Answered step by step

Verified Expert Solution

Question

1 Approved Answer

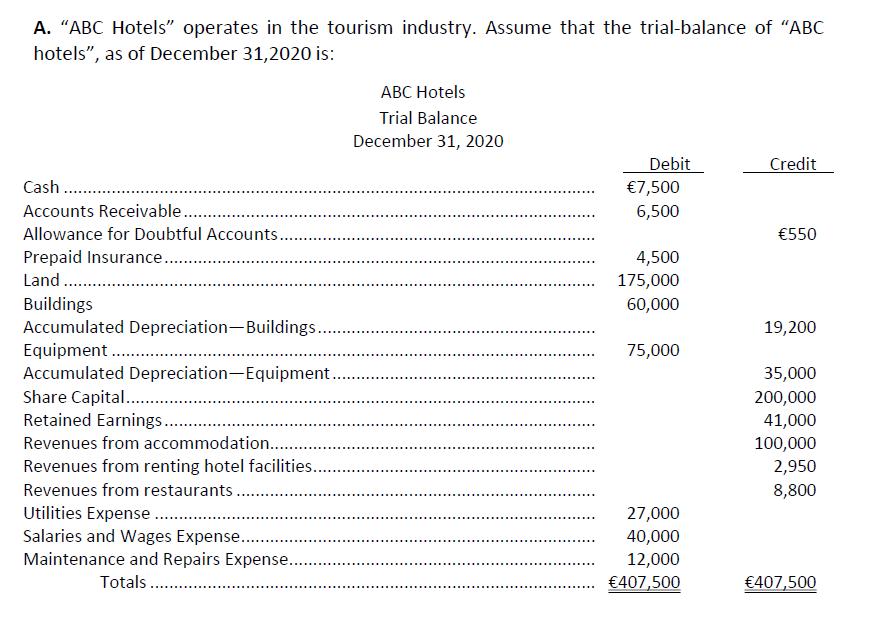

A. ABC Hotels operates in the tourism industry. Assume that the trial-balance of ABC hotels, as of December 31,2020 is: Cash......... Accounts Receivable............ Allowance

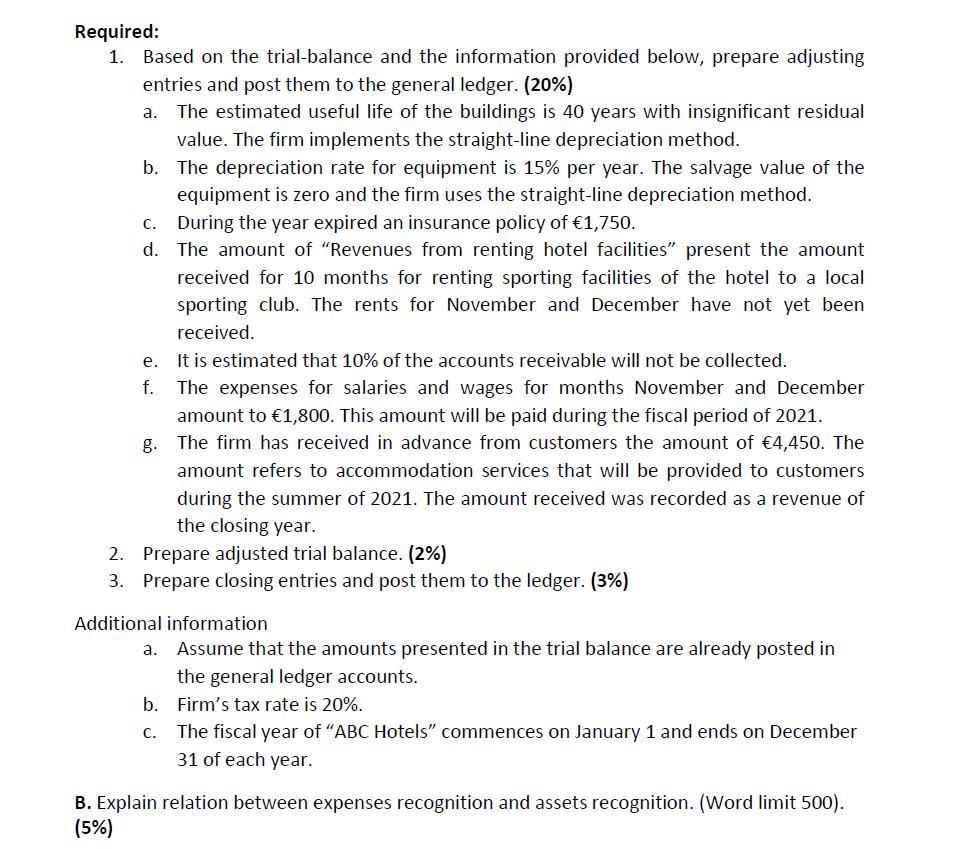

A. "ABC Hotels" operates in the tourism industry. Assume that the trial-balance of "ABC hotels", as of December 31,2020 is: Cash......... Accounts Receivable............ Allowance for Doubtful Accounts. Prepaid Insurance...... Land ........... ABC Hotels Trial Balance December 31, 2020 Buildings Accumulated Depreciation-Buildings........ Equipment .......... Accumulated Depreciation-Equipment. Share Capital.............. Retained Earnings........ Revenues from accommodation.............. Revenues from renting hotel facilities......... Revenues from restaurants ........ Utilities Expense......... Salaries and Wages Expense.... Maintenance and Repairs Expense..... Totals ................... Debit 7,500 6,500 4,500 175,000 60,000 75,000 27,000 40,000 12,000 407,500 Credit 550 19,200 35,000 200,000 41,000 100,000 2,950 8,800 407,500 Required: 1. Based on the trial-balance and the information provided below, prepare adjusting entries and post them to the general ledger. (20%) The estimated useful life of the buildings is 40 years with insignificant residual value. The firm implements the straight-line depreciation method. b. The depreciation rate for equipment is 15% per year. The salvage value of the equipment is zero and the firm uses the straight-line depreciation method. During the year expired an insurance policy of 1,750. d. The amount of "Revenues from renting hotel facilities" present the amount received for 10 months for renting sporting facilities of the hotel to a local sporting club. The rents for November and December have not yet been received. e. It is estimated that 10% of the accounts receivable will not be collected. f. The expenses for salaries and wages for months November and December amount to 1,800. This amount will be paid during the fiscal period of 2021. g. The firm has received in advance from customers the amount of 4,450. The amount refers to accommodation services that will be provided to customers during the summer of 2021. The amount received was recorded as a revenue of the closing year. 2. Prepare adjusted trial balance. (2%) 3. Prepare closing entries and post them to the ledger. (3%) Additional information a. b. c. Assume that the amounts presented in the trial balance are already posted in the general ledger accounts. Firm's tax rate is 20%. The fiscal year of "ABC Hotels" commences on January 1 and ends on December 31 of each year. B. Explain relation between expenses recognition and assets recognition. (Word limit 500). (5%)

Step by Step Solution

★★★★★

3.64 Rating (177 Votes )

There are 3 Steps involved in it

Step: 1

Based on the provided trial balance and additional information lets prepare the adjusting entries and post them to the general ledger a Depreciation e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started