Question

ABC Insurance Company has performed an analysis on their Philadelphia Homeowners portfolio and determined a rate increase is necessary to achieve the 56% Target Loss

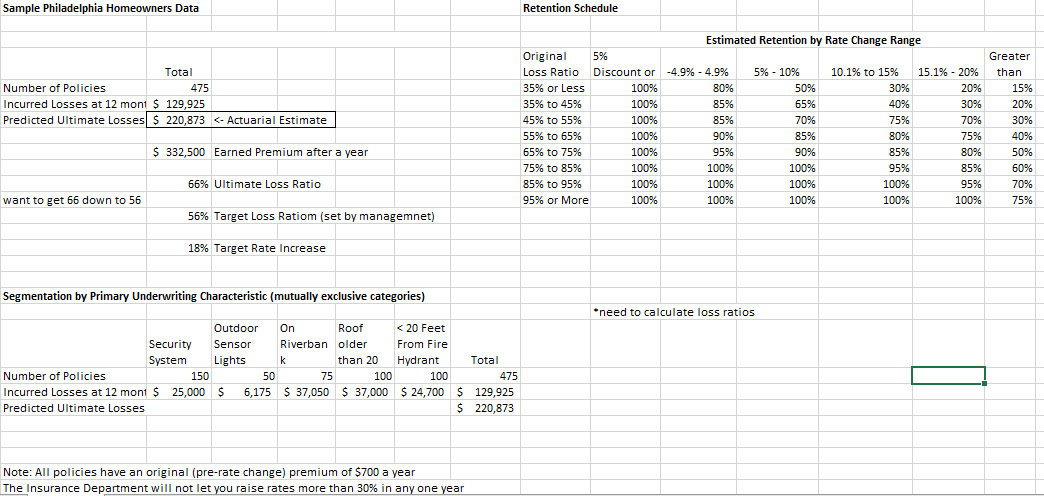

ABC Insurance Company has performed an analysis on their Philadelphia Homeowners portfolio and determined a rate increase is necessary to achieve the 56% Target Loss Ratio set by management.

The expected loss ratio of 66% was developed using an actuarial ultimate loss estimate of policies in the Philadelphia area. See tab "HO Data" of the file linked below:

HO Segmentation Fall 2019.xlsx

You believe the claim data can be segmented by Primary Underwriting Characteristic and would like to vary the rate increase by these characteristics to avoid adverse selection.

Using the segmentation template shown in class (second tab of the linked file) and the retention schedule (on the HO Data tab) show that if the 20% target rate increase is applied to all policies, the target loss ratio of 56% will not be achieved. (Assume that the development factor to take Total Incurred Losses at 12 months to ultimate can be applied to each segment.to estimate ultimate losses for each segment.)

Through trial and error, develop a recommended rate increase by segment that achieves the target loss ratio of 56%. Note the constraints of the retention schedule and the fact that the insurance department will not allow you to raise rates by more than 30% in a single year. (There is more than one solution.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started