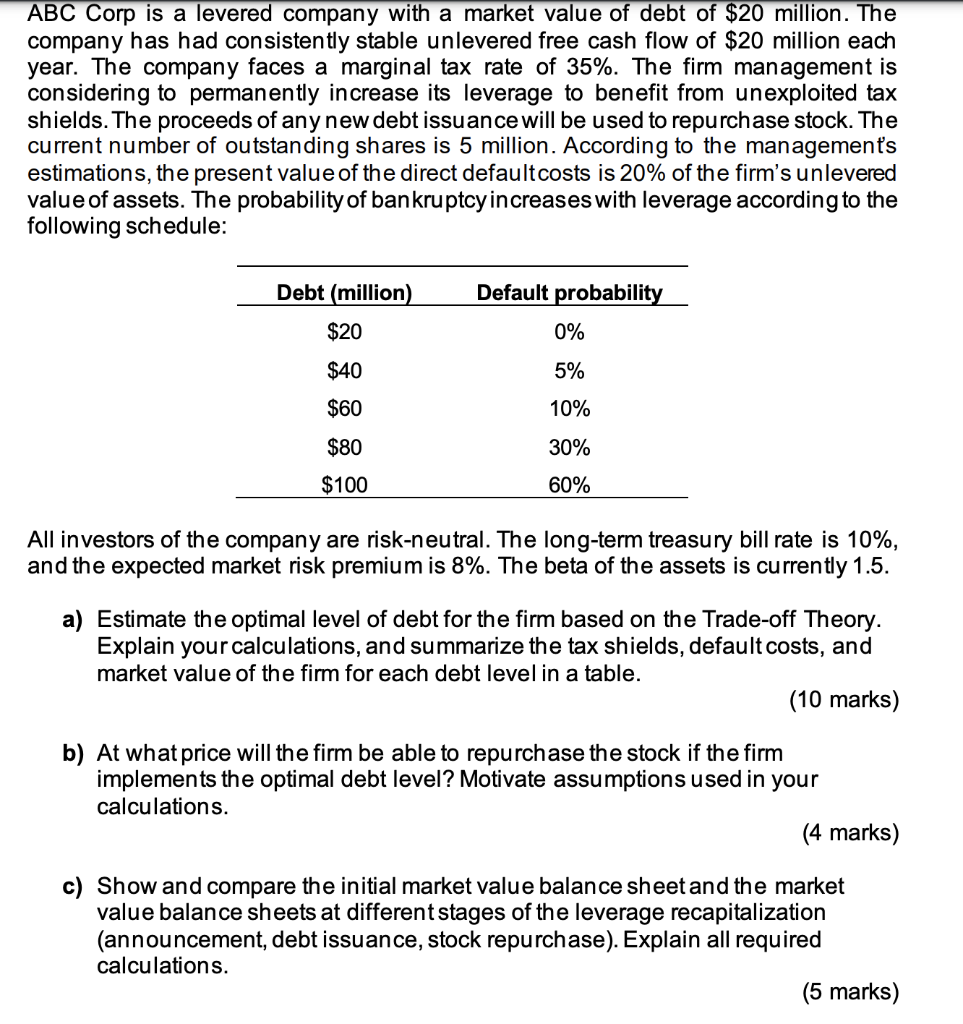

ABC Corp is a levered company with a market value of debt of $20 million. The company has had consistently stable unlevered free cash flow of $20 million each year. The company faces a marginal tax rate of 35%. The firm management is considering to permanently increase its leverage to benefit from unexploited tax shields. The proceeds of any new debt issuance will be used to repurchase stock. The current number of outstanding shares is 5 million. According to the management's estimations, the present value of the direct defaultcosts is 20% of the firm's unlevered value of assets. The probability of bankruptcy increases with leverage according to the following schedule: Default probability Debt (million) $20 0% $40 5% $60 10% $80 30% $100 60% All investors of the company are risk-neutral. The long-term treasury bill rate is 10%, and the expected market risk premium is 8%. The beta of the assets is currently 1.5. a) Estimate the optimal level of debt for the firm based on the Trade-off Theory. Explain your calculations, and summarize the tax shields, default costs, and market value of the firm for each debt level in a table. (10 marks) b) At what price will the firm be able to repurchase the stock if the firm implements the optimal debt level? Motivate assumptions used in your calculations. (4 marks) c) Show and compare the initial market value balance sheet and the market value balance sheets at different stages of the leverage recapitalization (announcement, debt issuance, stock repurchase). Explain all required calculations. (5 marks) ABC Corp is a levered company with a market value of debt of $20 million. The company has had consistently stable unlevered free cash flow of $20 million each year. The company faces a marginal tax rate of 35%. The firm management is considering to permanently increase its leverage to benefit from unexploited tax shields. The proceeds of any new debt issuance will be used to repurchase stock. The current number of outstanding shares is 5 million. According to the management's estimations, the present value of the direct defaultcosts is 20% of the firm's unlevered value of assets. The probability of bankruptcy increases with leverage according to the following schedule: Default probability Debt (million) $20 0% $40 5% $60 10% $80 30% $100 60% All investors of the company are risk-neutral. The long-term treasury bill rate is 10%, and the expected market risk premium is 8%. The beta of the assets is currently 1.5. a) Estimate the optimal level of debt for the firm based on the Trade-off Theory. Explain your calculations, and summarize the tax shields, default costs, and market value of the firm for each debt level in a table. (10 marks) b) At what price will the firm be able to repurchase the stock if the firm implements the optimal debt level? Motivate assumptions used in your calculations. (4 marks) c) Show and compare the initial market value balance sheet and the market value balance sheets at different stages of the leverage recapitalization (announcement, debt issuance, stock repurchase). Explain all required calculations