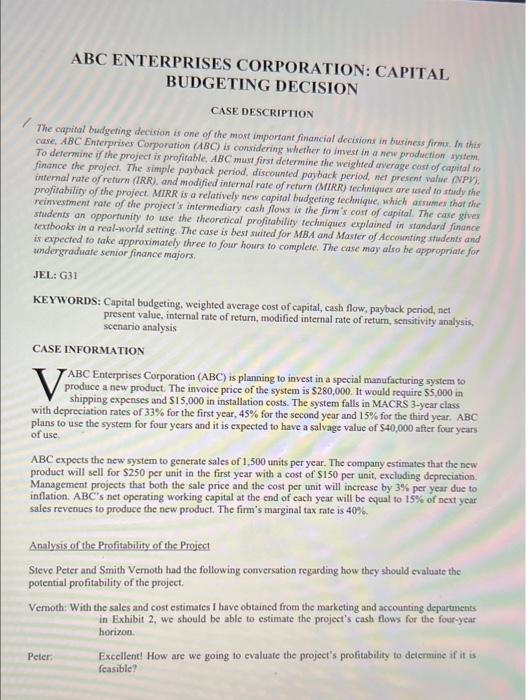

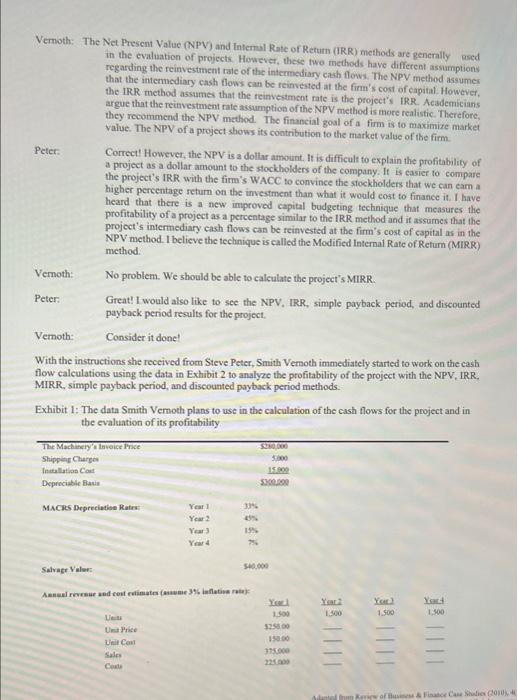

ABC ENTERPRISES CORPORATION: CAPITAL BUDGETING DECISION CASE DESCRIPTION The capital budgeting decision is one of the most important financial decisions in business firm. In this case, ABC Enterprises Corporation (ABC) is considering whether to invest in a new production system, To determine if the project is profitable. ABC must first determine the weighted average cost of capital so finance the project. The simple payback period, discounted payback period, net present value (NPV). internal rate of return (IRR) and modified internal rate of return (MIRR) techniques are used to study the profitability of the project. MIRR is a relatively new capital budgeting technique, which assumes that the reinvestment rate of the project's intermediary cash flows is the firm's cost of capital. The case giver students an opportunity to use the theoretical profitability techniques explained in standard finance textbooks in a real-world setting. The case is best suited for MBA and Master of Accounting students and is expected to take approximately three to four hours to complete. The case may also be appropriate for undergraduate senior finance majors JEL: G31 V KEYWORDS: Capital budgeting, weighted average cost of capital, cash flow, payback period, net present value, internal rate of return, modified internal rate of return, sensitivity analysis, scenario analysis CASE INFORMATION ABC Enterprises Corporation (ABC) is planning to invest in a special manufacturing system to produce a new product. The invoice price of the system is $280,000. It would require 55,000 in shipping expenses and $15,000 in installation costs. The system falls in MACRS 3-ycar class with depreciation rates of 33% for the first year, 45% for the second year and 15% for the third year. ABC plans to use the system for four years and it is expected to have a salvage value of $40,000 after four years of use. ABC expects the new system to generate sales of 1,500 units per year. The company estimates that the new product will sell for $250 per unit in the first year with a cost of $150 per unit, excluding depreciation. Management projects that both the sale price and the cost per unit will increase by 3% per year due to inflation. ABC's net operating working capital at the end of each year will be equal to 15% of next year sales revenues to produce the new product. The firm's marginal tax rate is 40% Analysis of the Profitability of the Project Steve Peter and Smith Vernoth had the following conversation regarding how they should evaluate the potential profitability of the project. Veroth: With the sales and cost estimates I have obtained from the marketing and accounting departments in Exhibit 2, we should be able to estimate the project's cash flows for the four-year horizon Excellent! How are we going to evaluate the project's profitability to determine if it is feasible? Peter Vemoth: The Net Present Value (NPV) and Internal Rate of Return (IRR) methods are generally used in the evaluation of projects. However, these two methods have different assumptions regarding the reinvestment rate of the intermediary cash flows. The NPV method assumes that the intermediary cash flows can be reinvested at the firm's cost of capital. However, the IRR method assumes that the reinvestment rate is the project's IRR. Academicians argue that the reinvestment rate assumption of the NPV method is more realistic. Therefore, they recommend the NPV method. The financial goal of a firm is to maximize market value. The NPV of a project shows its contribution to the market value of the firm. Peter Correct! However, the NPV is a dollar amount. It is difficult to explain the profitability of a project as a dollar amount to the stockholders of the company. It is easier to compare the project's IRR with the firm's WACC to convince the stockholders that we can eam a higher percentage return on the investment than what it would cost to finance it. I have heard that there is a new improved capital budgeting technique that measures the profitability of a project as a percentage similar to the IRR method