Answered step by step

Verified Expert Solution

Question

1 Approved Answer

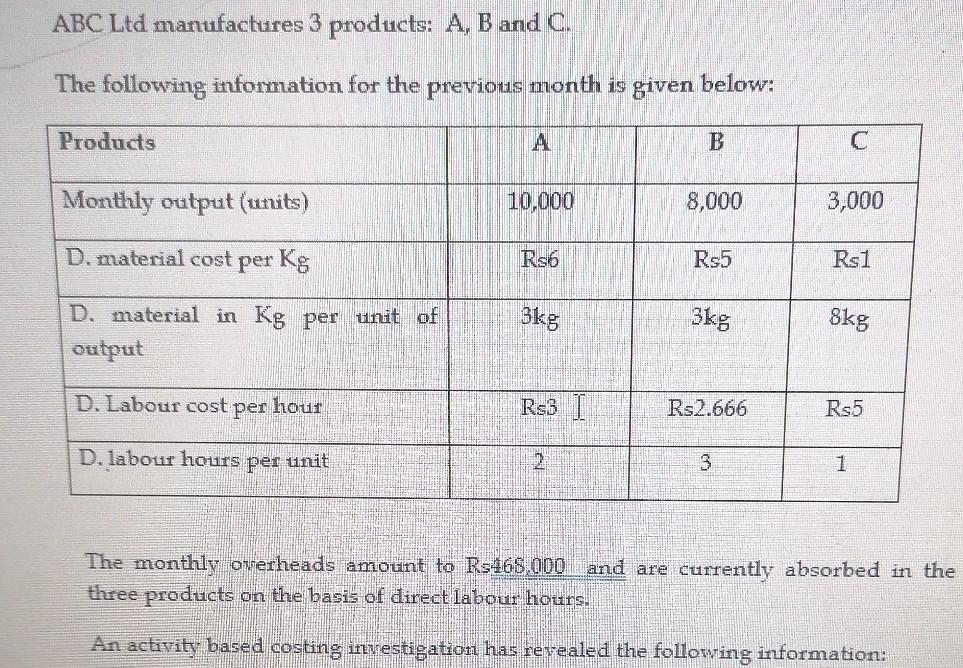

ABC Ltd manufactures 3 products: A, B and C. The following information for the previous month is given below: Products A B C Monthly output

