Answered step by step

Verified Expert Solution

Question

1 Approved Answer

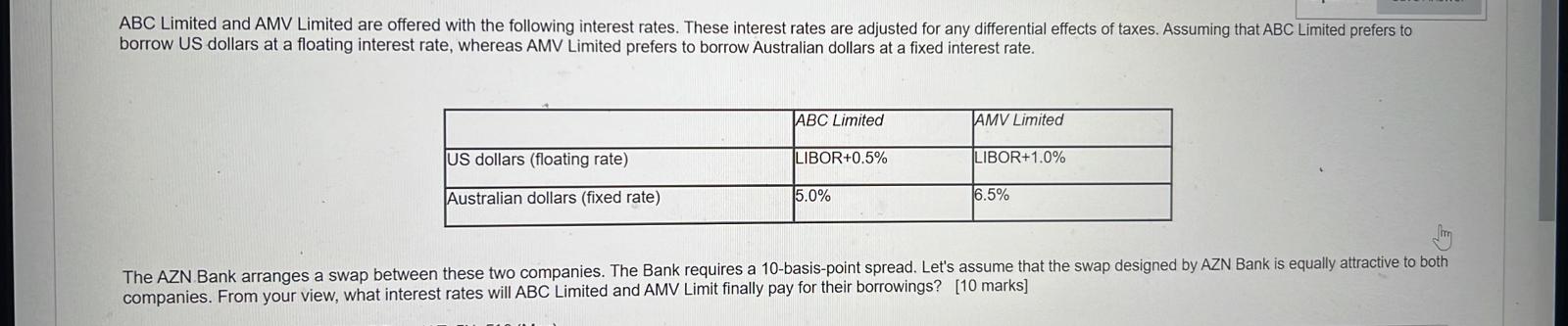

ABC Limited and AMV Limited are offered with the following interest rates. These interest rates are adjusted for any differential effects of taxes. Assuming that

ABC Limited and AMV Limited are offered with the following interest rates. These interest rates are adjusted for any differential effects of taxes. Assuming that ABC Limited prefers to borrow US dollars at a floating interest rate, whereas AMV Limited prefers to borrow Australian dollars at a fixed interest rate. The AZN Bank arranges a swap between these two companies. The Bank requires a 10-basis-point spread. Let's assume that the swap designed by AZN Bank is equally attractive to both companies. From your view, what interest rates will ABC Limited and AMV Limit finally pay for their borrowings? [10 marks]

ABC Limited and AMV Limited are offered with the following interest rates. These interest rates are adjusted for any differential effects of taxes. Assuming that ABC Limited prefers to borrow US dollars at a floating interest rate, whereas AMV Limited prefers to borrow Australian dollars at a fixed interest rate. The AZN Bank arranges a swap between these two companies. The Bank requires a 10-basis-point spread. Let's assume that the swap designed by AZN Bank is equally attractive to both companies. From your view, what interest rates will ABC Limited and AMV Limit finally pay for their borrowings? [10 marks] Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started