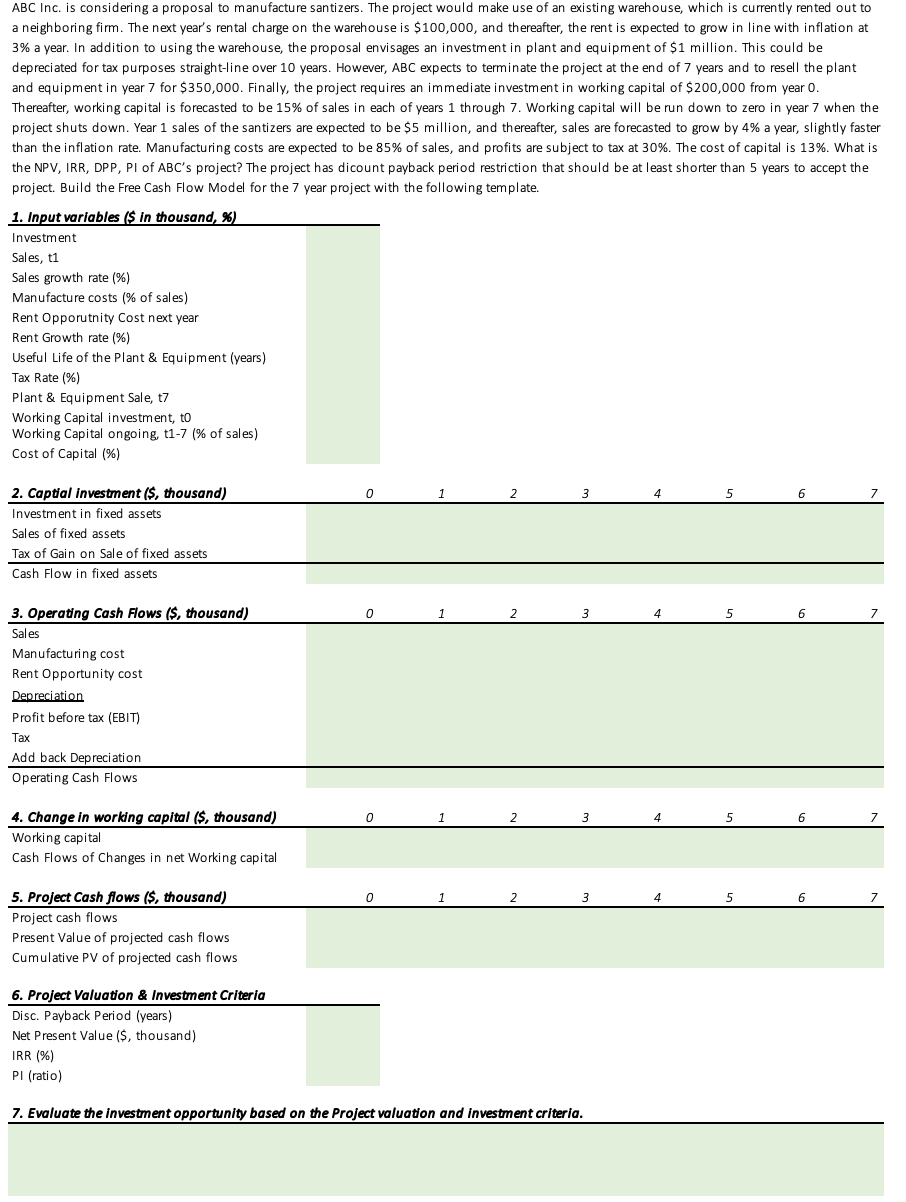

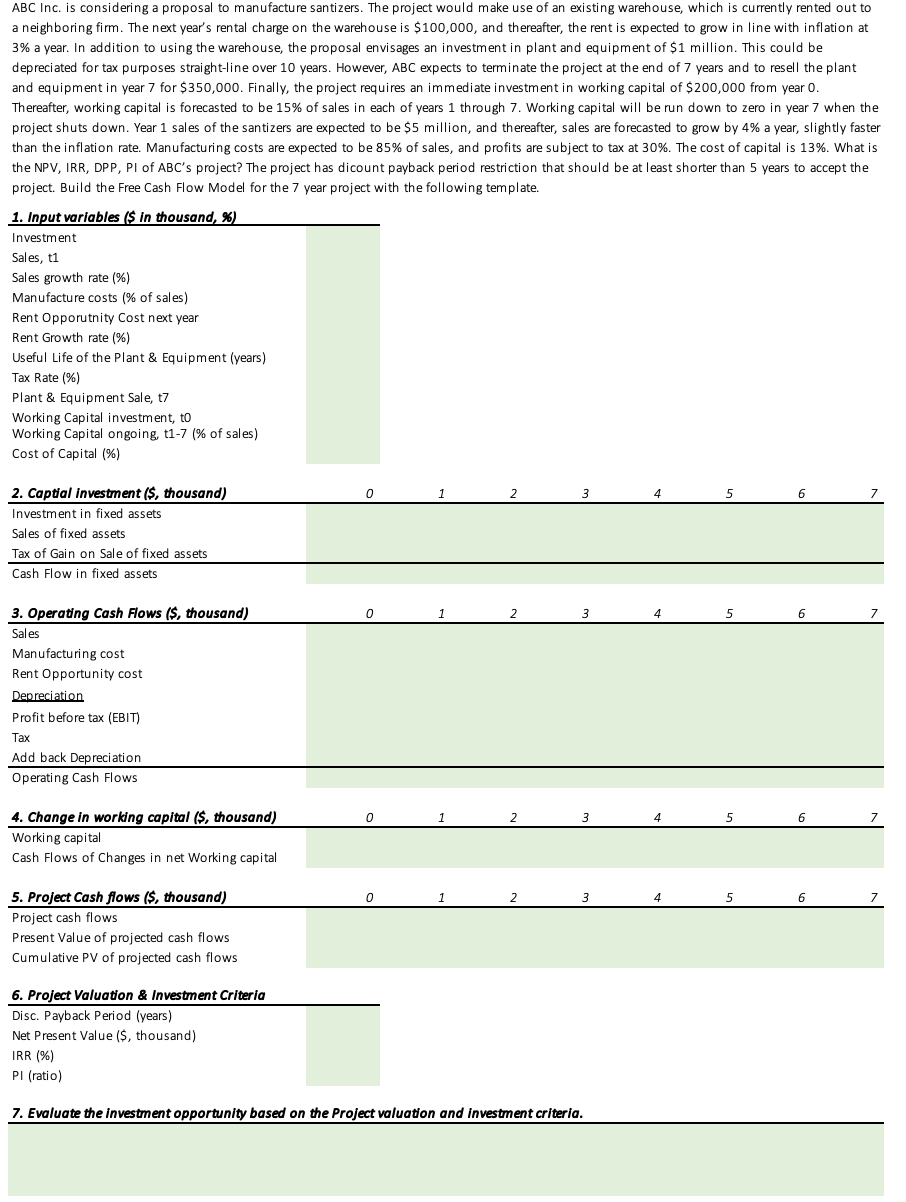

ABC Inc. is considering a proposal to manufacture santizers. The project would make use of an existing warehouse, which is currently rented out to a neighboring firm. The next year's rental charge on the warehouse is $100,000, and thereafter, the rent is expected to grow in line with inflation at 3% a year. In addition to using the warehouse, the proposal envisages an investment in plant and equipment of $1 million. This could be depreciated for tax purposes straight-line over 10 years. However, ABC expects to terminate the project at the end of 7 years and to resell the plant and equipment in year 7 for $350,000. Finally, the project requires an immediate investment in working capital of $200,000 from year 0. Thereafter, working capital is forecasted to be 15% of sales in each of years 1 through 7. Working capital will be run down to zero in year 7 when the project shuts down. Year 1 sales of the santizers are expected to be $5 million, and thereafter, sales are forecasted to grow by 4% a year, slightly faster than the inflation rate. Manufacturing costs are expected to be 85% of sales, and profits are subject to tax at 30%. The cost of capital is 13%. What is the NPV, IRR, DPP, PI of ABC's project? The project has dicount payback period restriction that should be at least shorter than 5 years to accept the project. Build the Free Cash Flow Model for the 7 year project with the following template. 