Answered step by step

Verified Expert Solution

Question

1 Approved Answer

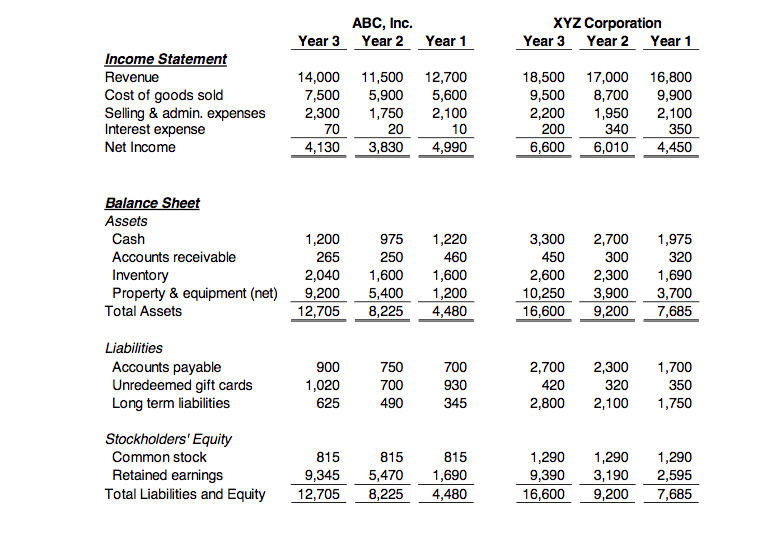

ABC, Inc. Year 2 XYZ Corporation Year 3 Year 2 Year 1 Year 3 Year 1 Income Statement Revenue Cost of goods sold Selling &

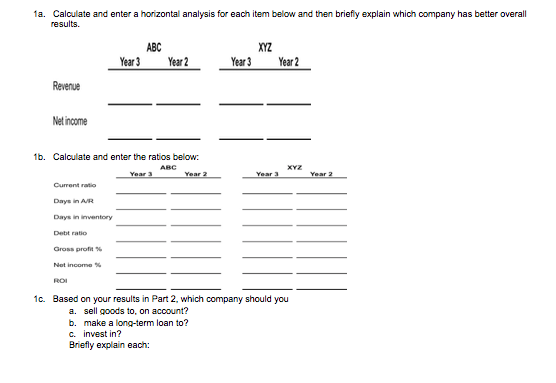

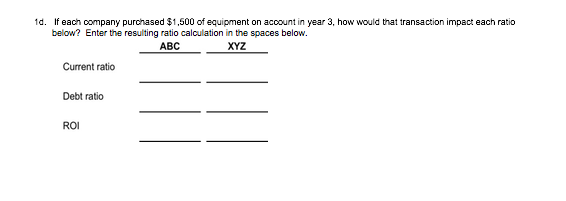

ABC, Inc. Year 2 XYZ Corporation Year 3 Year 2 Year 1 Year 3 Year 1 Income Statement Revenue Cost of goods sold Selling & admin. expenses Interest expense Net Income 14,000 7,500 2,300 11,500 12,700 5,900 5,600 1,750 2,100 2010 3,830 4,990 18,500 9,500 2,200 200 6,600 17,000 8,700 1,950 340 6,010 16,800 9,900 2,100 350 4,450 4,130 Balance Sheet Assets Cash Accounts receivable Inventory Property & equipment (net) Total Assets 975 250 1,600 3,300 450 2,700 300 1,200 265 2,040 9,200 12,705 1,220 460 1,600 1.200 1,975 320 10,250 16,600 3,900 9,200 3,700 7,685 Liabilities Accounts payable Unredeemed gift cards Long term liabilities 900 1,020 625 750 700 490 700 930 2,700 420 2,800 2,300 320 2,100 1,700 350 1,750 345 Stockholders' Equity Common stock Retained earnings Total Liabilities and Equity 815 9,3455,470 12,705 8,225 815 1,690 4,480 1,290 9,390 16,600 1,290 3,190 9,200 1,290 2,595 7,685 1a. Calculate and enter a horizontal analysis for each item below and then briefly explain which company has better overall results. ABC XYZ Year 3 Year 2 Year 3 Year 2 Revenue Net income 1b. Calculate and enter the ratios below: ABC Current ratio Days in AR Dwys in inventor Debit ratio Gross profit 1c. Based on your results in Part 2, which company should you a. sell goods to, on account? b. make a long-term loan to? c. invest in? Briefly explain each: 1d. if each company purchased $1.500 of equipment on account in year 3, how would that transaction impact each ratio below? Enter the resulting ratio calculation in the spaces below. ABC XYZ Current ratio Debt ratio ROI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started