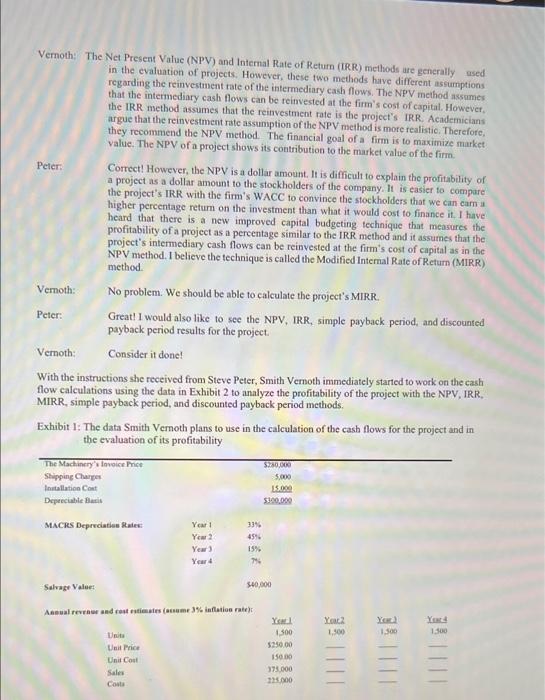

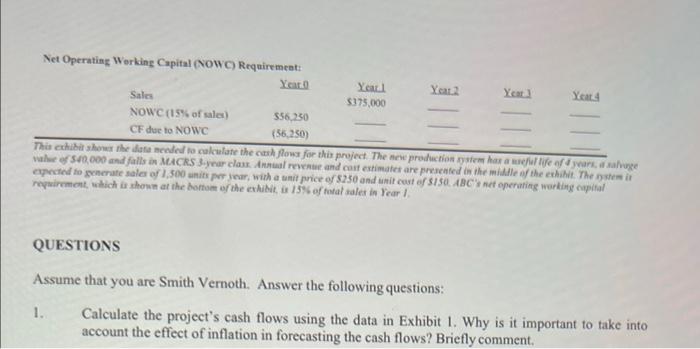

ABC ENTERPRISES CORPORATION: CAPITAL BUDGETING DECISION CASE DESCRIPTION 7 The capital budgeting decision is one of the most important financial decisions in business firme. In this case, ABC Enterprises Corporation (ABC) is considering whether to invest in a new production system To determine if the project is profitable, ABC must first determine the weighted average cost of capital to finance the project. The simple payback period, discounted payback period, nel present value (NPV). internal rate of turn (IRR), and modified internal rate of return (MIRR) techniques are sed to study the profitability of the project, MIRR is a relatively new capital budgeting technique, which assume that the reinvestment rate of the project's intermediary cash flows is the firm's cost of capital. The case gives students an opportunity to we the theoretical profitability techniques explained in standard finance textbooks in a real-world setting. The case is best suited for MBA and Master of Accounting students and is expected to take approximately three to four hours to complete. The case may also be appropriate for undergraduate senior finance majors. JEL: G31 KEYWORDS: Capital budgeting, weighted average cost of capital, cash flow, payback period, net present valuc, internal rate of return, modified internal rate of return, sensitivity analysis, scenario analysis CASE INFORMATION ABC Enterprises Corporation (ABC) is planning to invest in a special manufacturing system to produce a new product. The invoice price of the system is $280,000. It would require $5,000 in with depreciation rates of 33% for the first year, 45% for the second year and 15% for the third year. ABC plans to use the system for four years and it is expected to have a salvage value of $40,000 after four years of use ABC expects the new system to generate sales of 1,500 units per year. The company estimates that the new product will sell for $250 per unit in the first year with a cost of $150 per unit, excluding depreciation Management projects that both the sale price and the cost per unit will increase by 3% per year due to inflation. ABC's net operating working capital at the end of each year will be equal to 15% of next year sales revenues to produce the new product. The firm's marginal tax rate is 40%. Analysis of the Profitability of the Project Steve Peter and Smith Vemoth had the following conversation regarding how they should evaluate the potential profitability of the project. Vernoth: With the sales and cost estimates I have obtained from the marketing and accounting departments in Exhibit 2, we should be able to estimate the project's cash flows for the four-year horizon Peter Excellent! How are we going to evaluate the project's profitability to determine if it is feasible? Adapted from Review of the Sec, C200 USM puh. All sco USM Veroth: The Net Present Value (NPV) and Internal Rate of Return (IRR) methods are generally used in the evaluation of projects. However, these two methods have different assumptions regarding the reinvestment rate of the intermediary cash flows. The NPV method assumes that the intermediary cash flows can be reinvested at the firm's cost of capital. However, the IRR method assumes that the reinvestment rate is the project's IRR. Academicians argue that the reinvestment rate assumption of the NPV method is more realistic. Therefore, they recommend the NPV method. The financial goal of a firm is to maximize market value. The NPV of a project shows its contribution to the market value of the firm. Peter Correct. However, the NPV is a dollar amount. It is difficult to explain the profitability of a project as a dollar amount to the stockholders of the company. It is casier to compare the project's IRR with the firm's WACC to convince the stockholders that we can cama higher percentage return on the investment than what it would cost to finance it. I have heard that there is a new improved capital budgeting technique that measures the profitability of a project as a