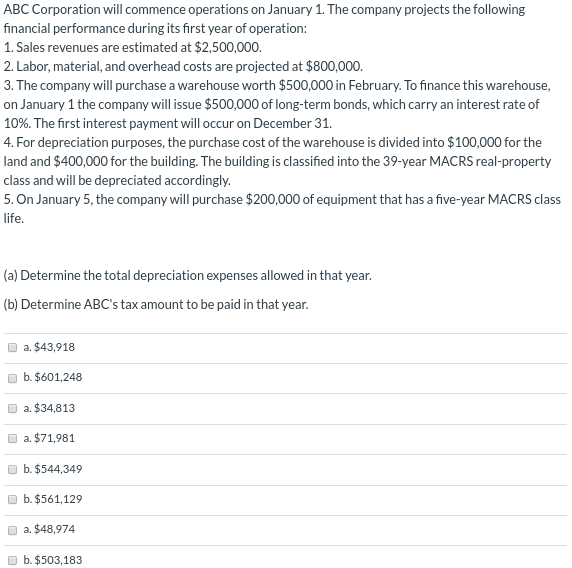

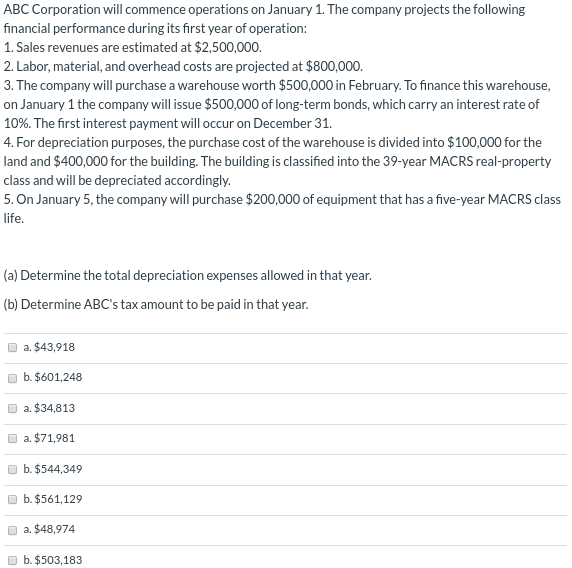

ABC Corporation will commence operations on January 1. The company projects the following financial performance during its first year of operation: 1. Sales revenues are estimated at $2,500,000. 2. Labor, material, and overhead costs are projected at $800,000. 3. The company will purchase a warehouse worth $500,000 in February. To finance this warehouse, on January 1 the company will issue $500,000 of long-term bonds, which carry an interest rate of 10%. The first interest payment will occur on December 31. 4. For depreciation purposes, the purchase cost of the warehouse is divided into $100,000 for the land and $400,000 for the building. The building is classified into the 39-year MACRS real-property class and will be depreciated accordingly. 5. On January 5, the company will purchase $200,000 of equipment that has a five-year MACRS class life (a) Determine the total depreciation expenses allowed in that year. (b) Determine ABC's tax amount to be paid in that year. a. $43,918 b. $601,248 .$34,813 a. $71,981 b. $544,349 b. $561,129 a. $48,974 b. $503,183 ABC Corporation will commence operations on January 1. The company projects the following financial performance during its first year of operation: 1. Sales revenues are estimated at $2,500,000. 2. Labor, material, and overhead costs are projected at $800,000. 3. The company will purchase a warehouse worth $500,000 in February. To finance this warehouse, on January 1 the company will issue $500,000 of long-term bonds, which carry an interest rate of 10%. The first interest payment will occur on December 31. 4. For depreciation purposes, the purchase cost of the warehouse is divided into $100,000 for the land and $400,000 for the building. The building is classified into the 39-year MACRS real-property class and will be depreciated accordingly. 5. On January 5, the company will purchase $200,000 of equipment that has a five-year MACRS class life (a) Determine the total depreciation expenses allowed in that year. (b) Determine ABC's tax amount to be paid in that year. a. $43,918 b. $601,248 .$34,813 a. $71,981 b. $544,349 b. $561,129 a. $48,974 b. $503,183