Answered step by step

Verified Expert Solution

Question

1 Approved Answer

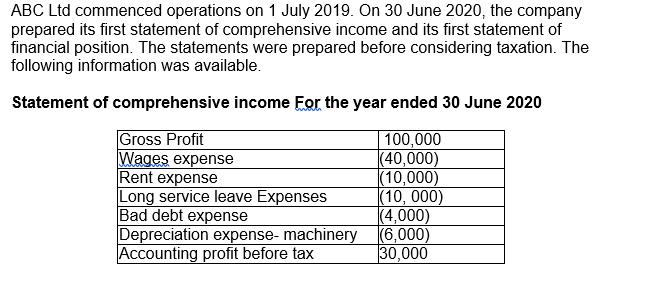

ABC Ltd commenced operations on 1 July 2019. On 30 June 2020, the company prepared its first statement of comprehensive income and its first

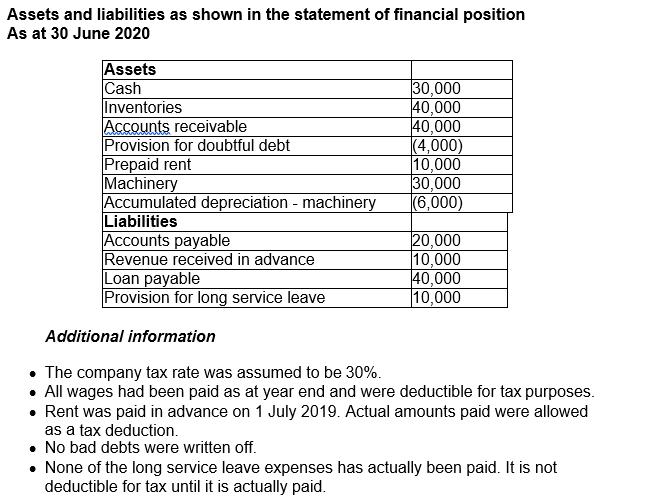

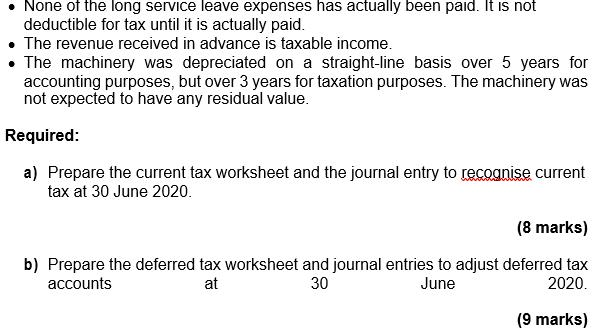

ABC Ltd commenced operations on 1 July 2019. On 30 June 2020, the company prepared its first statement of comprehensive income and its first statement of financial position. The statements were prepared before considering taxation. The following information was available. Statement of comprehensive income For the year ended 30 June 2020 Gross Profit Wages expense Rent expense Long service leave Expenses Bad debt expense Depreciation expense- machinery (6,000) Accounting profit before tax 100,000 |(40,000) |(10,000) (10, 000) (4,000) 30,000 Assets and liabilities as shown in the statement of financial position As at 30 June 2020 Assets Cash Inventories Accounts receivable Provision for doubtful debt Prepaid rent Machinery Accumulated depreciation - machinery Liabilities Accounts payable Revenue received in advance Loan payable Provision for long service leave 30,000 40,000 40,000 |(4,000) 10,000 30,000 |(6,000) 20,000 10,000 40,000 |10,000 Additional information The company tax rate was assumed to be 30%. All wages had been paid as at year end and were deductible for tax purposes. Rent was paid in advance on 1 July 2019. Actual amounts paid were allowed as a tax deduction. No bad debts were written off. None of the long service leave expenses has actually been paid. It is not deductible for tax until it is actually paid. None of the long service leave expenses has actually been paid. It is not deductible for tax until it is actually paid. The revenue received in advance is taxable income. The machinery was depreciated on a straight-line basis over 5 years for accounting purposes, but over 3 years for taxation purposes. The machinery was not expected to have any residual value. Required: a) Prepare the current tax worksheet and the journal entry to recognise current tax at 30 June 2020. (8 marks) b) Prepare the deferred tax worksheet and journal entries to adjust deferred tax 30 accounts at June 2020. (9 marks)

Step by Step Solution

★★★★★

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started