percentage similar to the IRR method and it assumes that the project's intermediary cash flows can be reinvested at the firm's cost of capital as in the NPV method. I believe the technique is called the Modified Internal Rate of Return (MIRR) method Vernoth: No problem. We should be able to calculate the project's MIRR. Peter: Great! I would also like to see the NPV, IRR, simple payback period, and discounted payback period results for the project. Veroth: Consider it done! With the instructions she received from Steve Peter, Smith Vernoth immediately started to work on the cash flow calculations using the data in Exhibit 2 to analyze the profitability of the project with the NPV, IRR, MIRR, simple payback period, and discounted payback period methods. Exhibit 1: The data Smith Vernoth plans to use in the calculation of the cash flows for the project and in the evaluation of its profitability The Machinery invoice Price Shipping Charger Installation Cont Depreciable Basi 5.000 15.00 5300.000 MACRS Depreciati ales 33% Yeart Yew 2 Year Year 4 15% 79 Salvage Value $40,000 Annual Revue and restentes em 3% allation rate Yaz 1,500 Your 1.500 1:00 Unite Unit Price Unit Cout Sales Costa Yol 1.500 5250.00 150.00 375.000 225.000 Net Operating Working Capital (NOW Requirement: Year: Year Year Year Yout Sales $375,000 NOWC(15% of sales) $56.250 CF due to NOWC (56,250) This chibal shower the data nended to calculate the cash flow for this project. The ne production has a life of yari salvage 540,000 and falls in MACRS 3.year clawr. Annual Revenue and cost estimates are presented in the middle of the thit. The system in expected to generate sale of 1,500 units per year with a unit price of $250 and unit cost of $150 ABC's net operating working capital requirement, which show at the bottom of the exhibit 15% of total sale in Year! QUESTIONS Assume that you are Smith Vernoth. Answer the following questions: 1. Calculate the project's cash flows using the data in Exhibit 1. Why is it important to take into account the effect of inflation in forecasting the cash flows? Briefly comment ABC ENTERPRISES CORPORATION: CAPITAL BUDGETING DECISION CASE DESCRIPTION 7 The capital budgeting decision is one of the most important financial decisions in business firme. In this case, ABC Enterprises Corporation (ABC) is considering whether to invest in a new production system To determine if the project is profitable, ABC must first determine the weighted average cost of capital to finance the project. The simple payback period, discounted payback period, nel present value (NPV). internal rate of turn (IRR), and modified internal rate of return (MIRR) techniques are sed to study the profitability of the project, MIRR is a relatively new capital budgeting technique, which assume that the reinvestment rate of the project's intermediary cash flows is the firm's cost of capital. The case gives students an opportunity to we the theoretical profitability techniques explained in standard finance textbooks in a real-world setting. The case is best suited for MBA and Master of Accounting students and is expected to take approximately three to four hours to complete. The case may also be appropriate for undergraduate senior finance majors. JEL: G31 KEYWORDS: Capital budgeting, weighted average cost of capital, cash flow, payback period, net present valuc, internal rate of return, modified internal rate of return, sensitivity analysis, scenario analysis CASE INFORMATION ABC Enterprises Corporation (ABC) is planning to invest in a special manufacturing system to produce a new product. The invoice price of the system is $280,000. It would require $5,000 in with depreciation rates of 33% for the first year, 45% for the second year and 15% for the third year. ABC plans to use the system for four years and it is expected to have a salvage value of $40,000 after four years of use ABC expects the new system to generate sales of 1,500 units per year. The company estimates that the new product will sell for $250 per unit in the first year with a cost of $150 per unit, excluding depreciation