Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Ltd is an Italian retail distributing company operating in the food sector. It has local branches in central and southern Italy. Growth is expected

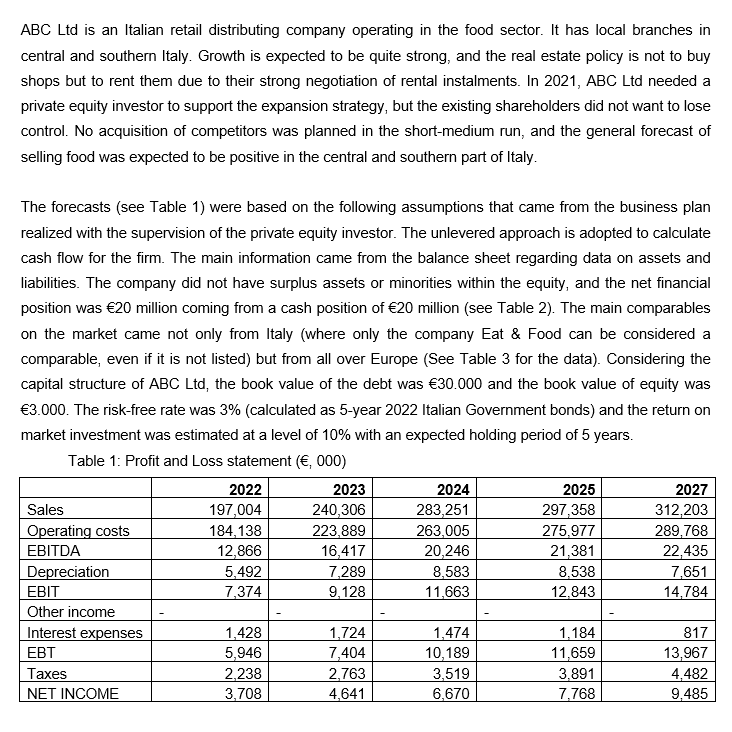

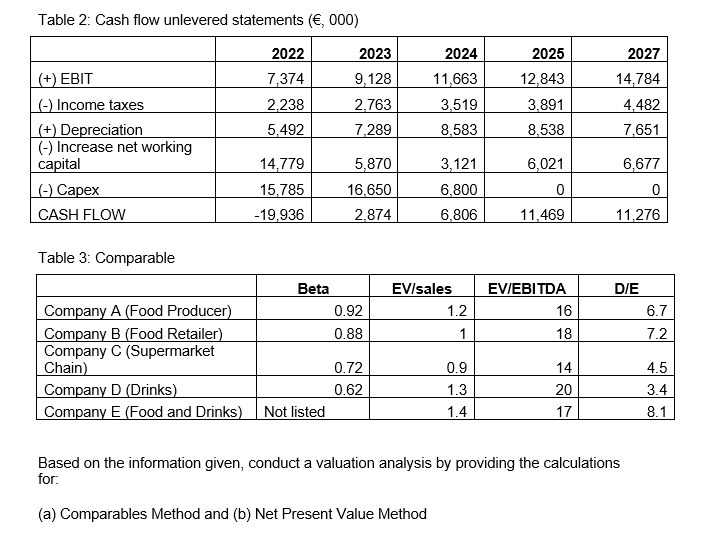

ABC Ltd is an Italian retail distributing company operating in the food sector. It has local branches in central and southern Italy. Growth is expected to be quite strong, and the real estate policy is not to buy shops but to rent them due to their strong negotiation of rental instalments. In 2021, ABC Ltd needed a private equity investor to support the expansion strategy, but the existing shareholders did not want to lose control. No acquisition of competitors was planned in the short-medium run, and the general forecast of selling food was expected to be positive in the central and southern part of Italy. The forecasts (see Table 1) were based on the following assumptions that came from the business plan realized with the supervision of the private equity investor. The unlevered approach is adopted to calculate cash flow for the firm. The main information came from the balance sheet regarding data on assets and liabilities. The company did not have surplus assets or minorities within the equity, and the net financial position was 20 million coming from a cash position of 20 million (see Table 2). The main comparables on the market came not only from Italy (where only the company Eat \& Food can be considered a comparable, even if it is not listed) but from all over Europe (See Table 3 for the data). Considering the capital structure of ABC Ltd, the book value of the debt was 30.000 and the book value of equity was 3.000. The risk-free rate was 3% (calculated as 5-year 2022 Italian Government bonds) and the return on market investment was estimated at a level of 10% with an expected holding period of 5 years. Table 1: Profit and Loss statement (,000) Table 2: Cash flow unlevered statements (,000) Table 3: Comparable Based on the information given, conduct a valuation analysis by providing the calculations for: (a) Comparables Method and (b) Net Present Value Method

ABC Ltd is an Italian retail distributing company operating in the food sector. It has local branches in central and southern Italy. Growth is expected to be quite strong, and the real estate policy is not to buy shops but to rent them due to their strong negotiation of rental instalments. In 2021, ABC Ltd needed a private equity investor to support the expansion strategy, but the existing shareholders did not want to lose control. No acquisition of competitors was planned in the short-medium run, and the general forecast of selling food was expected to be positive in the central and southern part of Italy. The forecasts (see Table 1) were based on the following assumptions that came from the business plan realized with the supervision of the private equity investor. The unlevered approach is adopted to calculate cash flow for the firm. The main information came from the balance sheet regarding data on assets and liabilities. The company did not have surplus assets or minorities within the equity, and the net financial position was 20 million coming from a cash position of 20 million (see Table 2). The main comparables on the market came not only from Italy (where only the company Eat \& Food can be considered a comparable, even if it is not listed) but from all over Europe (See Table 3 for the data). Considering the capital structure of ABC Ltd, the book value of the debt was 30.000 and the book value of equity was 3.000. The risk-free rate was 3% (calculated as 5-year 2022 Italian Government bonds) and the return on market investment was estimated at a level of 10% with an expected holding period of 5 years. Table 1: Profit and Loss statement (,000) Table 2: Cash flow unlevered statements (,000) Table 3: Comparable Based on the information given, conduct a valuation analysis by providing the calculations for: (a) Comparables Method and (b) Net Present Value Method Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started