Question

ABC Corporation, a publicly traded entity based in the US, has engaged your firm to prepare its FYE 12/31/2019 provision, including the calculation of the

ABC Corporation, a publicly traded entity based in the US, has engaged your firm to prepare its FYE 12/31/2019 provision, including the calculation of the income tax effects of stock based compensation. After an initial meeting with the stock administrator and ABC Corporation's Director of Tax, you have identified the relevant considerations for computing the income tax effects for stock based compensation.

a) Tax Benefit Reconciliation Reports ("TBR") from Equity Edge

From speaking to the stock administrator, ABC Corporation issues both non-qualified stock options ("NQSO") and restricted stock units ("RSU"). From the walkthrough of the tax benefit reconciliation reports with the client team, it appears that the tax rate has not been defined (i.e. set at 100%). The Director of Tax has also confirmed that none of its employees have elected Section 83(b) for its RSU's, and the applicable tax rate for US purposes is 25%.

b) ABC Corporation issues stock-based compensation to its employees in its only foreign subsidiary, ABC UK. Per discussion with the Director of Tax, the Company does not tender its RSU's under a net settlement process, where a company would deduct from the total number of shares to be delivered to the employee a number of shares with a value equal to the employee’s tax liability and remits the amount withheld to the tax authorities from its own resources.

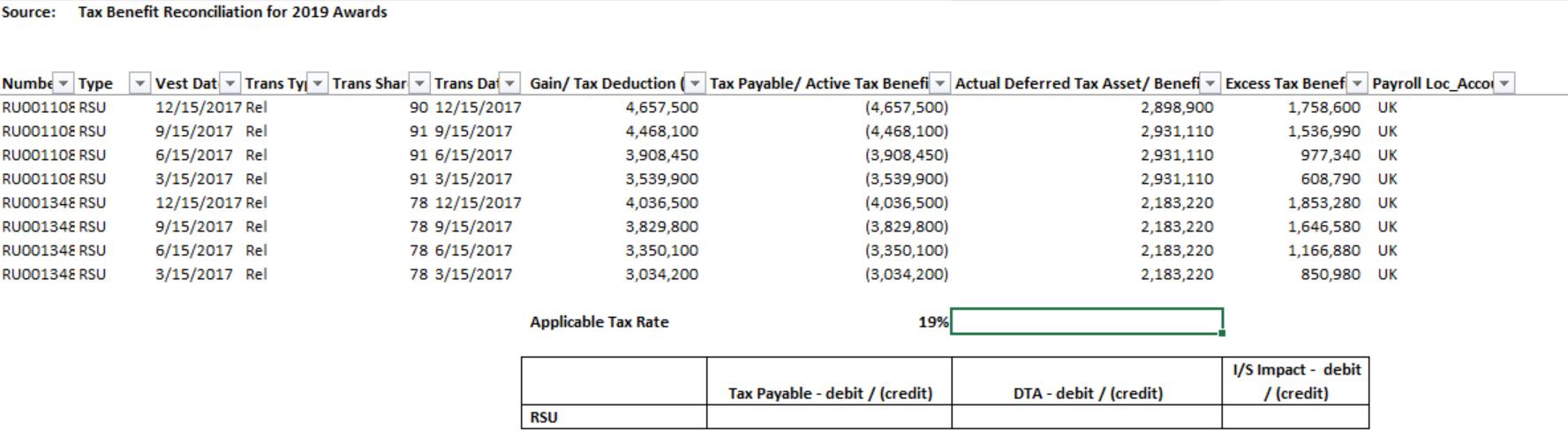

While you wait for more files to complete the computation of the YE provision, your manager suggests that you work on computing the journal entries for ABC UK for her review. Based on the TBR in the next tab, you compute the journal entries as follows (only asking for UK calculation for this question as an example):

| UK | Applicable Tax Rate | 19% | |

| Tax Payable - debit / (credit) | DTA - debit / (credit) | I/S Impact - debit / (credit) | |

| RSU | $ - | $ - | $ - |

UK TBR tab:

Source: Tax Benefit Reconciliation for 2019 Awards Numbe Type RU001108 RSU RU001108 RSU RU001108 RSU RU001108 RSU RU001348 RSU RU001348 RSU RUO01348 RSU RU001348 RSU 91 9/15/2017 Vest Dat Trans Ty Trans Shar Trans Da 12/15/2017 Rel 90 12/15/2017 9/15/2017 Rel 6/15/2017 Rel 3/15/2017 Rel 12/15/2017 Rel 9/15/2017 Rel 91 6/15/2017 91 3/15/2017 78 12/15/2017 78 9/15/2017 78 6/15/2017 6/15/2017 Rel 3/15/2017 Rel 78 3/15/2017 Gain/ Tax Deduction (Tax Payable/ Active Tax Benefi Actual Deferred Tax Asset/ Benefi Excess Tax Benef Payroll Loc_Acco (4,657,500) 2,898,900 1,758,600 UK 2,931,110 1,536,990 UK 2,931,110 977,340 UK 2,931,110 608,790 UK 2,183,220 1,853,280 UK 2,183,220 1,646,580 UK 2,183,220 1,166,880 UK 850,980 UK 2,183,220 4,657,500 4,468,100 3,908,450 3,539,900 4,036,500 3,829,800 3,350,100 3,034,200 Applicable Tax Rate RSU (4,468,100) (3,908,450) (3,539,900) (4,036,500) (3,829,800) (3,350,100) (3,034,200) 19% Tax Payable - debit / (credit) DTA - debit / (credit) I/S Impact - debit / (credit)

Step by Step Solution

3.37 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

a For the USbased employees the journal entries for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started