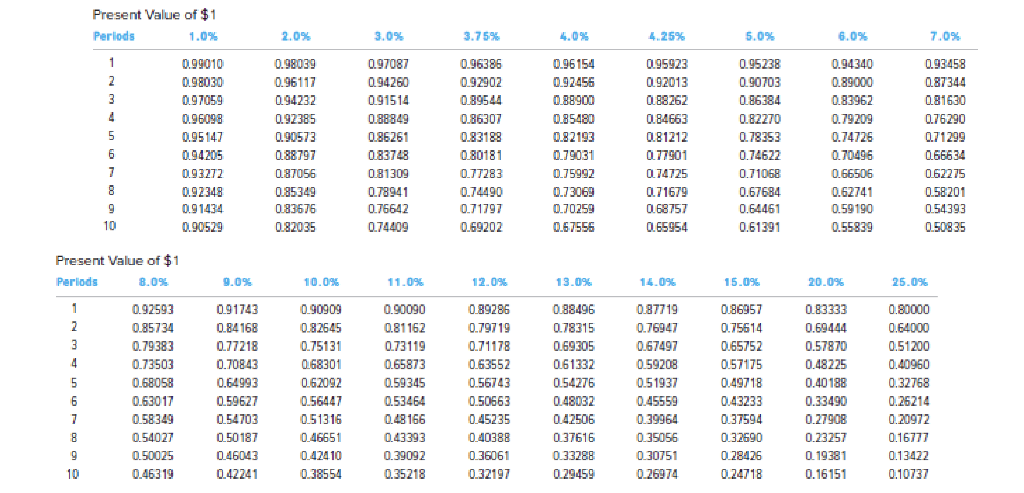

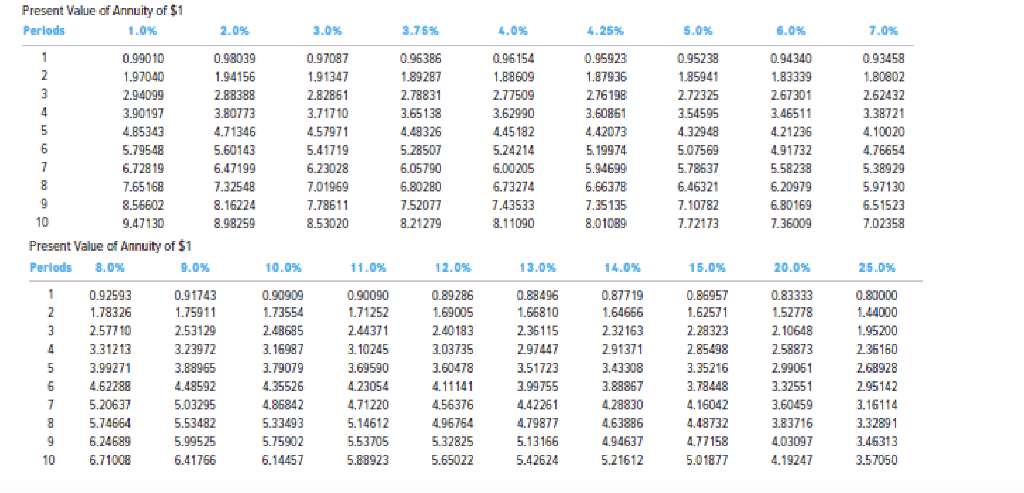

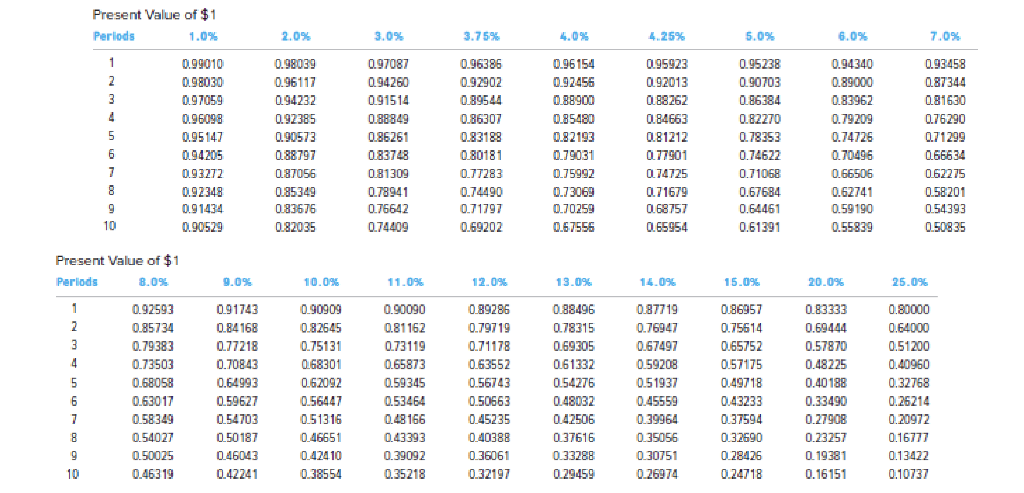

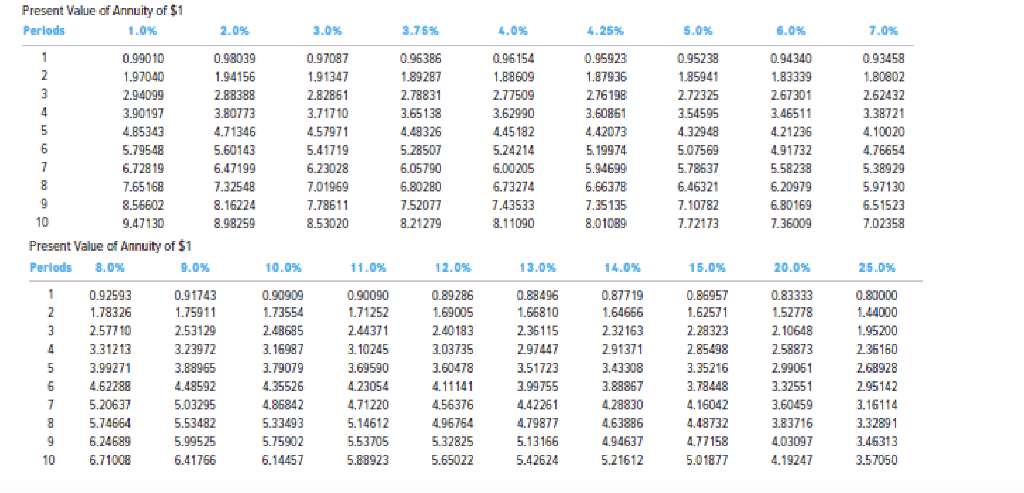

ABC issued 3-year, 6%, $100,000 bonds on January 1, 2019. The bond pays interest every June 30 and December 31, with the principal to be paid in 3 years. The market rate at the time of issuance is 8%, and the company uses the effective-interest method of amortization. Refer to the time value tables. Show the calculation and work

-

Compute the initial selling price of the bonds on January 1, 2019;

-

Provide the journal entry for the SECOND interest payment on Dec 31, 2019;

-

On December 31, 2019, Orange Company retires all of the bonds at 105 (after all interest payments and amortization have been recorded for 2019). Prepare the journal entry for this early retirement; show your calculations.

