Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Ltd is listed on the JSE Limited with a 28 February year end. The ABC Ltd's financial statements for the year ended 28

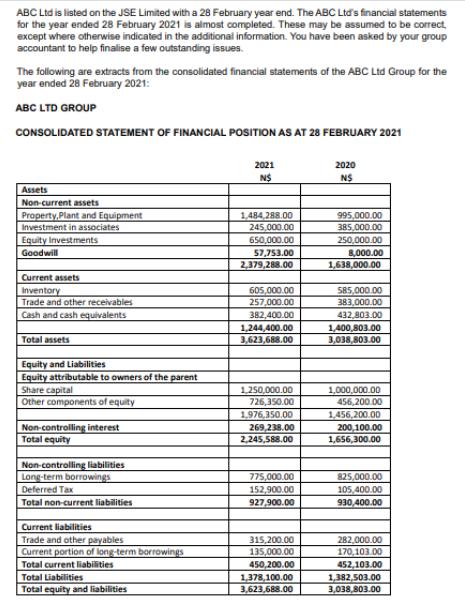

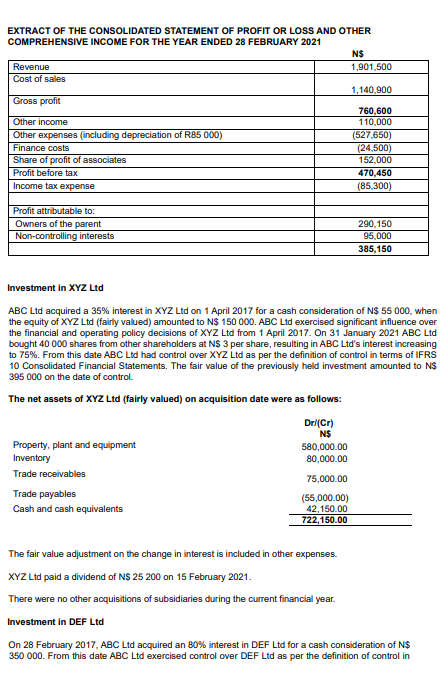

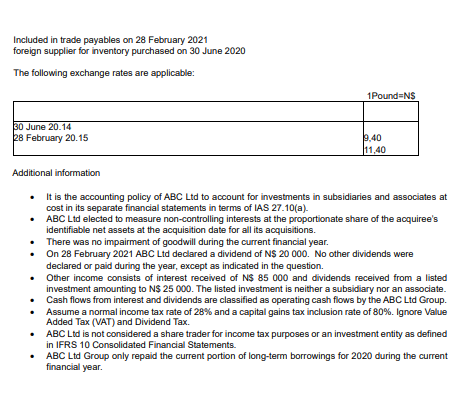

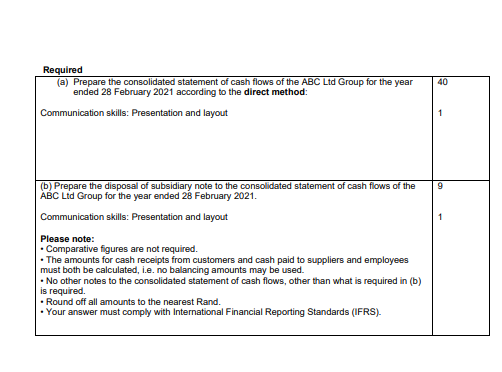

ABC Ltd is listed on the JSE Limited with a 28 February year end. The ABC Ltd's financial statements for the year ended 28 February 2021 is almost completed. These may be assumed to be correct, except where otherwise indicated in the additional information. You have been asked by your group accountant to help finalise a few outstanding issues. The following are extracts from the consolidated financial statements of the ABC Ltd Group for the year ended 28 February 2021: ABC LTD GROUP CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 28 FEBRUARY 2021 Assets Non-current assets Property Plant and Equipment Investment in associates Equity Investments Goodwill Current assets Inventory Trade and other receivables Cash and cash equivalents Total assets Equity and Liabilities Equity attributable to owners of the parent Share capital Other components of equity Non-controlling interest Total equity Non-controlling liabilities Long-term borrowings Deferred Tax Total non-current liabilities Current liabilities Trade and other payables Current portion of long-term borrowings Total current liabilities Total Liabilities Total equity and liabilities 2021 N$ 1,484,288.00 245,000.00 650,000.00 57,753.00 2,379,288.00 605,000.00 257,000.00 382,400.00 1,244,400.00 3,623,688.00 1,250,000.00 726,350.00 1,976,350.00 269,238.00 2,245,588.00 775,000.00 152,900.00 927,900.00 315,200.00 135,000.00 450,200.00 1,378,100.00 3,623,688.00 2020 NS 995,000.00 385,000.00 250,000.00 8,000.00 1,638,000.00 585,000.00 383,000.00 432,803.00 1,400,803.00 3,038,803.00 1,000,000.00 456,200.00 1,456,200.00 200,100.00 1,656,300.00 825,000.00 105,400.00 930,400.00 282,000.00 170,103.00 452,103.00 1,382,503.00 3,038,803.00 EXTRACT OF THE CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 28 FEBRUARY 2021 Revenue Cost of sales Gross profit Other income Other expenses (including depreciation of R85 000) Finance costs Share of profit of associates Profit before tax Income tax expense Profit attributable to: Owners of the parent Non-controlling interests Property, plant and equipment Inventory Trade receivables Trade payables Cash and cash equivalents Dri(Cr) N$ 580,000.00 80,000.00 75,000.00 (55,000.00) 42,150.00 722,150.00 N$ 1,901,500 Investment in XYZ Ltd ABC Ltd acquired a 35% interest in XYZ Ltd on 1 April 2017 for a cash consideration of N$ 55 000, when the equity of XYZ Ltd (fairly valued) amounted to N$ 150 000. ABC Ltd exercised significant influence over the financial and operating policy decisions of XYZ Ltd from 1 April 2017. On 31 January 2021 ABC Ltd bought 40 000 shares from other shareholders at N$ 3 per share, resulting in ABC Ltd's interest increasing to 75%. From this date ABC Ltd had control over XYZ Ltd as per the definition of control in terms of IFRS 10 Consolidated Financial Statements. The fair value of the previously held investment