and it assumes that the project's intermediary cash flows can be reinvested at the firm's cost of capital as in the NPV method. I believe the technique is called the Modified Internal Rate of Return (MIRR) method. Vemoth: No problem. We should be able to calculate the project's MIRR. Peter Great! I would also like to see the NPV, IRR, simple payback period, and discounted payback period results for the project. Veroth: Consider it done! With the instructions she received from Steve Peter, Smith Vemoth immediately started to work on the cash flow calculations using the data in Exhibit 2 to analyze the profitability of the project with the NPV, IRR. MIRR, simple payback period, and discounted payback period methods. Exhibit 1: The data Smith Vemoth plans to use in the calculation of the cash flows for the project and in the evaluation of its profitability The Machinery's voice Price Shipping Charges Installation Cout Depreciable Base Sod 3.00 15 5.300.000 30 MACRS Depreciation Rates Year Year 2 Year 15% Salvage Value Annual Revenue and cost ratimates (am 3% inflation rates Ya You YOG 1.500 Le U Price Unit Coul Sales Cle 1500 335800 1500 375.000 Chiesa Net Operating Working Capital (NOWCRequirement: YO Year Yee Year Year Sales 3375.000 NOWC (15% of wales) 556,250 CF due to NOWC (56.250) Therethi shows the data nended to calculate the cash flow for this project. The new production system has a life of years, yule 540,000 and falls in MACRS 3-war class Anale and cost estimates are presented in the middle of the shit The aspected to generate sale of 1.500 units per var, with a unit price of $250 and it cost of $150 ABC's operating working capital requirement, which is shown at the bottom of the exhibit 15% of total sales in Year 1. QUESTIONS Assume that you are Smith Vernoth. Answer the following questions: 1. 2. brent Evaluate the profitability of the project with the NPV, IRR, MIRR, simple payback period, and discounted payback period methods if the discount rate is 9.37%. Is the project acceptable? Briefly explain. Why is the NPV method superior to the other methods of capital budgeting? Briefly explain ABC ENTERPRISES CORPORATION: CAPITAL BUDGETING DECISION CASE DESCRIPTION The capital budgeting decision is one of the most important financial decisions in business firm. In this case, ABC Enterprises Corporation (ABC) is considering whether to invest in a new production system, To determine if the project is profitable. ABC must first determine the weighted average cost of capital so finance the project. The simple payback period, discounted payback period, net present value (NPV). internal rate of return (IRR) and modified internal rate of return (MIRR) techniques are used to study the profitability of the project. MIRR is a relatively new capital budgeting technique, which assumes that the reinvestment rate of the project's intermediary cash flows is the firm's cost of capital. The case giver students an opportunity to use the theoretical profitability techniques explained in standard finance textbooks in a real-world setting. The case is best suited for MBA and Master of Accounting students and is expected to take approximately three to four hours to complete. The case may also be appropriate for undergraduate senior finance majors JEL: G31 V KEYWORDS: Capital budgeting, weighted average cost of capital, cash flow, payback period, net present value, internal rate of return, modified internal rate of return, sensitivity analysis, scenario analysis CASE INFORMATION ABC Enterprises Corporation (ABC) is planning to invest in a special manufacturing system to produce a new product. The invoice price of the system is $280,000. It would require 55,000 in shipping expenses and $15,000 in installation costs. The system falls in MACRS 3-ycar class with depreciation rates of 33% for the first year, 45% for the second year and 15% for the third year. ABC plans to use the system for four years and it is expected to have a salvage value of $40,000 after four years of use. ABC expects the new system to generate sales of 1,500 units per year. The company estimates that the new product will sell for $250 per unit in the first