Present Value of $1 Periods 1.0% 2.0% 3.0% 3.75% 4.0% 4.25% 5.0% 6.0% 7.0% 1 3 4 5 6 0.99010 0.98030 0.97059 0.96098 0.95 147 0.94205 0.93272 0.92348 0.91434 0.90529 0.98039 0.96117 0.94232 0.92385 0.90573 0.88797 0.87056 0.85349 0.83676 0.82035 0.97087 0.94260 0.91514 0.88849 0.86261 0.83748 0.81309 0.78941 0.76642 0.74409 0.96386 0.92902 0.89544 0.86307 0.83188 0.80181 0.77283 0.74490 0.71797 0.69202 0.96154 0.92456 0.88900 0.85480 0.82193 0.79031 0.75992 0.73069 0.70259 0.67556 0.95923 0.92013 0.88262 0.84663 0.81212 0.77901 0.74725 0.71679 0.68757 0.65954 0.95238 0.90703 0.86384 0.82270 0.78353 0.74622 0.71068 0.67684 0.64461 0.61391 0.94340 0.89000 0.83962 0.79209 0.74726 0.70496 0.66506 0.62741 0.59190 0.55839 0.93458 0.87344 0.81630 0.76290 0.71299 0.66634 0.62275 0.58201 0.54393 0.50835 8 9 10 Present Value of $1 Periods 8.0% 9.0% 10.0% 11.0% 12.0% 13.09 14.0% 15.09 20.0% 25.09 1 2 3 4 5 6 7 0.92593 0.85734 0.79383 0.73503 0.68058 0.63017 0.58349 0.54027 0.50025 0.46319 0.91743 0.84168 0.77218 0.70843 0.64993 0.59627 0.54703 0.50187 0.46043 0.42241 0.90909 0.82645 0.75131 0.68301 0.62092 0.56447 0.51316 0.46651 0.42410 0.38554 0.90090 0.81162 0.73119 0.65873 0.59345 0.53464 0.48166 0.43393 0.39092 0.35218 0.89286 0.79719 0.71178 0.63552 0.56743 0.50663 0.45235 0.40388 0.36061 0.32197 0.88496 0.78315 0.69305 0.61332 0.54276 0.48032 0.42506 0.37616 0.33288 0.29459 0.87719 0.76947 0.67497 0.59208 0.51937 0.45559 0.39964 0.35056 0.30751 0.26974 0.86957 0.75614 0.65752 0.57175 0.49718 0.43233 0.37594 0.32690 0.28426 0.24718 0.83333 0.69444 0.57870 0.48225 0.40188 0.33490 0.27908 0.23257 0.19381 0.16151 0.80000 0.64000 0.51200 0.40960 0.32768 0.26214 0.20972 0.16777 0.13422 0.10737 9 10 Present Value of Annuity of $1 Periods 1.0% 2.0% 3.0% 3.75% 4.0% 4.25% 5.0% 6.0% 7.0% 0.99010 0.98039 2 1.97040 1.94156 3 2.94099 2.88388 4 3.90197 3.80773 5 4.85343 4.71346 6 5.79548 5.60143 7 6.72819 6.47199 8 7.65168 7.32548 9 8.56602 8.16224 10 9.47130 8.98259 Present Value of Annuity of $1 Periods 8.0% 9.0% 0.97087 1.91347 2.82851 3.71710 4.57971 5.41719 6.23028 7.01969 7.78611 8.53020 0.96386 1.89287 2.78831 3.65138 4.48326 5.28507 6.05790 6.80280 7.52077 8.21279 0.96154 1.88609 2.77509 3.62990 4.45182 5.24214 6.00205 6.73274 7.43533 8.11090 0.95923 1.87936 2.76198 3.60861 4.4.2073 5.19974 5.94699 6.66378 7.35135 8.01089 0.95238 1.85941 2.72325 3.54595 4.32948 5.07569 5.78637 6.46321 7.10782 7.72173 0.94340 1.83339 2.67301 3.46511 4.21236 4.91732 5.58238 6.20979 6.80169 7.36009 0.93458 1.80802 2.62432 3.38721 4.10020 4.76654 5.38929 5.97130 6.51523 7.02358 10.0% 11.0% 12.0% 13.0% 15.0% 20.0% 25.0% 1 2 3 4 5 6 7 0.92593 1.78326 2.57710 3.31213 3.99271 4.62288 5.20637 5.74664 6.24689 6.71008 0.91743 1.75911 2.53129 3.23972 3.88965 4.48592 5.03295 5.53482 5.99525 6.41766 0.90909 1.73554 2.48685 3.16987 3.79079 4.35526 4.86842 5.33493 5.75902 6.14457 0.90090 1.71252 2.44371 3.10245 3.69590 4.23054 4.71220 5.14612 5.53705 5.88923 0.89286 1.69005 2.40183 3.03735 3.60478 4.11141 4.56376 4.96764 5.32825 5.65022 0.88496 11.66810 2.35115 2.97447 3.51723 3.99755 4.42261 4.79877 5.13166 5.42624 14.0% 0.87719 1.64666 2.32163 2.91371 3.43308 3.88867 4.28830 4.63886 4.94637 5.21612 0.86957 1.62571 2.28323 2.85498 3.35216 3.78448 4.16042 4.48732 4.77158 5.0 1877 0.83333 1.52778 2.10648 2.58873 2.99061 3.32551 3.60459 3.83716 4.03097 4.19247 0.80000 1.44000 1.95200 2.35160 2.68928 2.95142 3.16114 3.32891 3.46313 3.57050 8 10