ABC Inc. is considering the replacement of an old printing machine with a new one that will increase revenue by $3,000 per year ( revenue = $3,000/year). The new machine costs $15,000, has an estimated life of 6 years, and can be depreciated straight-line to a zero salvage value over the next 6-year period. The new machine is expected to have a disposal value of $3,000 at the end of its estimated life.

The old machine was bought 4 years ago at $5,000 and is being depreciated under the straight-line method to a zero salvage value (original life = 10 years). The old machine, however, is not likely to have any disposal value at the end of its useful life (6 years from now) but has a current market value of $4,000. The applicable corporate tax rate is 21%, and the firms WACC is 12%.

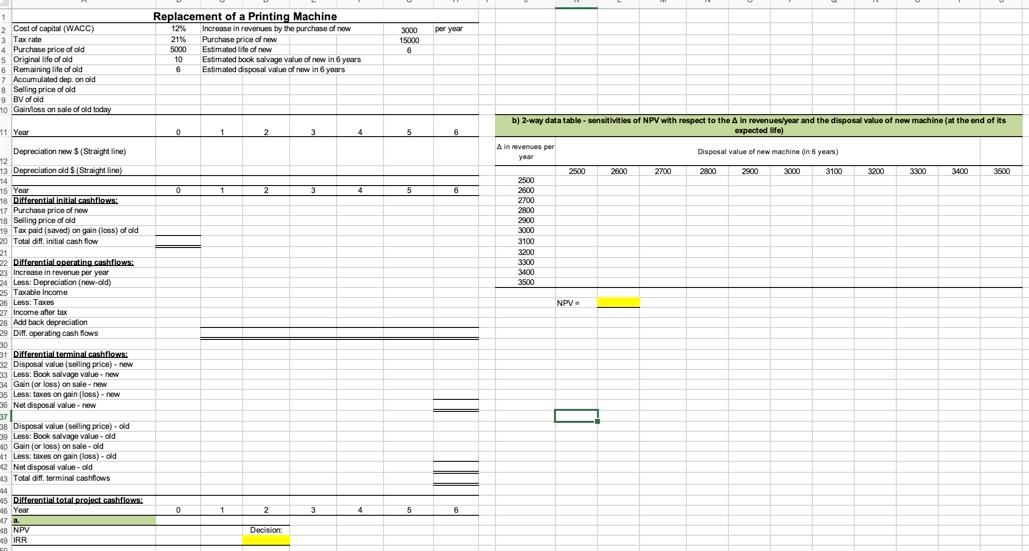

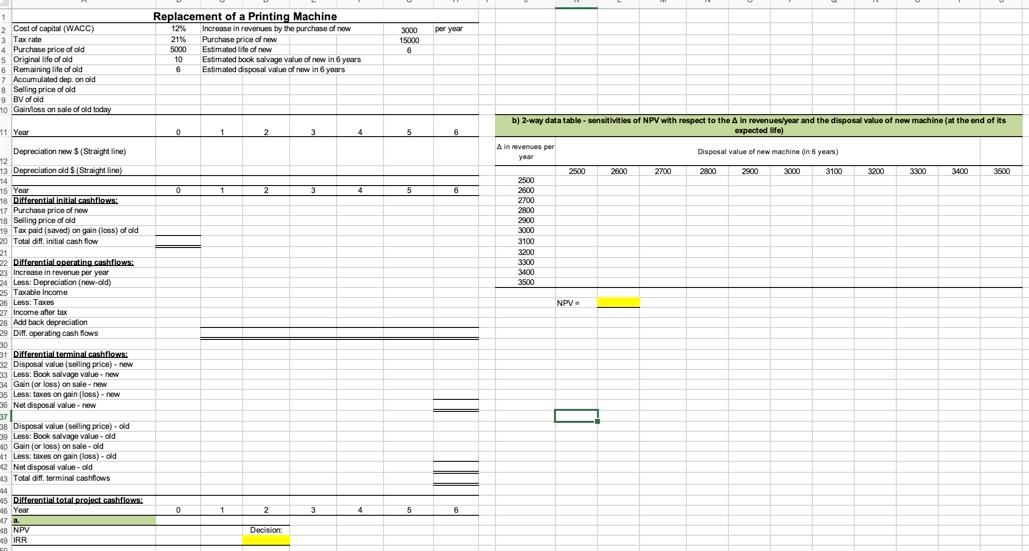

a) Should the new machine replace the old one? Assume that the old machine can be used for another six years if not replaced.

