Question

ABC limited decides to buyback 10% of FULLY y paid up equity shares at 25% premium over the prevailing market price of rupees 40 per

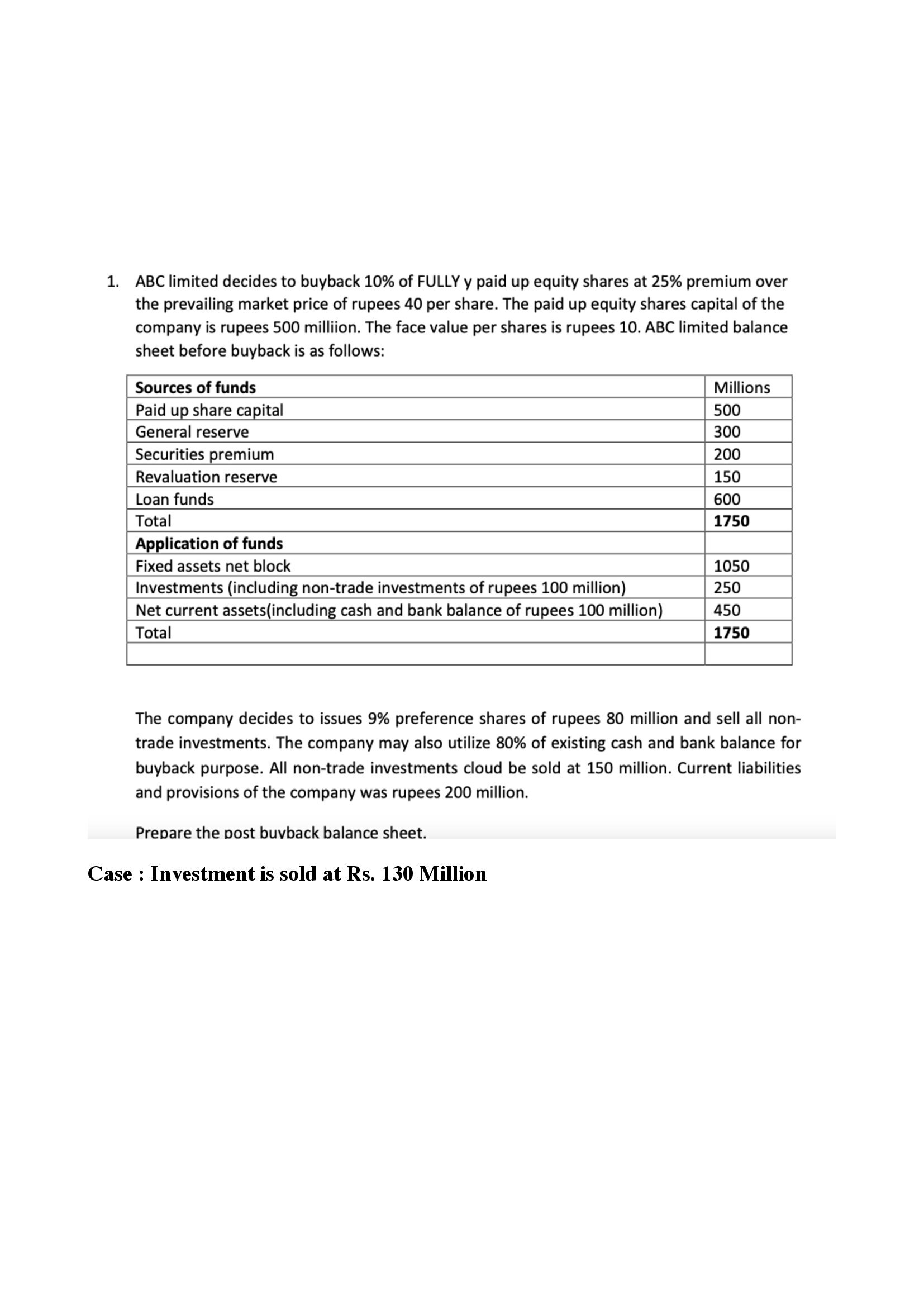

ABC limited decides to buyback 10% of FULLY y paid up equity shares at 25% premium over the prevailing market price of rupees 40 per share. The paid up equity shares capital of the company is rupees 500 milliion. The face value per shares is rupees 10. ABC limited balance sheet before buyback is as follows: Sources of funds Millions Paid up share capital 500 General reserve 300 Securities premium 200 Revaluation reserve 150 Loan funds 600 Total 1750 Application of funds Fixed assets net block 1050 Investments (including non-trade investments of rupees 100 million) 250 Net current assets(including cash and bank balance of rupees 100 million) 450 Total 1750 The company decides to issues 9% preference shares of rupees 80 million and sell all non- trade investments. The company may also utilize 80% of existing cash and bank balance for buyback purpose. All non-trade investments colud be sold at 150 million. Current liabilities and provisions of the company was rupees 200 million. Prepare the post buyback balance sheet. Case 1: Investment is sold at Rs. 130 Million

ABC limited decides to buyback 10% of FULLY y paid up equity shares at 25% premium over the prevailing market price of rupees 40 per share. The paid up equity shares capital of the company is rupees 500 milliion. The face value per shares is rupees 10. ABC limited balance sheet before buyback is as follows: Sources of funds Millions Paid up share capital 500 General reserve 300 Securities premium 200 Revaluation reserve 150 Loan funds 600 Total 1750 Application of funds Fixed assets net block 1050 Investments (including non-trade investments of rupees 100 million) 250 Net current assets(including cash and bank balance of rupees 100 million) 450 Total 1750 The company decides to issues 9% preference shares of rupees 80 million and sell all non- trade investments. The company may also utilize 80% of existing cash and bank balance for buyback purpose. All non-trade investments colud be sold at 150 million. Current liabilities and provisions of the company was rupees 200 million. Prepare the post buyback balance sheet. Case 1: Investment is sold at Rs. 130 Million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started