Answered step by step

Verified Expert Solution

Question

1 Approved Answer

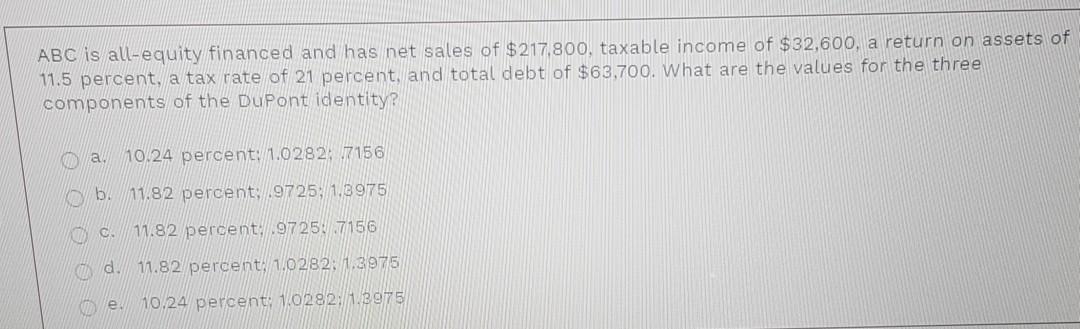

ABC is all-equity financed and has net sales of $217,800, taxable income of $32,600, a return on assets of 11.5 percent, a tax rate of

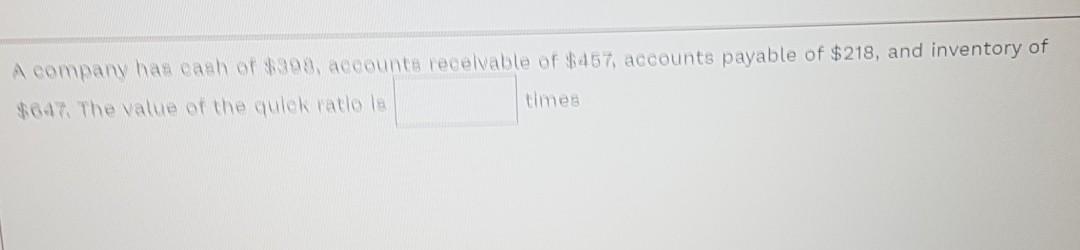

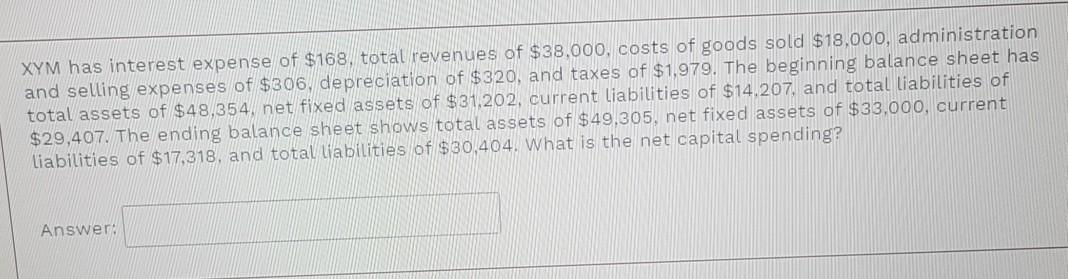

ABC is all-equity financed and has net sales of $217,800, taxable income of $32,600, a return on assets of 11.5 percent, a tax rate of 21 percent, and total debt of $63,700. What are the values for the three components of the DuPont identity? a. 10.24 percent: 1.0282, 17156 b. 11.82 percent 9725; 1,8975 c. 11.82 percent: 97250 7156 d. 11.82 percent 10282: 1.3.1975 10.24 percent: 10282:1.3975 A company has caah of $993, accounts receivable of $457, accounts payable of $218, and inventory of $647. The value of the quick ratio le times XYM has interest expense of $168. total revenues of $38,000, costs of goods sold $18,000, administration and selling expenses of $306, depreciation of $320, and taxes of $1,979. The beginning balance sheet has total assets of $48,354, net fixed assets of $31,202, current liabilities of $14,207, and total liabilities of $29,407. The ending balance sheet shows total assets of $49,305, net fixed assets of $33.000, current Liabilities of $17,318, and total liabilities of $30,404. What is the net capital spending

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started