year with a cost of $150 per unit, excluding depreciation. Management projects that both the sale price and the cost per unit will increase by 3% per year due to inflation. ABC's net operating working capital at the end of each year will be equal to 15% of next year sales revenues to produce the new product. The firm's marginal tax rate is 40% Analysis of the Profitability of the Project Steve Peter and Smith Vernoth had the following conversation regarding how they should evaluate the potential profitability of the project. Veroth: With the sales and cost estimates I have obtained from the marketing and accounting departments in Exhibit 2, we should be able to estimate the project's cash flows for the four-year horizon Excellent! How are we going to evaluate the project's profitability to determine if it is feasible? Peter Vemoth: The Net Present Value (NPV) and Internal Rate of Return (IRR) methods are generally used in the evaluation of projects. However, these two methods have different assumptions regarding the reinvestment rate of the intermediary cash flows. The NPV method assumes that the intermediary cash flows can be reinvested at the firm's cost of capital. However, the IRR method assumes that the reinvestment rate is the project's IRR. Academicians argue that the reinvestment rate assumption of the NPV method is more realistic. Therefore, they recommend the NPV method. The financial goal of a firm is to maximize market value. The NPV of a project shows its contribution to the market value of the firm. Peter Correct! However, the NPV is a dollar amount. It is difficult to explain the profitability of a project as a dollar amount to the stockholders of the company. It is easier to compare the project's IRR with the firm's WACC to convince the stockholders that we can eam a higher percentage return on the investment than what it would cost to finance it. I have heard that there is a new improved capital budgeting technique that measures the profitability of a project as a percentage similar to the IRR method and it assumes that the project's intermediary cash flows can be reinvested at the firm's cost of capital as in the NPV method. I believe the technique is called the Modified Internal Rate of Return (MIRR) method. Vemoth: No problem. We should be able to calculate the project's MIRR. Peter Great! I would also like to see the NPV, IRR, simple payback period, and discounted payback period results for the project. Veroth: Consider it done! With the instructions she received from Steve Peter, Smith Vemoth immediately started to work on the cash flow calculations using the data in Exhibit 2 to analyze the profitability of the project with the NPV, IRR. MIRR, simple payback period, and discounted payback period methods. Exhibit 1: The data Smith Vemoth plans to use in the calculation of the cash flows for the project and in the evaluation of its profitability The Machinery's voice Price Shipping Charges Installation Cout Depreciable Base Sod 3.00 15 5.300.000 30 MACRS Depreciation Rates Year Year 2 Year 15% Salvage Value Annual Revenue and cost ratimates (am 3% inflation rates Ya You YOG 1.500 Le U Price Unit Coul Sales Cle 1500 335800 1500 375.000 Chiesa Net Operating Working Capital (NOWCRequirement: YO Year Yee Year Year Sales 3375.000 NOWC (15% of wales) 556,250 CF due to NOWC (56.250) Therethi shows the data nended to calculate the cash flow for this project. The new production system has a life of years, yule 540,000 and falls in MACRS 3-war class Anale and cost estimates are presented in the middle of the shit The aspected to generate sale of 1.500 units per var, with a unit price of $250 and it cost of $150 ABC's operating working capital requirement, which is shown at the bottom of the exhibit 15% of total sales in Year 1. QUESTIONS Assume that you are Smith Vernoth. Answer the following questions: 1. 2. brent Evaluate the profitability of the project with the NPV, IRR, MIRR, simple payback period, and discounted payback period methods if the discount rate is 9.37%. Is the project acceptable? Briefly explain. Why is the NPV method superior to the other methods of capital budgeting? Briefly explain