b) Create a data table showing the sensitivities of NPV with respect to the change in revenue generated by the new machine and the expected disposal value of the new machine (at the end of its 6-year expected life). Use a $2,500 to $3,500 range for both the change in revenue and the disposal value of the new machine (with a $100 increment). What is the NPV of the project if the change in revenue generated by the new machine is $3,000 and the expected disposal value of the new machine is $3,500?

please use this as a guide and show formulas

per year 1 2 Cost of capital (WACC) 3 Tax rate 4 Purchase price of old 5 Original life of old 6 Remaining life of old 7 Accumulated dep. on old 8 Selling price of old 9 BV of old 10 Gairloss on sale of old today Replacement of a Printing Machine 12% Increase in revenues by the purchase of new 21% Purchase price of new 5000 Estimated life of now 10 Estimated book salvage value of new in 6 years 6 Estimated disposal value of new in 6 years 3000 15000 6 b) 2-way data table-sensitivities of NPV with respect to the A in revenues year and the disposal value of new machine (at the end of its expected life) 11 Year 0 1 2 5 6 A in revenues per year Disposal value of new machine on years) 2500 2800 2700 2800 2900 3000 3100 3200 3300 3400 3500 0 1 2 3 4 5 6 2500 2800 2700 2800 2900 3000 3100 3200 3300 3000 3500 NPV Depreciation new $ (Straight line) 12 13 Depreciation old $ (Straight line) 14 15 Year 18 DifferentialInitial cashflows: 17 Purchase price of new 18 Selling price of old 19 Tax paid (saved) on gain (loss) of old 20 Total dift, initial cash flow 21 22 Differential operating cashflows: 23 Increase in revenue per year 24 Less: Depreciation (new-old) 25 Taxable income 26 Less: Taxes 27 Income after tax 28 Add back depreciation 29 Diff. operating cash flows 30 31 Differential terminal cashflows: 32 Disposal value (selling price) - new 33 Less: Book salvage value 34 Gain (or loss) on sale-new 35 Less taxes on gain (los) new 36 Net disposal value - new 37 38 Disposal value (selling price). old 39 Less: Book salvage value-old 40 Gain or loss) on sale-old 41 Less taxes on gain (loss) - Old 2 Net disposal value-old 43 Total diff. terminal cashflows 14 45 Differential total project cashflows: 46 Year 17 a. 4 NPV 49 IRR = 0 2 3 4 5 6 Decision per year 1 2 Cost of capital (WACC) 3 Tax rate 4 Purchase price of old 5 Original life of old 6 Remaining life of old 7 Accumulated dep. on old 8 Selling price of old 9 BV of old 10 Gairloss on sale of old today Replacement of a Printing Machine 12% Increase in revenues by the purchase of new 21% Purchase price of new 5000 Estimated life of now 10 Estimated book salvage value of new in 6 years 6 Estimated disposal value of new in 6 years 3000 15000 6 b) 2-way data table-sensitivities of NPV with respect to the A in revenues year and the disposal value of new machine (at the end of its expected life) 11 Year 0 1 2 5 6 A in revenues per year Disposal value of new machine on years) 2500 2800 2700 2800 2900 3000 3100 3200 3300 3400 3500 0 1 2 3 4 5 6 2500 2800 2700 2800 2900 3000 3100 3200 3300 3000 3500 NPV Depreciation new $ (Straight line) 12 13 Depreciation old $ (Straight line) 14 15 Year 18 DifferentialInitial cashflows: 17 Purchase price of new 18 Selling price of old 19 Tax paid (saved) on gain (loss) of old 20 Total dift, initial cash flow 21 22 Differential operating cashflows: 23 Increase in revenue per year 24 Less: Depreciation (new-old) 25 Taxable income 26 Less: Taxes 27 Income after tax 28 Add back depreciation 29 Diff. operating cash flows 30 31 Differential terminal cashflows: 32 Disposal value (selling price) - new 33 Less: Book salvage value 34 Gain (or loss) on sale-new 35 Less taxes on gain (los) new 36 Net disposal value - new 37 38 Disposal value (selling price). old 39 Less: Book salvage value-old 40 Gain or loss) on sale-old 41 Less taxes on gain (loss) - Old 2 Net disposal value-old 43 Total diff. terminal cashflows 14 45 Differential total project cashflows: 46 Year 17 a. 4 NPV 49 IRR = 0 2 3 4 5 6 Decision