1. Input variables ($ in thousand, %) Investment Sales, ti Sales growth rate (%) Manufacture costs % of sales) Rent Opporutnity Cost next year Rent Growth rate (%) Useful Life of the Plant & Equipment (years) Tax Rate (%) Plant & Equipment Sale, t7 Working Capital investment, to Working Capital ongoing, t1-7 (% of sales) Cost of Capital (%) 3 4 5 6 2. Captial investment ($, thousand) Investment in fixed assets Sales of fixed assets Tax of Gain on Sale of fixed assets Cash Flow in fixed assets 0 3 4 6 3. Operating Cash Flows (s, thousand) Sales Manufacturing cost Rent Opportunity cost Depreciation Profit before tax (EBIT) Tax Add back Depreciation Operating Cash Flows 0 2 3 4 5 6 4. Change in working capital ($, thousand) Working capital Cash Flows of Changes in net Working capital 0 1 2 3 4 5 6 5. Project Cash flows (s, thousand) Project cash flows Present Value of projected cash flows Cumulative PV of projected cash flows 6. Project Valuation & Investment Criteria Disc. Payback Period (years) Net Present Value ($, thousand) IRR (%) PI (ratio) 7. Evaluate the investment opportunity based on the Project valuation and investment criteria. ABC Inc. is considering a proposal to manufacture santizers. The project would make use of an existing warehouse, which is currently rented out to a neighboring firm. The next year's rental charge on the warehouse is $100,000, and thereafter, the rent is expected to grow in line with inflation at 3% a year. In addition to using the warehouse, the proposal envisages an investment in plant and equipment of $1 million. This could be depreciated for tax purposes straight-line over 10 years. However, ABC expects to terminate the project at the end of 7 years and to resell the plant and equipment in year 7 for $350,000. Finally, the project requires an immediate investment in working capital of $200,000 from year 0. Thereafter, working capital is forecasted to be 15% of sales in each of years 1 through 7. Working capital will