Question

ABC Inc. is a juice producer which has been growing steadily for the past 5 years. According to the expected market demand, the company is

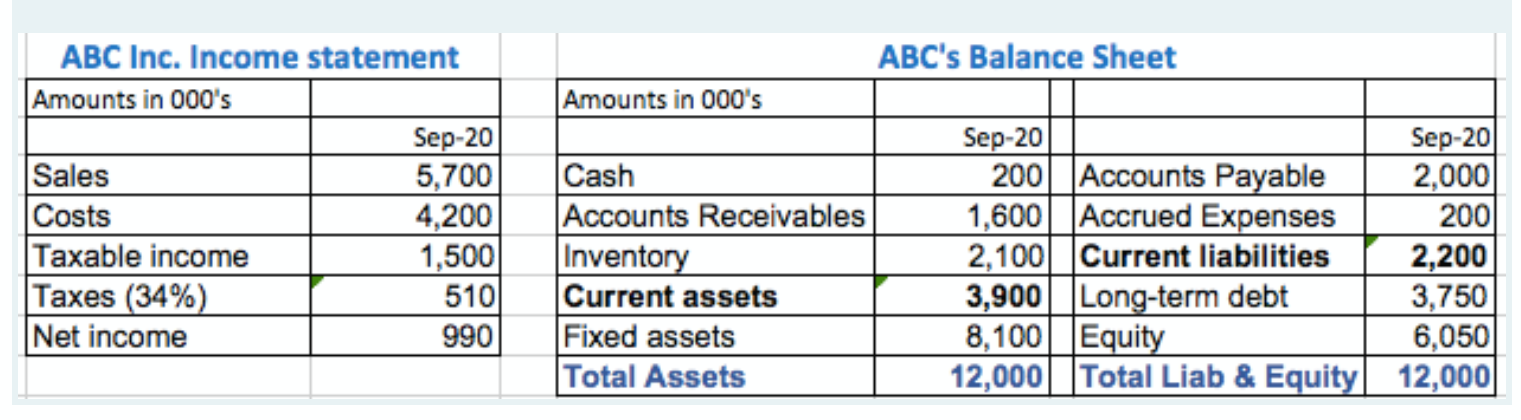

ABC Inc. is a juice producer which has been growing steadily for the past 5 years. According to the expected market demand, the company is planning to grow its sales at 15% next year. Since the company is currently operating at full capacity, fixed assets will also grow proportional to sales, same as current assets and current liabilities. However, long-term debt and equity will not grow proportional to sales but rather management will decide upon their next year level based on an acceptable level of debt to equity ratio as well as ROE ratio. The company has a dividend pay-out ratio of 40%, which the management want to maintain in order to meet the shareholders' expectations. Below are the financial statements of ABC Inc. for the year ending Sept 2020.

If the ROE & Debt Equity ratios if the company decides to cover the "external money needed" by raising debt?(ROE =16.91%, Debt to Equity Ratio is 67.38%), and the ROE & Debt Equity Ratio if the company decides to cover the "external money needed" by raising new equity(ROE =15.14%, Debt to Equity Ratio is 49.87%)

1. How would an increase in debt or equity impact the ROE and debt to equity ratios?

2. If the company has a strict target of not exceeding a Debt-Equity ratio of 65%, which option (raising debt or raising equity) would be the preferred option

3. If we assume that the company decided not to raise any external fund and depend solely on its own internally generated funds, what would be the maximum growth rate that it can achieve?

4. What is the company's sustainable growth rate?

5. In addition to the planned 15% growth of the next year, the company is considering a future mega project of introducing a new entire production line that can increase its market share by 5%. The company is planning for this expansion to take place four years from today when the company's production team is better prepared for such a leap in production. The total investment cost of this project is $3M, and the company wants to finance it by 50% debt and 50% equity. How much does the company need to save every year, for the coming four years, to raise $1.5M, if its saving account earns an interest rate of 4%?

ABC's Balance Sheet Amounts in 000's ABC Inc. Income statement Amounts in 000's Sep-20 Sales 5,700 Costs 4,200 Taxable income 1,500 Taxes (34%) 510 Net income 990 Cash Accounts Receivables Inventory Current assets Fixed assets Total Assets Sep-20 Sep-20 200 Accounts Payable 2,000 1,600||Accrued Expenses 200 2,100 Current liabilities 2,200 3,900 Long-term debt 3,750 8,100 Equity 6,050 12,000 Total Liab & Equity 12,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started