Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Inc, a US Company, bought machine parts from a German company on December 1, 20X1, for Euro 2,000, when the spot rate was $0,4895.

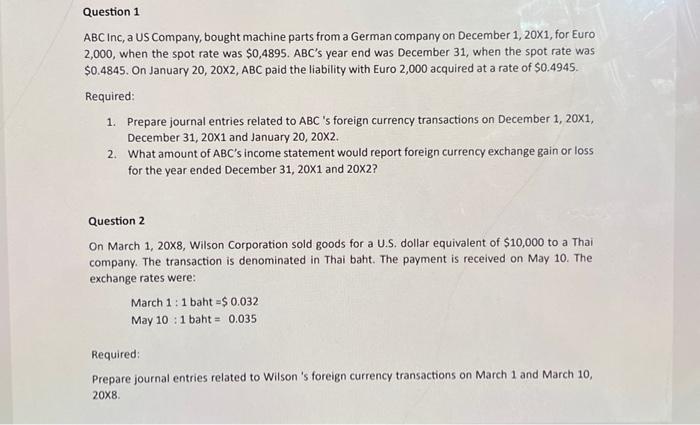

ABC Inc, a US Company, bought machine parts from a German company on December 1, 20X1, for Euro 2,000, when the spot rate was $0,4895. ABC's year end was December 31, when the spot rate was $0.4845. On January 20, 20X2, ABC paid the liability with Euro 2,000 acquired at a rate of $0.4945. Required: 1. Prepare journal entries related to ABC's foreign currency transactions on December 1, 20X1, December 31, 20X1 and January 20, 20X2. 2. What amount of ABC's income statement would report foreign currency exchange gain or loss for the year ended December 31, 20X1 and 20X2?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started