be run down to zero in year 7 when the project shuts down. Year 1 sales of the santizers are expected to be $5 million, and thereafter, sales are forecasted to grow by 4% a year, slightly faster than the inflation rate. Manufacturing costs are expected to be 85% of sales, and profits are subject to tax at 30%. The cost of capital is 13%. What is the NPV, IRR, DPP, PI of ABC's project? The project has dicount payback period restriction that should be at least shorter than 5 years to accept the project. Build the Free Cash Flow Model for the 7 year project with the following template. 1. Input variables ($ in thousand, %) Investment Sales, ti Sales growth rate (%) Manufacture costs % of sales) Rent Opporutnity Cost next year Rent Growth rate (%) Useful Life of the Plant & Equipment (years) Tax Rate (%) Plant & Equipment Sale, t7 Working Capital investment, to Working Capital ongoing, t1-7 (% of sales) Cost of Capital (%) 3 4 5 6 2. Captial investment ($, thousand) Investment in fixed assets Sales of fixed assets Tax of Gain on Sale of fixed assets Cash Flow in fixed assets 0 3 4 6 3. Operating Cash Flows (s, thousand) Sales Manufacturing cost Rent Opportunity cost Depreciation Profit before tax (EBIT) Tax Add back Depreciation Operating Cash Flows 0 2 3 4 5 6 4. Change in working capital ($, thousand) Working capital Cash Flows of Changes in net Working capital 0 1 2 3 4 5 6 5. Project Cash flows (s, thousand) Project cash flows Present Value of projected cash flows Cumulative PV of projected cash flows 6. Project Valuation & Investment Criteria Disc. Payback Period (years) Net Present Value ($, thousand) IRR (%) PI (ratio) 7. Evaluate the investment opportunity based on the Project valuation and investment criteria