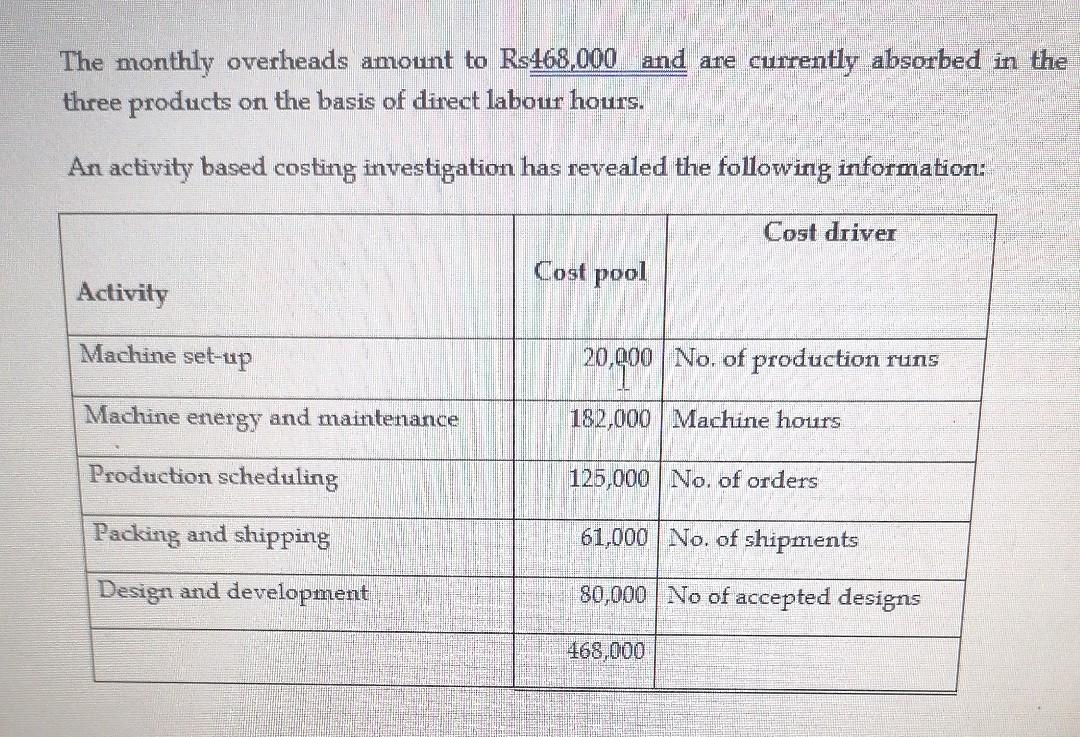

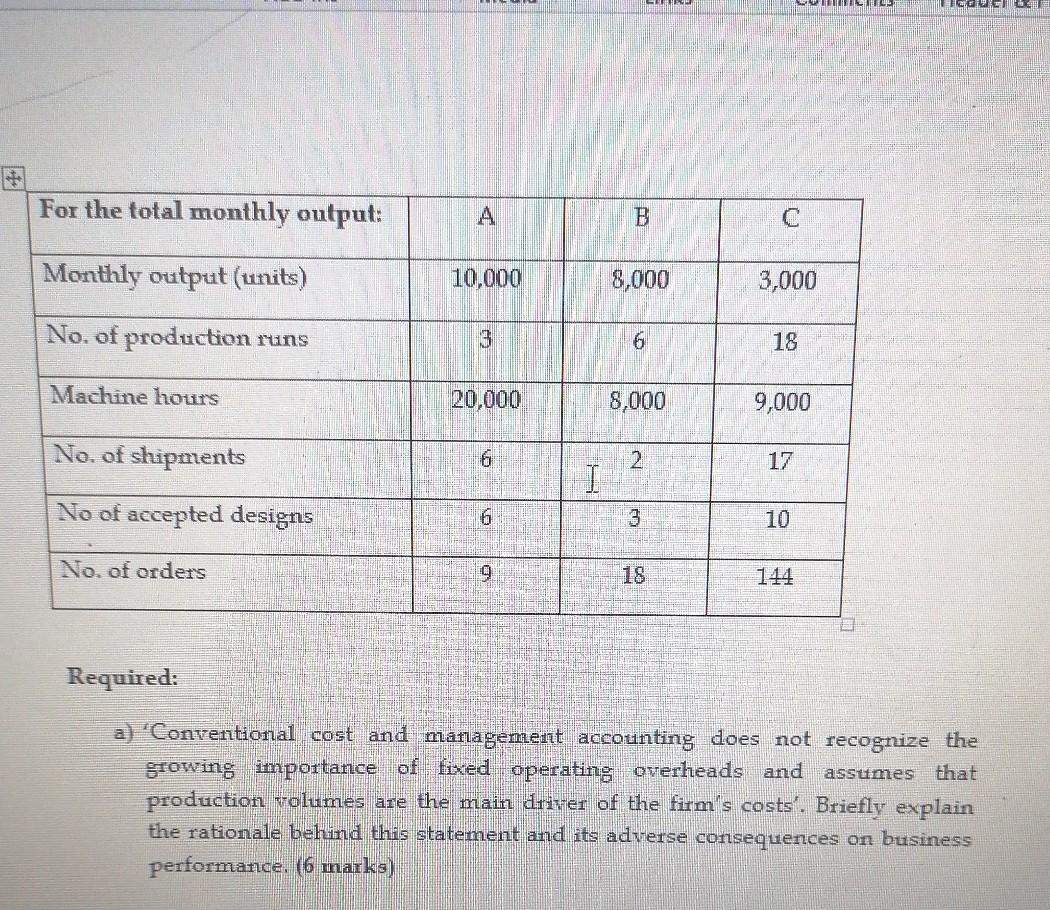

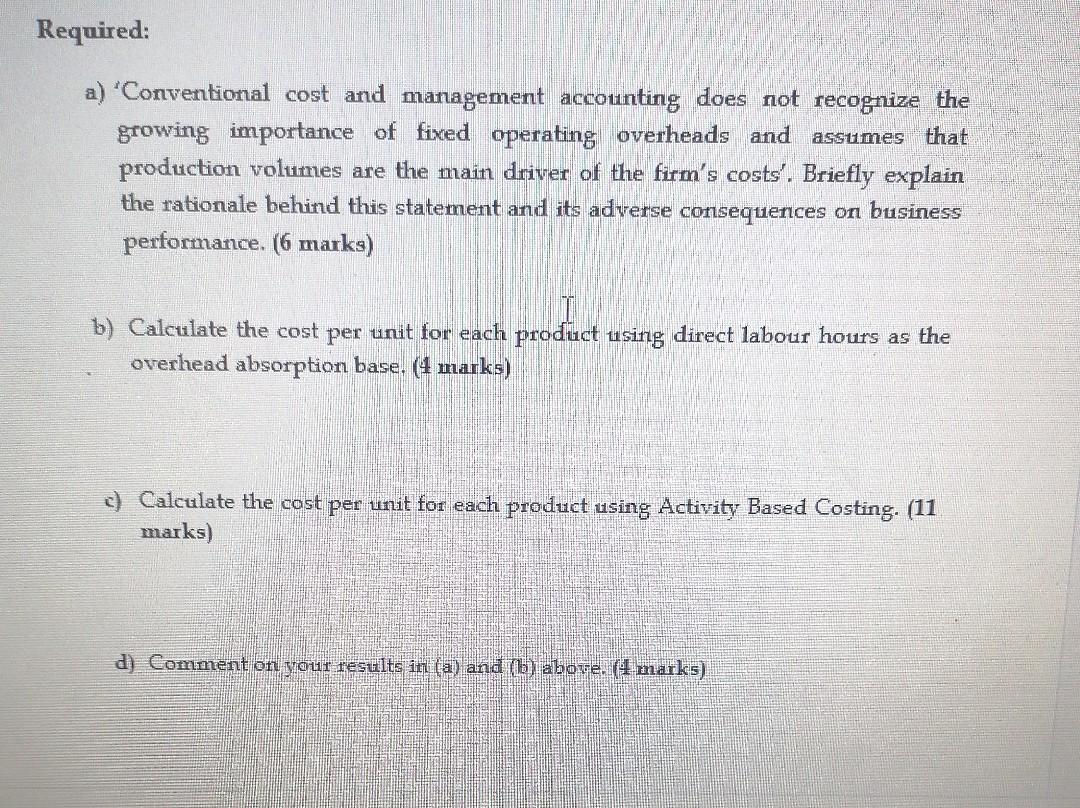

ABC Ltd manufactures 3 products: A, B and C. The following information for the previous month is given below: Products A B C Monthly output (units) 10,000 8,000 3,000 D. material cost per Kg Rs6 Rs5 Rs1 3kg 3kg D. material in Kg per unit of output 8kg D. Labour cost per hour R-3T Rs2.666 Rs5 D. labour hours per unit 3 1 The monthly overheads amount to Rs468.000 and are currently absorbed in the three products on the basis of direct labour hours. An activity based costing investigation has revealed the following information: The monthly overheads amount to Rs468,000 and are currently absorbed in the three products on the basis of direct labour hours. An activity based costing investigation has revealed the following information: Cost driver Cost pool Activity Machine set-up 20,000 No. of production runs Machine energy and maintenance 182,000 Machine hours Production scheduling 125,000 No. of orders Packing and shipping 61,000 No. of shipments Design and development 80,000 No of accepted designs 468,000 For the total monthly output: A B Monthly output (units) 10,000 8,000 3,000 No. of production runs 6 18 Machine hours 20,000 8,000 9,000 No. of shipments 6 2 I 3 No of accepted designs 6 10 No. of orders 9 144 Required: assumes a) 'Conventional cost and management accounting does not recognize the growing importance of fixed operating overheads and that production volumes are the main driver of the firm's costs'. Briefly explain the rationale behind this statement and its adverse consequences on business performance. (6 marks) Required: a) 'Conventional cost and management accounting does not recognize the growing importance of fixed operating overheads and assumes that production volumes are the main driver of the firm's costs'. Briefly explain the rationale behind this statement and its adverse consequences on business performance. (6 marks) b) Calculate the cost per unit for each product using direct labour hours as the overhead absorption base. (4 marks) c) Calculate the cost per unit for each product using Activity Based Costing. (11 marks) d) Comment on your results in (a) and (b) above. (I marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started