Question

ABC Corporation has outstanding shares of common stock of which A, B, C and D each owns 100 shares. In on transaction, ABC Corporation

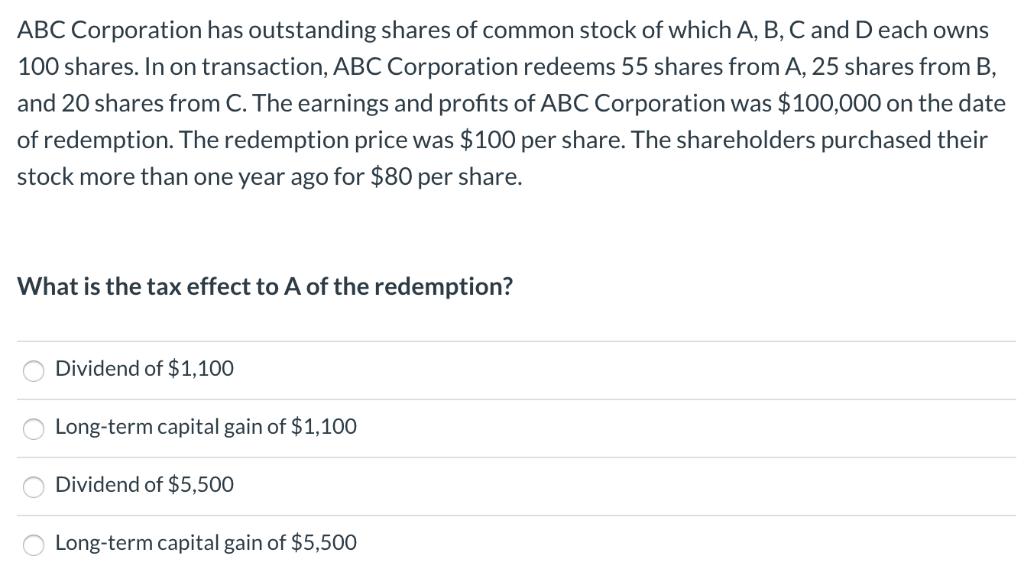

ABC Corporation has outstanding shares of common stock of which A, B, C and D each owns 100 shares. In on transaction, ABC Corporation redeems 55 shares from A, 25 shares from B, and 20 shares from C. The earnings and profits of ABC Corporation was $100,000 on the date of redemption. The redemption price was $100 per share. The shareholders purchased their stock more than one year ago for $80 per share. What is the tax effect to A of the redemption? Dividend of $1,100 Long-term capital gain of $1,100 Dividend of $5,500 Long-term capital gain of $5,500

Step by Step Solution

3.61 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

A B C Answer is option B 1100 Particulars Redeemed No of shares R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Microeconomics An Intuitive Approach with Calculus

Authors: Thomas Nechyba

1st edition

538453257, 978-0538453257

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App