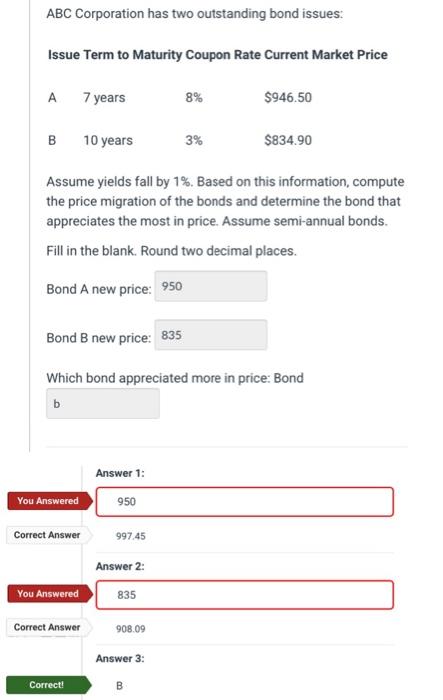

Question: ABC Corporation has two outstanding bond issues: Issue Term to Maturity Coupon Rate Current Market Price A 7 years 8% $946.50 B 10 years 3%

ABC Corporation has two outstanding bond issues: Issue Term to Maturity Coupon Rate Current Market Price Assume yields fall by 1%. Based on this information, compute the price migration of the bonds and determine the bond that appreciates the most in price. Assume semi-annual bonds. Fill in the blank. Round two decimal places. Bond A new price: Bond B new price: Which bond appreciated more in price: Bond Answer 1: 997.45 Answer 2: Answer 3 : B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts