Answered step by step

Verified Expert Solution

Question

1 Approved Answer

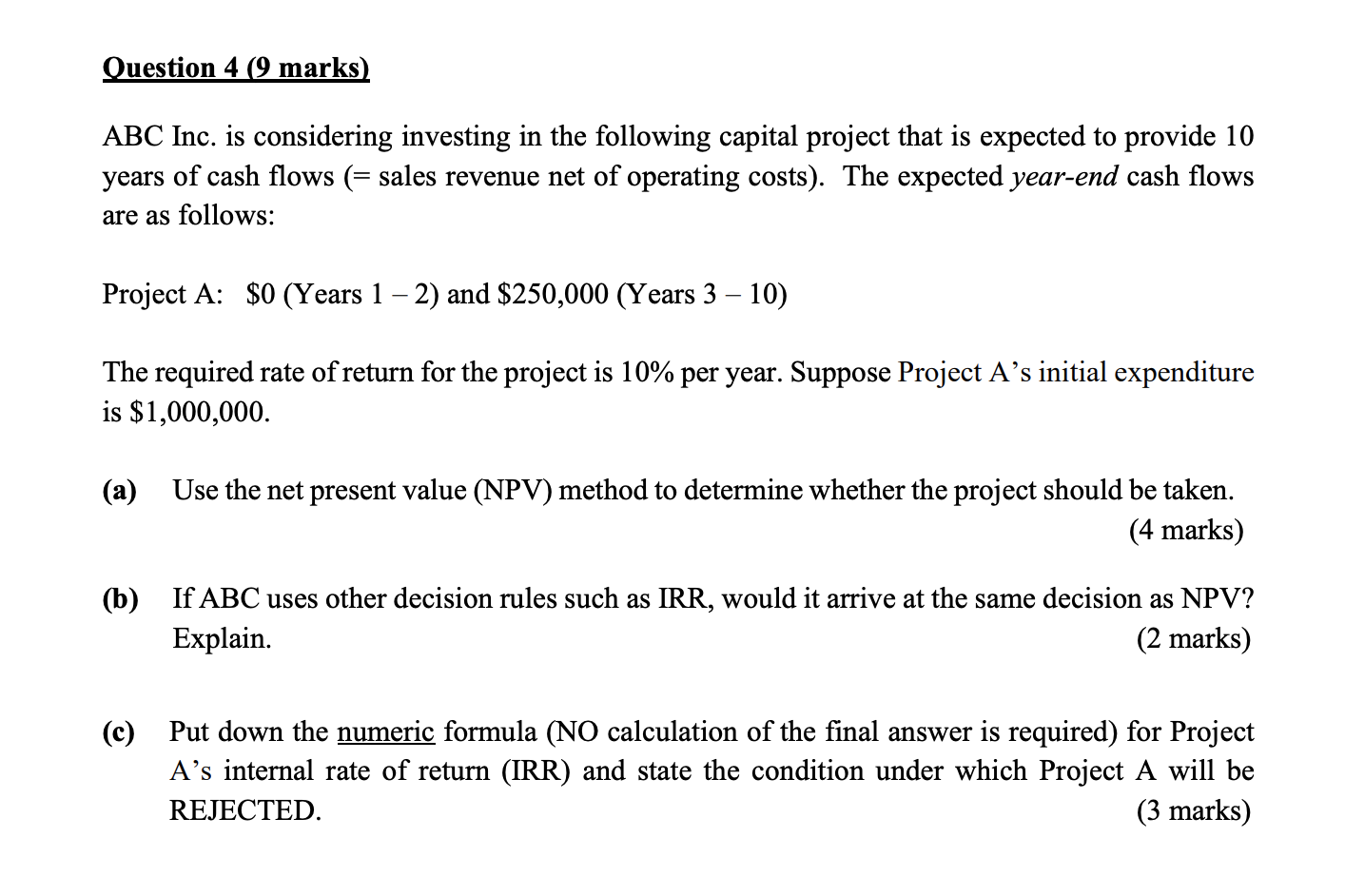

ABC Inc. is considering investing in the following capital project that is expected to provide 1 0 years of cash flows ( = sales revenue

ABC Inc. is considering investing in the following capital project that is expected to provide

years of cash flows sales revenue net of operating costs The expected yearend cash flows

are as follows:

Project A: $Years and $Years

The required rate of return for the project is per year. Suppose Project As initial expenditure

is $

a Use the net present value NPV method to determine whether the project should be taken.

marks

b If ABC uses other decision rules such as IRR, would it arrive at the same decision as NPV

Explain. marks

c Put down the numeric formula NO calculation of the final answer is required for Project

As internal rate of return IRR and state the condition under which Project A will be

REJECTED. marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started