amounted to N$ 395 000 on the date of control. The net assets of XYZ Ltd (fairly valued) on acquisition date were as follows: The fair value adjustment on the change in interest is included in other expenses. XYZ Ltd paid a dividend of N$ 25 200 on 15 February 2021. There were no other acquisitions of subsidiaries during the current financial year. Investment in DEF Ltd 1,140,900 760,600 110,000 (527,650) (24,500) 152,000 470,450 (85,300) 290,150 95,000 385,150 On 28 February 2017, ABC Ltd acquired an 80% interest in DEF Ltd for a cash consideration of N$ 350 000. From this date ABC Ltd exercised control over DEF Ltd as per the definition of control in Included in trade payables on 28 February 2021 foreign supplier for inventory purchased on 30 June 2020 The following exchange rates are applicable: 30 June 20.14 28 February 20.15 1Pound=N$ 9,40 11,40 Additional information It is the accounting policy of ABC Ltd to account for investments in subsidiaries and associates at cost in its separate financial statements in terms of IAS 27.10(a). ABC Ltd elected to measure non-controlling interests at the proportionate share of the acquiree's identifiable net assets at the acquisition date for all its acquisitions. There was no impairment of goodwill during the current financial year. On 28 February 2021 ABC Ltd declared a dividend of N$ 20 000. No other dividends were declared or paid during the year, except as indicated in the question. Other income consists of interest received of N$ 85 000 and dividends received from a listed investment amounting to N$ 25 000. The listed investment is neither a subsidiary nor an associate. Cash flows from interest and dividends are classified as operating cash flows by the ABC Ltd Group. Assume a normal income tax rate of 28% and a capital gains tax inclusion rate of 80%. Ignore Value Added Tax (VAT) and Dividend Tax. ABC Ltd is not considered a share trader for income tax purposes or an investment entity as defined in IFRS 10 Consolidated Financial Statements. ABC Ltd Group only repaid the current portion of long-term borrowings for 2020 during the current financial year. Required (a) Prepare the consolidated statement of cash flows of the ABC Ltd Group for the year ended 28 February 2021 according to the direct method: Communication skills: Presentation and layout (b) Prepare the disposal of subsidiary note to the consolidated statement of cash flows of the ABC Ltd Group for the year ended 28 February 2021. Communication skills: Presentation and layout Please note: Comparative figures are not required. The amounts for cash receipts from customers and cash paid to suppliers and employees must both be calculated, i.e. no balancing amounts may be used. No other notes to the consolidated statement of cash flows, other than what is required in (b) is required. Round off all amounts to the nearest Rand. Your answer must comply with International Financial Reporting Standards (IFRS). 40 9

Step by Step Solution

★★★★★

3.39 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Sure Lets go through the calculations step by step 1 Calculate the fair value adjustment for the cha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started