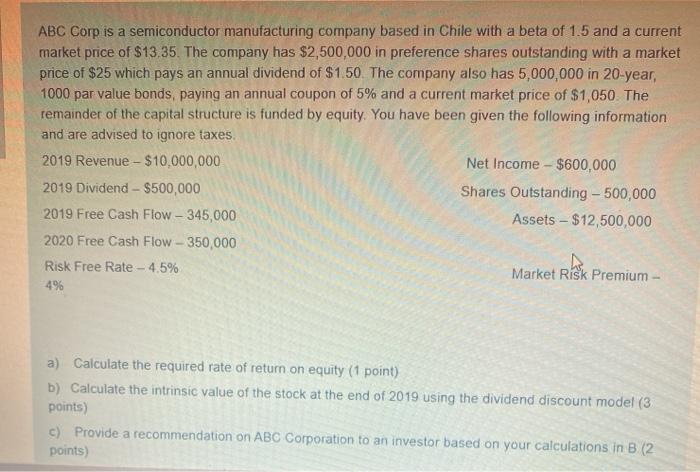

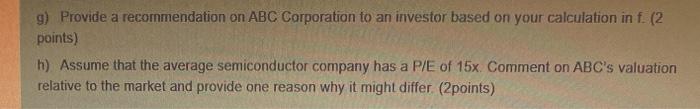

ABC Corp is a semiconductor manufacturing company based in Chile with a beta of 1.5 and a current market price of $13.35. The company has $2,500,000 in preference shares outstanding with a market price of $25 which pays an annual dividend of $1.50. The company also has 5,000,000 in 20 year, 1000 par value bonds, paying an annual coupon of 5% and a current market price of $1,050 The remainder of the capital structure is funded by equity. You have been given the following information and are advised to ignore taxes 2019 Revenue - $10,000,000 Net Income - $600,000 2019 Dividend - $500,000 Shares Outstanding - 500,000 2019 Free Cash Flow - 345,000 Assets $12,500,000 2020 Free Cash Flow - 350,000 Risk Free Rate -4.5% Market Risk Premium 4% a) Calculate the required rate of return on equity (1 point) b) Calculate the intrinsic value of the stock at the end of 2019 using the dividend discount model (3 points) c) Provide a recommendation on ABC Corporation to an investor based on your calculations in B (2 points) g) Provide a recommendation on ABC Corporation to an investor based on your calculation in f. (2 points) h) Assume that the average semiconductor company has a P/E of 15x. Comment on ABC's valuation relative to the market and provide one reason why it might differ (2points) ABC Corp is a semiconductor manufacturing company based in Chile with a beta of 1.5 and a current market price of $13.35. The company has $2,500,000 in preference shares outstanding with a market price of $25 which pays an annual dividend of $1.50. The company also has 5,000,000 in 20 year, 1000 par value bonds, paying an annual coupon of 5% and a current market price of $1,050 The remainder of the capital structure is funded by equity. You have been given the following information and are advised to ignore taxes 2019 Revenue - $10,000,000 Net Income - $600,000 2019 Dividend - $500,000 Shares Outstanding - 500,000 2019 Free Cash Flow - 345,000 Assets $12,500,000 2020 Free Cash Flow - 350,000 Risk Free Rate -4.5% Market Risk Premium 4% a) Calculate the required rate of return on equity (1 point) b) Calculate the intrinsic value of the stock at the end of 2019 using the dividend discount model (3 points) c) Provide a recommendation on ABC Corporation to an investor based on your calculations in B (2 points) g) Provide a recommendation on ABC Corporation to an investor based on your calculation in f. (2 points) h) Assume that the average semiconductor company has a P/E of 15x. Comment on ABC's valuation relative to the market and provide one reason why it might differ (2points)