Answered step by step

Verified Expert Solution

Question

1 Approved Answer

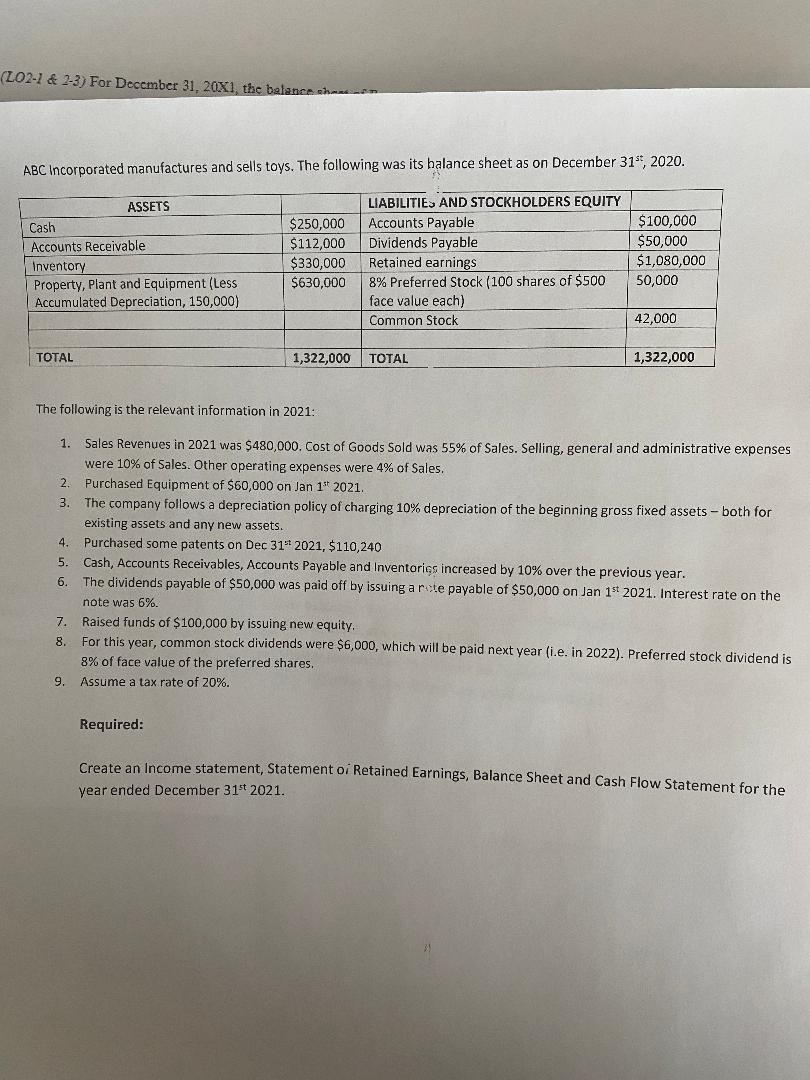

ABC Incorporated manufactures and sells toys. The following was its halance sheet as on December 31st,2020. The following is the relevant information in 2021 :