Management projects that both the sale price and the cost per unit will increase by 3% per year due to inflation. ABC's net operating working capital at the end of each year will be equal to 15% of next year sales revenues to produce the new product. The firm's marginal tax rate is 40%. Analysis of the Profitability of the Project Steve Peter and Smith Vemoth had the following conversation regarding how they should evaluate the potential profitability of the project. Vernoth: With the sales and cost estimates I have obtained from the marketing and accounting departments in Exhibit 2, we should be able to estimate the project's cash flows for the four-year horizon Peter Excellent! How are we going to evaluate the project's profitability to determine if it is feasible? Adapted from Review of the Sec, C200 USM puh. All sco USM Veroth: The Net Present Value (NPV) and Internal Rate of Return (IRR) methods are generally used in the evaluation of projects. However, these two methods have different assumptions regarding the reinvestment rate of the intermediary cash flows. The NPV method assumes that the intermediary cash flows can be reinvested at the firm's cost of capital. However, the IRR method assumes that the reinvestment rate is the project's IRR. Academicians argue that the reinvestment rate assumption of the NPV method is more realistic. Therefore, they recommend the NPV method. The financial goal of a firm is to maximize market value. The NPV of a project shows its contribution to the market value of the firm. Peter Correct. However, the NPV is a dollar amount. It is difficult to explain the profitability of a project as a dollar amount to the stockholders of the company. It is casier to compare the project's IRR with the firm's WACC to convince the stockholders that we can cama higher percentage return on the investment than what it would cost to finance it. I have heard that there is a new improved capital budgeting technique that measures the profitability of a project as a percentage similar to the IRR method and it assumes that the project's intermediary cash flows can be reinvested at the firm's cost of capital as in the NPV method. I believe the technique is called the Modified Internal Rate of Return (MIRR) method Vernoth: No problem. We should be able to calculate the project's MIRR. Peter: Great! I would also like to see the NPV, IRR, simple payback period, and discounted payback period results for the project. Veroth: Consider it done! With the instructions she received from Steve Peter, Smith Vernoth immediately started to work on the cash flow calculations using the data in Exhibit 2 to analyze the profitability of the project with the NPV, IRR, MIRR, simple payback period, and discounted payback period methods. Exhibit 1: The data Smith Vernoth plans to use in the calculation of the cash flows for the project and in the evaluation of its profitability The Machinery invoice Price Shipping Charger Installation Cont Depreciable Basi 5.000 15.00 5300.000 MACRS Depreciati ales 33% Yeart Yew 2 Year Year 4 15% 79 Salvage Value $40,000 Annual Revue and restentes em 3% allation rate Yaz 1,500 Your 1.500 1:00 Unite Unit Price Unit Cout Sales Costa Yol 1.500 5250.00 150.00 375.000 225.000 Net Operating Working Capital (NOW Requirement: Year: Year Year Year Yout Sales $375,000 NOWC(15% of sales) $56.250 CF due to NOWC (56,250) This chibal shower the data nended to calculate the cash flow for this project. The ne production has a life of yari salvage 540,000 and falls in MACRS 3.year clawr. Annual Revenue and cost estimates are presented in the middle of the thit. The system in expected to generate sale of 1,500 units per year with a unit price of $250 and unit cost of $150 ABC's net operating working capital requirement, which show at the bottom of the exhibit 15% of total sale in Year! QUESTIONS Assume that you are Smith Vernoth. Answer the following questions: 1. Calculate the project's cash flows using the data in Exhibit 1. Why is it important to take into account the effect of inflation in forecasting the cash flows? Briefly comment