Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC is the first project of the CU Company. The economic life of this project is 9 years including two years of establishment the project

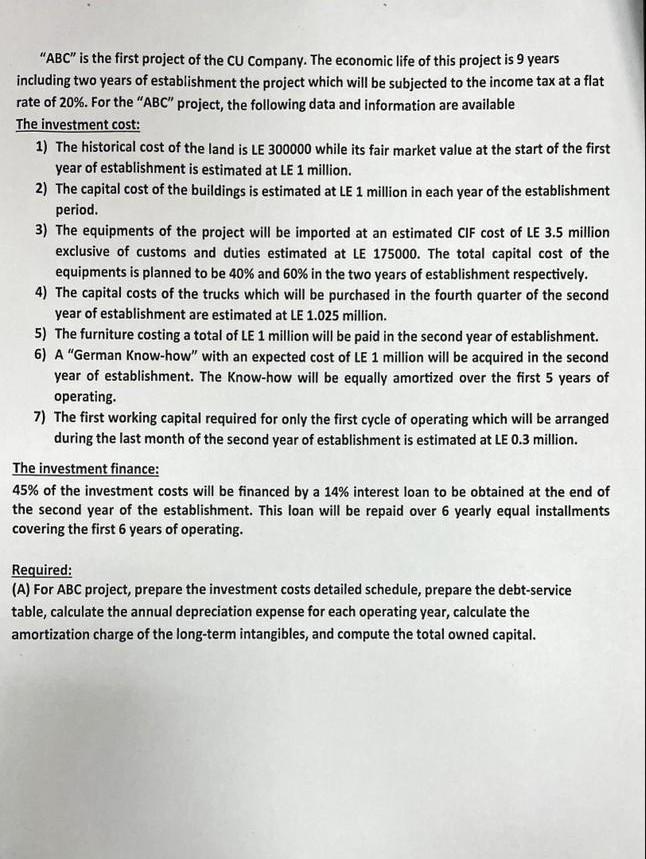

"ABC" is the first project of the CU Company. The economic life of this project is 9 years including two years of establishment the project which will be subjected to the income tax at a flat rate of 20%. For the "ABC" project, the following data and information are available The investment cost: 1) The historical cost of the land is LE 300000 while its fair market value at the start of the first year of establishment is estimated at LE 1 million. 2) The capital cost of the buildings is estimated at LE 1 million in each year of the establishment period. 3) The equipments of the project will be imported at an estimated CIF cost of LE 3.5 million exclusive of customs and duties estimated at LE 175000 . The total capital cost of the equipments is planned to be 40% and 60% in the two years of establishment respectively. 4) The capital costs of the trucks which will be purchased in the fourth quarter of the second year of establishment are estimated at LE 1.025 million. 5) The furniture costing a total of LE 1 million will be paid in the second year of establishment. 6) A "German Know-how" with an expected cost of LE 1 million will be acquired in the second year of establishment. The Know-how will be equally amortized over the first 5 years of operating. 7) The first working capital required for only the first cycle of operating which will be arranged during the last month of the second year of establishment is estimated at LE 0.3 million. The investment finance: 45% of the investment costs will be financed by a 14% interest loan to be obtained at the end of the second year of the establishment. This loan will be repaid over 6 yearly equal installments covering the first 6 years of operating. Required: (A) For ABC project, prepare the investment costs detailed schedule, prepare the debt-service table, calculate the annual depreciation expense for each operating year, calculate the amortization charge of the long-term intangibles, and compute the total owned capital. "ABC" is the first project of the CU Company. The economic life of this project is 9 years including two years of establishment the project which will be subjected to the income tax at a flat rate of 20%. For the "ABC" project, the following data and information are available The investment cost: 1) The historical cost of the land is LE 300000 while its fair market value at the start of the first year of establishment is estimated at LE 1 million. 2) The capital cost of the buildings is estimated at LE 1 million in each year of the establishment period. 3) The equipments of the project will be imported at an estimated CIF cost of LE 3.5 million exclusive of customs and duties estimated at LE 175000 . The total capital cost of the equipments is planned to be 40% and 60% in the two years of establishment respectively. 4) The capital costs of the trucks which will be purchased in the fourth quarter of the second year of establishment are estimated at LE 1.025 million. 5) The furniture costing a total of LE 1 million will be paid in the second year of establishment. 6) A "German Know-how" with an expected cost of LE 1 million will be acquired in the second year of establishment. The Know-how will be equally amortized over the first 5 years of operating. 7) The first working capital required for only the first cycle of operating which will be arranged during the last month of the second year of establishment is estimated at LE 0.3 million. The investment finance: 45% of the investment costs will be financed by a 14% interest loan to be obtained at the end of the second year of the establishment. This loan will be repaid over 6 yearly equal installments covering the first 6 years of operating. Required: (A) For ABC project, prepare the investment costs detailed schedule, prepare the debt-service table, calculate the annual depreciation expense for each operating year, calculate the amortization charge of the long-term intangibles, and compute the total owned capital

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started