ABC Incorporated manufactures and sells toys. The following was its halance sheet as on December 31st,2020. The following is the relevant information in 2021 : 1. Sales Revenues in 2021 was $480,000. Cost of Goods Sold was 55% of Sales. Selling, general and administrative expenses were 10% of Sales. Other operating expenses were 4% of Sales. 2. Purchased Equipment of $60,000 on Jan 1st2021. 3. The company follows a depreciation policy of charging 10% depreciation of the beginning gross fixed assets - both for existing assets and any new assets. 4. Purchased some patents on Dec 31st2021,$110,240 5. Cash, Accounts Receivables, Accounts Payable and Inventoriss increased by 10% over the previous year. 6. The dividends payable of $50,000 was paid off by issuing a rite payable of $50,000 on Jan 1st2021. Interest rate on the note was 6%. 7. Raised funds of $100,000 by issuing new equity. 8. For this year, common stock dividends were $6,000, which will be paid next year (i.e. in 2022). Preferred stock dividend is 8% of face value of the preferred shares. 9. Assume a tax rate of 20%. Required: Create an Income statement, Statement oi Retained Earnings, Balance Sheet and Cash Flow Statement for the year ended December 31st2021 ABC Incorporated manufactures and sells toys. The following was its halance sheet as on December 31st,2020. The following is the relevant information in 2021 : 1. Sales Revenues in 2021 was $480,000. Cost of Goods Sold was 55% of Sales. Selling, general and administrative expenses were 10% of Sales. Other operating expenses were 4% of Sales. 2. Purchased Equipment of $60,000 on Jan 1st2021. 3. The company follows a depreciation policy of charging 10% depreciation of the beginning gross fixed assets - both for existing assets and any new assets. 4. Purchased some patents on Dec 31st2021,$110,240 5. Cash, Accounts Receivables, Accounts Payable and Inventoriss increased by 10% over the previous year. 6. The dividends payable of $50,000 was paid off by issuing a rite payable of $50,000 on Jan 1st2021. Interest rate on the note was 6%. 7. Raised funds of $100,000 by issuing new equity. 8. For this year, common stock dividends were $6,000, which will be paid next year (i.e. in 2022). Preferred stock dividend is 8% of face value of the preferred shares. 9. Assume a tax rate of 20%. Required: Create an Income statement, Statement oi Retained Earnings, Balance Sheet and Cash Flow Statement for the year ended December 31st2021

ABC Incorporated manufactures and sells toys. The following was its halance sheet as on December 31st,2020. The following is the relevant information in 2021 : 1. Sales Revenues in 2021 was $480,000. Cost of Goods Sold was 55% of Sales. Selling, general and administrative expenses were 10% of Sales. Other operating expenses were 4% of Sales. 2. Purchased Equipment of $60,000 on Jan 1st2021. 3. The company follows a depreciation policy of charging 10% depreciation of the beginning gross fixed assets - both for existing assets and any new assets. 4. Purchased some patents on Dec 31st2021,$110,240 5. Cash, Accounts Receivables, Accounts Payable and Inventoriss increased by 10% over the previous year. 6. The dividends payable of $50,000 was paid off by issuing a rite payable of $50,000 on Jan 1st2021. Interest rate on the note was 6%. 7. Raised funds of $100,000 by issuing new equity. 8. For this year, common stock dividends were $6,000, which will be paid next year (i.e. in 2022). Preferred stock dividend is 8% of face value of the preferred shares. 9. Assume a tax rate of 20%. Required: Create an Income statement, Statement oi Retained Earnings, Balance Sheet and Cash Flow Statement for the year ended December 31st2021 ABC Incorporated manufactures and sells toys. The following was its halance sheet as on December 31st,2020. The following is the relevant information in 2021 : 1. Sales Revenues in 2021 was $480,000. Cost of Goods Sold was 55% of Sales. Selling, general and administrative expenses were 10% of Sales. Other operating expenses were 4% of Sales. 2. Purchased Equipment of $60,000 on Jan 1st2021. 3. The company follows a depreciation policy of charging 10% depreciation of the beginning gross fixed assets - both for existing assets and any new assets. 4. Purchased some patents on Dec 31st2021,$110,240 5. Cash, Accounts Receivables, Accounts Payable and Inventoriss increased by 10% over the previous year. 6. The dividends payable of $50,000 was paid off by issuing a rite payable of $50,000 on Jan 1st2021. Interest rate on the note was 6%. 7. Raised funds of $100,000 by issuing new equity. 8. For this year, common stock dividends were $6,000, which will be paid next year (i.e. in 2022). Preferred stock dividend is 8% of face value of the preferred shares. 9. Assume a tax rate of 20%. Required: Create an Income statement, Statement oi Retained Earnings, Balance Sheet and Cash Flow Statement for the year ended December 31st2021 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started