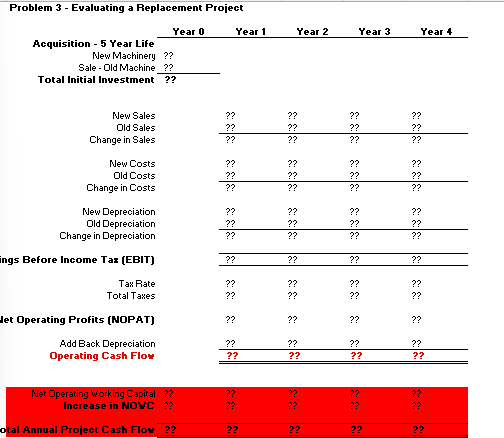

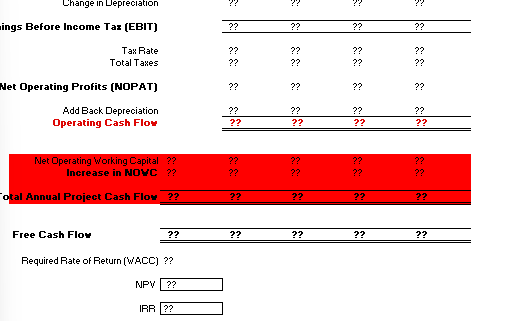

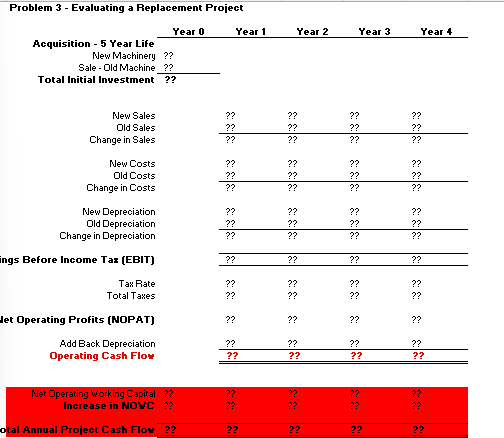

ABC Inc. wishes to buy new machinery that would cost $166,000, but it would lead to increased output, higher sales, and higher costs. Moreover, the firm would receive $100,000 after taxes for the old machine. The new machine would result in sales of $120,000 per year versus old sales of $70,000, and the new costs would be $40,000 versus old costs of $20,000. Finally, the old machine was being depreciated at the rate of $10,000 per year, but the new machine would have $30,000 of annual depreciation. The marginal tax rate is 25 percent and WACC is 10 percent. Based on these figures, and assuming the new and old machines both have a life of four years, find the incremental cash flows.a

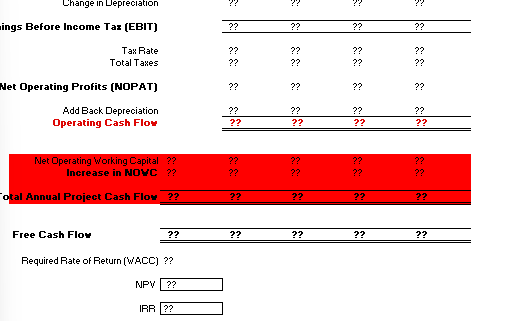

Problem 3 - Evaluating a Replacement Project Acquisition - 5 Year Life New Machinery ?? Sale - Old Machine ?? Total Initial Investment ?? New Sales Old Sales Change in Sales New Costs Old Costs Change in Costs New Depreciation Old Depreciation Change in Depreciation ings Before Income Tax (EBIT) Tax Rate Total Taxes Year 0 let Operating Profits [NOPAT) Add Back Depreciation Operating Cash Flow Net Operating Working Capital ?? Increase in NOVC ?? otal Annual Project Cash Flow __?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? Year 1 ?? ?? ?? ?? ?? Year 2 ?? ?? 22 ?? ?? 22 333 ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? Year 3 ?? ?? ?? 383 ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? Year 4 333 333 ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? Change in Depreciation ings Before Income Tax (EBIT) Tax Rate Total Taxes Net Operating Profits (NOPAT) Add Back Depreciation Operating Cash Flow Net Operating Working Capital ?? Increase in NOVC ?? otal Annual Project Cash Flow ?? Free Cash Flow Required Rate of Return (WACC) ?? NPY ?? ?? IRR ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? E: ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? 2 ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? Problem 3 - Evaluating a Replacement Project Acquisition - 5 Year Life New Machinery ?? Sale - Old Machine ?? Total Initial Investment ?? New Sales Old Sales Change in Sales New Costs Old Costs Change in Costs New Depreciation Old Depreciation Change in Depreciation ings Before Income Tax (EBIT) Tax Rate Total Taxes Year 0 let Operating Profits [NOPAT) Add Back Depreciation Operating Cash Flow Net Operating Working Capital ?? Increase in NOVC ?? otal Annual Project Cash Flow __?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? Year 1 ?? ?? ?? ?? ?? Year 2 ?? ?? 22 ?? ?? 22 333 ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? Year 3 ?? ?? ?? 383 ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? Year 4 333 333 ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? Change in Depreciation ings Before Income Tax (EBIT) Tax Rate Total Taxes Net Operating Profits (NOPAT) Add Back Depreciation Operating Cash Flow Net Operating Working Capital ?? Increase in NOVC ?? otal Annual Project Cash Flow ?? Free Cash Flow Required Rate of Return (WACC) ?? NPY ?? ?? IRR ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? E: ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? 2